Should You Give Up On Uber Stock? Pros And Cons Analyzed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Give Up on Uber Stock? Pros and Cons Analyzed

The ride-hailing giant, Uber, has had a rollercoaster ride since its IPO. While it’s revolutionized transportation and delivery, its stock performance hasn't always mirrored its innovative spirit. So, should investors give up on Uber stock, or is there still potential for growth? Let's delve into the pros and cons to help you make an informed decision.

Uber's Strengths: A Look at the Positives

Uber's dominance in the ride-sharing and food delivery markets is undeniable. This market leadership translates into several key advantages:

- Massive Market Share: Uber holds a significant portion of the global ride-hailing market, giving it immense pricing power and brand recognition. This established presence is a strong foundation for future growth.

- Diversified Revenue Streams: Beyond rides, Uber Eats has become a major player in the food delivery sector, diversifying its revenue streams and reducing reliance on a single service. This diversification mitigates risk associated with market fluctuations in any one area.

- Technological Innovation: Uber continues to invest heavily in technology, exploring autonomous vehicles, drone delivery, and other innovative solutions. These advancements could significantly disrupt existing markets and create new revenue streams.

- Global Expansion: Uber operates in numerous countries worldwide, offering significant opportunities for expansion and growth in emerging markets. This international presence provides a buffer against economic downturns in any single region.

Uber's Challenges: Weighing the Negatives

Despite its strengths, Uber faces several significant challenges that investors need to consider:

- Profitability Concerns: Uber has historically struggled with profitability, facing intense competition and high operating costs. Achieving consistent profitability remains a key challenge for the company. This ongoing issue makes some investors hesitant.

- Regulatory Hurdles: The ride-hailing industry is heavily regulated, and Uber faces ongoing legal battles and regulatory challenges in various jurisdictions. These regulatory hurdles can impact operations and profitability.

- Driver Compensation and Labor Issues: The company faces continuous pressure regarding driver compensation and worker classification. These labor-related issues can lead to increased costs and negative publicity.

- Intense Competition: The ride-sharing and food delivery markets are highly competitive, with established players and new entrants vying for market share. This fierce competition puts pressure on pricing and profitability margins.

Should You Hold or Sell? The Verdict

The decision of whether to hold or sell Uber stock depends heavily on your individual investment strategy and risk tolerance. While the company possesses significant strengths, including market leadership and diversification, the profitability concerns and regulatory challenges present substantial risks.

Here's a quick summary to help you decide:

- Hold: If you're a long-term investor with a high risk tolerance and believe in Uber's long-term growth potential, holding might be a viable strategy. The company's innovation and global reach offer potential for significant returns.

- Sell: If you're risk-averse or seeking more stable investments, selling might be the prudent choice. The ongoing profitability issues and regulatory uncertainties present considerable risks.

Ultimately, thorough due diligence and a careful consideration of your personal investment goals are crucial before making any decisions regarding Uber stock. Consulting with a financial advisor is always recommended before making significant investment choices. Remember, past performance is not indicative of future results. The information provided here is for informational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Give Up On Uber Stock? Pros And Cons Analyzed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sustainable Energy Investment Analyzing Oklo Stocks Potential

May 27, 2025

Sustainable Energy Investment Analyzing Oklo Stocks Potential

May 27, 2025 -

2025 French Open Haddad Maia And Baptiste Match Prediction And Analysis

May 27, 2025

2025 French Open Haddad Maia And Baptiste Match Prediction And Analysis

May 27, 2025 -

French Open Womens Draw Day 2 Key Matches And Predictions

May 27, 2025

French Open Womens Draw Day 2 Key Matches And Predictions

May 27, 2025 -

Phoenix The Cat And His Human Arrive In Hawaii After Transpacific Sailing Adventure

May 27, 2025

Phoenix The Cat And His Human Arrive In Hawaii After Transpacific Sailing Adventure

May 27, 2025 -

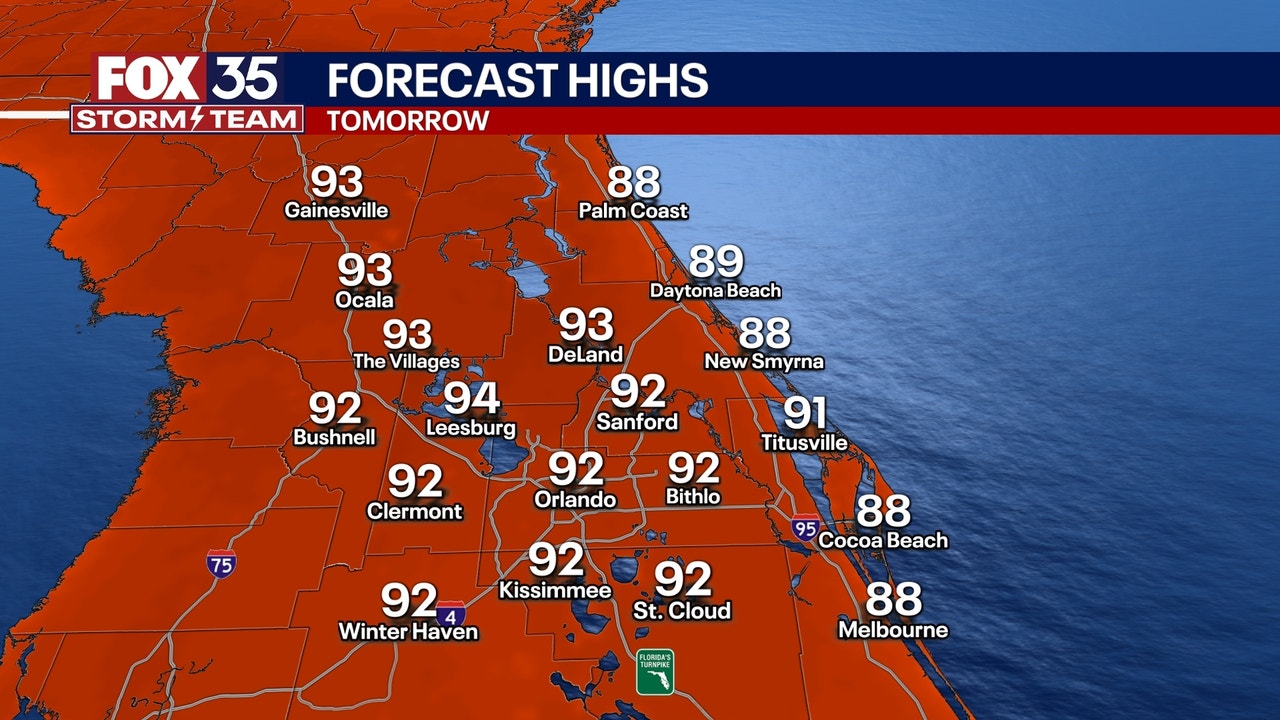

Orlando Facing Scorching Heat And Humidity Storms Possible Midweek

May 27, 2025

Orlando Facing Scorching Heat And Humidity Storms Possible Midweek

May 27, 2025