Significant Investment: Wellington Management Acquires 15,775 Robinhood Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Wellington Management Takes a Stake in Robinhood: 15,775 Shares Acquired

Headline: Wellington Management Invests in Robinhood: A Significant Acquisition of 15,775 Shares Signals Confidence

Introduction: The financial world is buzzing after prominent investment management firm, Wellington Management, revealed a significant acquisition of 15,775 Robinhood shares. This strategic move signals a vote of confidence in the controversial yet innovative brokerage app, sparking debate about the future trajectory of the company and its stock. Is this a bullish indicator for Robinhood's long-term prospects, or simply a calculated gamble by a seasoned investor? Let's delve into the details.

Why this Matters: Wellington Management, a Boston-based firm managing trillions of dollars in assets, doesn't make investments lightly. Their acquisition of Robinhood shares, while relatively small in the grand scheme of things, carries significant weight. It suggests that despite recent challenges and volatility, Wellington sees potential for growth and profitability within Robinhood's business model. This could influence other investors and potentially boost Robinhood's stock price.

Understanding the Context: Robinhood, known for its commission-free trading platform and user-friendly interface, has experienced a rollercoaster ride since its initial public offering (IPO). Early success was followed by periods of intense scrutiny, including regulatory investigations and criticisms surrounding its trading practices. However, the company has continued to innovate, expanding its offerings beyond stock trading to include cryptocurrency and options trading.

The Implications for Robinhood: Wellington's investment could represent a turning point for Robinhood. It provides a degree of legitimacy and validation, potentially attracting further institutional investment. This influx of capital could be crucial for Robinhood's continued growth and expansion into new markets and financial products. However, it's crucial to remember that this is just one investment, and the overall market sentiment towards Robinhood remains complex.

What this Means for Investors: For individual investors, this news offers a mixed bag. While it's encouraging to see a large firm like Wellington investing in Robinhood, it's not a guaranteed signal of future success. Due diligence and thorough research remain paramount before making any investment decisions. It's vital to consider the inherent risks associated with Robinhood's business model and the volatile nature of the stock market.

Looking Ahead: The future of Robinhood remains uncertain. While Wellington's investment is a positive development, the company faces ongoing challenges including increasing competition, regulatory hurdles, and the ever-changing landscape of the fintech industry. The coming months will be crucial in determining whether this investment represents a genuine turning point or simply a temporary blip in the company's overall trajectory. We will continue to monitor the situation and provide updates as they become available.

Keywords: Robinhood, Wellington Management, Investment, Stock Market, Fintech, IPO, Shares, Acquisition, Trading, Cryptocurrency, Options Trading, Financial News, Stock Price, Market Volatility

Call to Action (subtle): Stay informed about the latest developments in the financial markets by subscribing to our newsletter (link to newsletter signup). Learn more about investing wisely by reading our guide to responsible investing (link to relevant article).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Significant Investment: Wellington Management Acquires 15,775 Robinhood Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

U S Open Day 2 Sam Burns Final Putt Secures 65

Jun 14, 2025

U S Open Day 2 Sam Burns Final Putt Secures 65

Jun 14, 2025 -

Delaney Rowe Clarifies Relationship Status Amid B J Novak Speculation

Jun 14, 2025

Delaney Rowe Clarifies Relationship Status Amid B J Novak Speculation

Jun 14, 2025 -

High Scores Predicted Analyzing The U S Open 2025 At Oakmont

Jun 14, 2025

High Scores Predicted Analyzing The U S Open 2025 At Oakmont

Jun 14, 2025 -

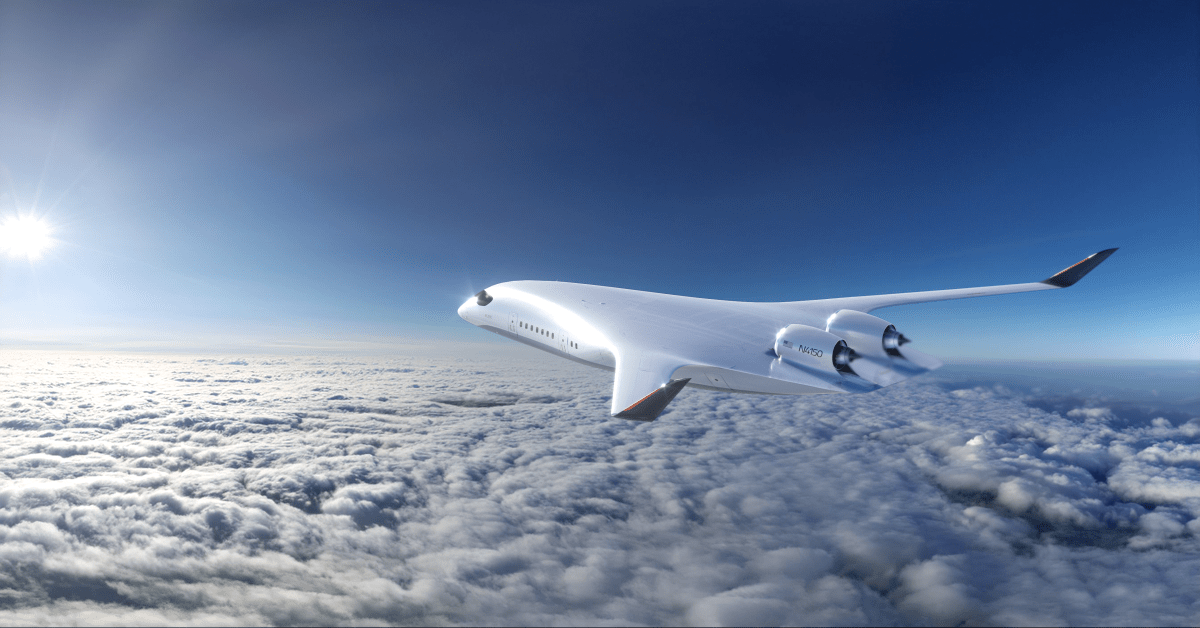

The Future Of Flight How This Company Is Leading Low Carbon Air Travel

Jun 14, 2025

The Future Of Flight How This Company Is Leading Low Carbon Air Travel

Jun 14, 2025 -

49ers Tight End Kittle Backs Wide Receiver Samuel Following Fresh Attacks

Jun 14, 2025

49ers Tight End Kittle Backs Wide Receiver Samuel Following Fresh Attacks

Jun 14, 2025