Should You Sell Intel Stock (INTC) After Its Sharp Decline?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Sell Intel Stock (INTC) After its Sharp Decline? Navigating the Chipmaker's Uncertain Future

Intel (INTC) has experienced a significant stock price decline recently, leaving many investors questioning their next move. Should you hold onto your Intel shares, or is it time to cut your losses and sell? The answer, unfortunately, isn't straightforward and depends on your individual investment strategy and risk tolerance. This article will explore the factors influencing Intel's current market performance and help you make an informed decision.

Intel's Recent Struggles: A Deep Dive

Intel's recent downturn stems from a confluence of factors. The global chip shortage, while initially benefiting the company, has since eased, leading to decreased demand and increased competition. Furthermore, Intel has faced challenges in its transition to leading-edge manufacturing processes, falling behind rivals like TSMC and Samsung in producing smaller, more efficient chips. This technological lag has impacted its market share in key segments, particularly in the high-margin data center market.

The company's financial performance reflects these difficulties. Revenue growth has slowed, and profit margins have been squeezed. While Intel has announced ambitious plans for future growth, including significant investments in new manufacturing facilities and research and development, these initiatives will take time to bear fruit.

Analyzing the Arguments for Selling INTC

Several compelling reasons suggest selling Intel stock:

- Lagging Technology: Intel's struggle to compete with rivals in advanced chip manufacturing is a significant concern. This technological gap could continue to impact its market share and profitability in the long term.

- Increased Competition: The semiconductor industry is fiercely competitive, with powerful players like AMD, Nvidia, and Qualcomm vying for market share. Intel's recent struggles have only intensified this pressure.

- Uncertain Future: While Intel's long-term plans are ambitious, their success is far from guaranteed. Investors need to carefully weigh the risks associated with these long-term investments.

- Alternative Investment Opportunities: The current market offers various attractive investment opportunities across diverse sectors. Diversification is key, and shifting some capital to more promising sectors might be a prudent strategy.

Arguments for Holding onto INTC Stock

Despite the challenges, there are arguments for retaining your Intel shares:

- Potential for Turnaround: Intel's substantial investments in research and development could lead to a significant technological turnaround. A successful comeback could drive substantial stock price appreciation.

- Undervalued Asset: Some analysts believe that the current stock price undervalues Intel's assets and long-term potential. A strategic turnaround could unlock significant value for shareholders.

- Dividend Payments: Intel pays a consistent dividend, providing a steady income stream for investors. This can be a significant factor for long-term investors seeking passive income.

- Market Dominance in Certain Segments: Intel still holds a dominant position in certain segments of the semiconductor market. This provides a strong base for future growth, even amidst challenges.

Making the Right Decision: A Personalized Approach

Ultimately, the decision to sell or hold Intel stock depends on your individual circumstances and investment goals. Consider the following:

- Your Risk Tolerance: Are you comfortable with the risks associated with holding Intel stock during this period of uncertainty?

- Your Investment Timeline: Are you investing for the short term or the long term? Long-term investors might be more willing to ride out the current challenges.

- Your Diversification Strategy: How much of your portfolio is allocated to Intel stock? Overexposure to a single stock, particularly one facing headwinds, can be risky.

Consult a Financial Advisor: Before making any investment decisions, it's crucial to consult with a qualified financial advisor. They can provide personalized guidance based on your individual financial situation and risk tolerance. They can also help you assess alternative investment options and create a diversified portfolio.

