Should You Invest In Oklo Stock? A Guide To Sustainable Nuclear Power Investments

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Invest in Oklo Stock? A Guide to Sustainable Nuclear Power Investments

The energy sector is undergoing a dramatic transformation, with a growing focus on sustainable and environmentally friendly solutions. Nuclear power, often overlooked in the renewable energy conversation, is experiencing a resurgence, driven by advancements in reactor technology and a renewed urgency to combat climate change. One company at the forefront of this revolution is Oklo, a pioneering firm developing advanced nuclear reactors. But is investing in Oklo stock the right move for you? This guide explores the potential benefits and risks.

What is Oklo?

Oklo is a California-based company developing small modular reactors (SMRs) – a groundbreaking approach to nuclear power generation. Unlike traditional large-scale reactors, SMRs are significantly smaller, safer, and more efficient. Oklo's design emphasizes reduced waste, improved safety features, and a lower overall environmental footprint, making it a compelling proposition for investors interested in sustainable energy solutions. Their technology focuses on utilizing low-enriched uranium, further mitigating proliferation risks associated with nuclear technology.

The Appeal of Investing in Sustainable Nuclear Power:

The investment case for Oklo, and sustainable nuclear power in general, rests on several key pillars:

- Growing Demand for Clean Energy: The global push towards decarbonization is driving immense demand for clean energy sources. Nuclear power offers a reliable, high-density energy solution that doesn't rely on intermittent sources like solar or wind.

- Technological Advancement: Oklo's innovative SMR technology addresses many of the concerns associated with traditional nuclear power plants, including safety, waste management, and proliferation risks.

- Government Support: Several governments worldwide are actively investing in and supporting the development of advanced nuclear reactors, recognizing their crucial role in achieving net-zero emissions targets. This supportive regulatory environment can be a significant catalyst for companies like Oklo.

- Potential for High Returns: The early-stage nature of the advanced nuclear reactor market presents the potential for significant returns for early investors, if the technology proves successful and gains widespread adoption.

Risks Associated with Oklo Stock:

While the potential upside is substantial, investing in Oklo stock also carries considerable risks:

- Regulatory Hurdles: The regulatory landscape for nuclear power is complex and often lengthy. Delays in obtaining necessary permits and approvals could significantly impact Oklo's timeline and financial performance.

- Technological Challenges: Developing and deploying a novel technology like Oklo's SMRs presents inherent technological risks. Unexpected challenges during development or deployment could lead to cost overruns and delays.

- Market Volatility: The stock market is inherently volatile, and early-stage companies like Oklo are particularly susceptible to market fluctuations.

- Competition: The advanced nuclear reactor market is becoming increasingly competitive, with several companies vying for market share.

Should You Invest?

The decision of whether or not to invest in Oklo stock is highly personal and depends on your individual risk tolerance and investment goals. It's crucial to conduct thorough due diligence, including:

- Analyzing Oklo's financial statements and projections.

- Understanding the company's technological roadmap and potential challenges.

- Assessing the regulatory landscape and potential policy changes.

- Diversifying your portfolio to mitigate risk.

Consider consulting with a qualified financial advisor before making any investment decisions. This article provides information for educational purposes only and should not be considered financial advice.

Further Research: Learn more about small modular reactors by researching the and exploring reports from organizations like the .

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct thorough research and consider consulting a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Invest In Oklo Stock? A Guide To Sustainable Nuclear Power Investments. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Revised Offer Lincoln National Raises Cash Tender To 420 M

May 28, 2025

Revised Offer Lincoln National Raises Cash Tender To 420 M

May 28, 2025 -

Summer Heat Intensifies In Orlando Stormy Weather On The Horizon

May 28, 2025

Summer Heat Intensifies In Orlando Stormy Weather On The Horizon

May 28, 2025 -

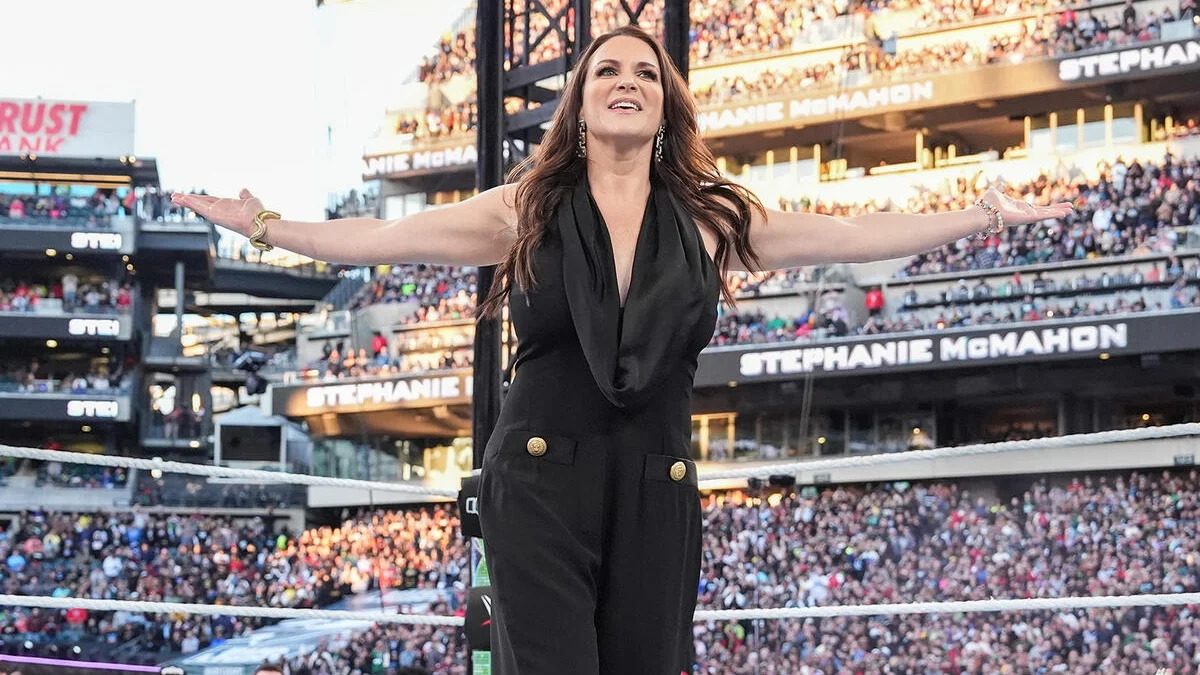

Wwes Stephanie Mc Mahon On A Tattoo She Almost Got Thank God

May 28, 2025

Wwes Stephanie Mc Mahon On A Tattoo She Almost Got Thank God

May 28, 2025 -

French President And First Lady Addressing The Plane Altercation

May 28, 2025

French President And First Lady Addressing The Plane Altercation

May 28, 2025 -

Severe Overnight Storm Causes Widespread Power Outages 165 000 Affected

May 28, 2025

Severe Overnight Storm Causes Widespread Power Outages 165 000 Affected

May 28, 2025