Should You Give Up On Uber Stock Now?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Give Up on Uber Stock Now? A Deep Dive into the Ride-Sharing Giant's Future

Uber. The name conjures images of convenient rides, food delivery, and a seemingly unstoppable tech giant. But lately, the ride hasn't been so smooth for investors. With fluctuating stock prices and a competitive market, many are questioning: should you give up on Uber stock now? The answer, as with most investments, is complex and depends on your individual circumstances and risk tolerance.

This article will delve into the current state of Uber, examining the factors driving its stock performance and offering insights to help you make an informed decision.

Uber's Current Landscape: A Mixed Bag

Uber's business model is multifaceted, encompassing ride-sharing, food delivery (Uber Eats), freight transportation, and even micromobility options like scooters and bikes. This diversification is both a strength and a weakness.

Strengths:

- Market Leader: Uber remains a dominant player in the ride-sharing and food delivery markets, boasting significant brand recognition and a vast user base. This established presence provides a strong foundation for future growth.

- Technological Innovation: Uber consistently invests in technology, improving its platform, optimizing logistics, and exploring new avenues for expansion. This commitment to innovation is crucial in a rapidly evolving tech landscape.

- Expanding Services: Diversification beyond ride-sharing helps mitigate risk and provides multiple avenues for revenue generation. The success of Uber Eats, for example, has become a crucial component of the company's overall performance.

Weaknesses:

- Profitability Concerns: Uber has historically struggled with profitability, facing intense competition and high operating costs. Achieving sustained profitability remains a key challenge.

- Regulatory Hurdles: The ride-sharing industry faces ongoing regulatory challenges globally, impacting operational costs and potential expansion plans. Navigating these legal and regulatory landscapes is a constant battle.

- Intense Competition: The market is saturated with competitors, including Lyft, DoorDash, and regional players, all vying for market share. This fierce competition puts pressure on pricing and profitability.

Analyzing the Stock Performance:

Uber's stock price has experienced significant volatility. While it has shown periods of growth, it's also faced considerable dips. Factors influencing this volatility include:

- Economic conditions: Recessions and economic downturns can significantly impact consumer spending on non-essential services like ride-sharing and food delivery.

- Fuel prices: Fluctuations in fuel prices directly affect Uber drivers' costs and, consequently, the overall profitability of the ride-sharing segment.

- Investor sentiment: Overall market sentiment and investor confidence play a significant role in stock price fluctuations. Negative news or perceived risks can lead to sell-offs.

Should You Hold or Sell? A Personal Assessment

Ultimately, the decision of whether to hold or sell Uber stock is a personal one. Consider these factors:

- Your Investment Goals: Are you a long-term investor looking for potential growth, or are you seeking short-term gains? Uber's long-term potential is promising, but the journey may be bumpy.

- Your Risk Tolerance: Uber stock is considered a moderately high-risk investment. Are you comfortable with the potential for significant price fluctuations?

- Your Portfolio Diversification: Does Uber represent a significant portion of your portfolio? Over-concentration in a single stock, especially a volatile one, can be risky.

Looking Ahead:

Uber's future hinges on its ability to navigate the challenges outlined above. Continued innovation, strategic expansion, and a focus on profitability will be key to its long-term success. Staying informed about industry trends, regulatory changes, and the company's financial performance is crucial for any investor considering holding or purchasing Uber stock. Consult with a financial advisor for personalized guidance.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Give Up On Uber Stock Now?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nfl Admits Need For Scheduling Adjustments After Burrows Public Complaint

May 27, 2025

Nfl Admits Need For Scheduling Adjustments After Burrows Public Complaint

May 27, 2025 -

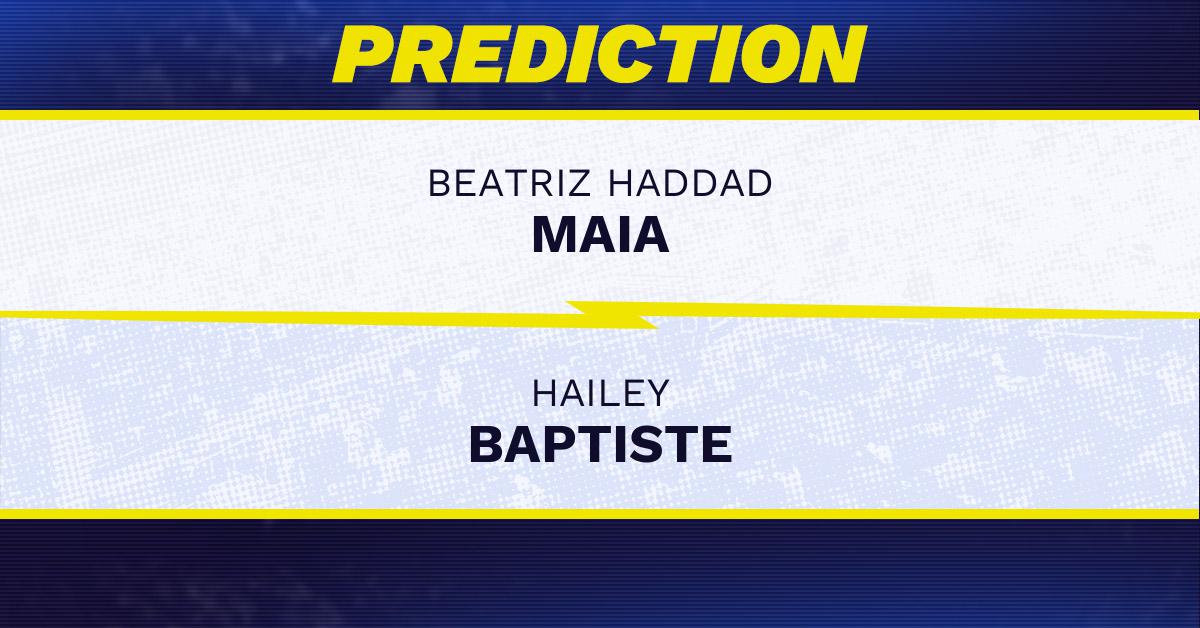

French Open 2025 Betting In Depth Preview Of Haddad Maia Vs Baptiste

May 27, 2025

French Open 2025 Betting In Depth Preview Of Haddad Maia Vs Baptiste

May 27, 2025 -

Trumps Apple Tariff A Deep Dive Into Potential Economic Impacts

May 27, 2025

Trumps Apple Tariff A Deep Dive Into Potential Economic Impacts

May 27, 2025 -

Outperforming Palantir 3 Promising Ai Stocks To Watch

May 27, 2025

Outperforming Palantir 3 Promising Ai Stocks To Watch

May 27, 2025 -

Uber Technologies Stock 24 Analyst Forecasts For The Future

May 27, 2025

Uber Technologies Stock 24 Analyst Forecasts For The Future

May 27, 2025