Conclusion:

The recent decline in Intel's stock price presents a challenging scenario for investors. While the company faces significant headwinds, its potential for a turnaround and its continued dominance in certain market segments cannot be ignored. Careful consideration of your risk tolerance, investment timeline, and overall portfolio diversification is essential in making an informed decision about whether to sell or hold your INTC shares. Remember to seek professional advice before making any significant investment changes.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Sell Intel Stock (INTC) After Its Sharp Decline?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Turnstile 2025 North American Tour Cities Venues And Ticket Information

Jun 10, 2025

Turnstile 2025 North American Tour Cities Venues And Ticket Information

Jun 10, 2025 -

Stuttgart Open 2025 Safiullins Skillful Lob Secures Victory

Jun 10, 2025

Stuttgart Open 2025 Safiullins Skillful Lob Secures Victory

Jun 10, 2025 -

2025 Tony Awards Unforgettable Performances And Wins

Jun 10, 2025

2025 Tony Awards Unforgettable Performances And Wins

Jun 10, 2025 -

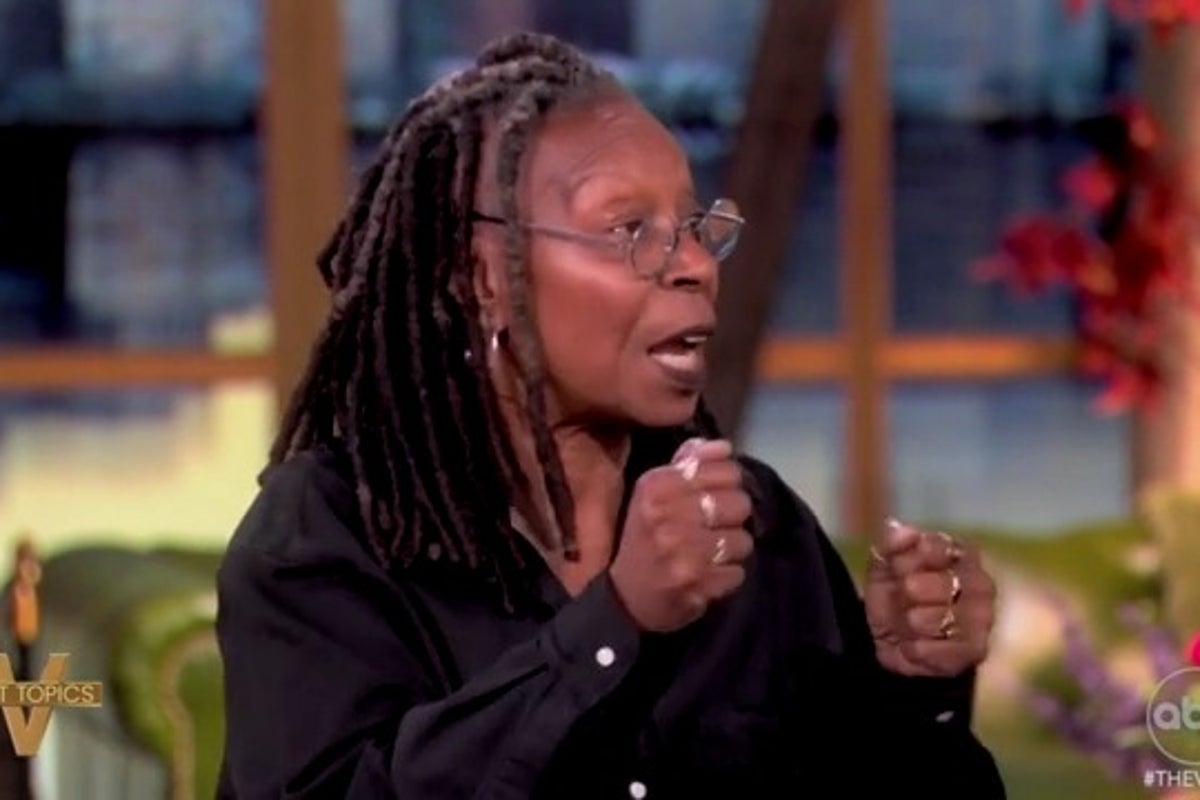

Whoopi Goldberg And The View Panel Clash Over Authenticity Of Musk Trump Relationship

Jun 10, 2025

Whoopi Goldberg And The View Panel Clash Over Authenticity Of Musk Trump Relationship

Jun 10, 2025 -

Musk Floats The Patriot Party Amid Growing Tensions With Trump

Jun 10, 2025

Musk Floats The Patriot Party Amid Growing Tensions With Trump

Jun 10, 2025