Should You Ditch Uber Stock? Analyzing The Investment Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Ditch Uber Stock? Analyzing the Investment Risks

Uber. The name conjures images of convenient rides, food delivery, and a seemingly unstoppable tech giant. But behind the sleek app and global reach lies a complex business model with significant inherent risks. So, should you ditch Uber stock (UBER)? The answer, as with any investment, isn't simple, but a careful analysis of the risks is crucial before making any decisions.

Uber's Current Market Position: A Double-Edged Sword

Uber dominates ride-sharing and food delivery in many markets, boasting impressive user numbers and brand recognition. This market leadership is a major strength, contributing to significant revenue. However, this dominance also attracts intense competition. Rivals like Lyft, DoorDash, and even emerging players constantly challenge Uber's market share, leading to price wars and squeezed profit margins. The competitive landscape remains fiercely contested, demanding constant innovation and significant investment to maintain its edge.

Profitability Remains Elusive: A Key Concern for Investors

While Uber’s revenue is substantial, consistent profitability remains a significant challenge. High operating costs, including driver compensation, marketing expenses, and technology infrastructure, often outweigh revenue gains. Investors should closely scrutinize Uber's financial statements, focusing on key metrics like EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and free cash flow to assess the long-term sustainability of its business model. The company's reliance on attracting and retaining drivers, often considered independent contractors, adds another layer of complexity and potential cost fluctuation.

Regulatory Hurdles and Legal Battles: Navigating a Complex Landscape

Uber operates in a heavily regulated environment, facing ongoing challenges with labor laws, licensing requirements, and safety regulations. The classification of drivers as independent contractors has been a source of continuous legal battles and potential liabilities. These regulatory hurdles and legal uncertainties contribute to investment risk and can significantly impact profitability and future growth. Changes in regulations, particularly regarding worker classification, could substantially alter Uber's operating costs.

Technological Disruption and Future Uncertainty:

The technology sector is notorious for rapid innovation and disruption. New technologies and business models could emerge, challenging Uber's existing dominance. Autonomous vehicles, for example, represent both an opportunity and a threat. While potentially reducing operating costs, the development and integration of autonomous vehicles require substantial investment and present considerable technical and regulatory challenges.

Factors to Consider Before Making a Decision:

Before deciding whether to hold or sell Uber stock, investors should consider:

- Your risk tolerance: Uber stock is considered a higher-risk investment due to the factors discussed above.

- Your investment horizon: A longer-term investment might allow for weathering short-term market fluctuations.

- Diversification: Uber should be only one part of a well-diversified investment portfolio.

- Alternative investments: Explore other opportunities in the transportation or technology sectors that might offer lower risk and comparable potential returns.

Conclusion: A Cautious Approach is Advised

Uber's position in the market is undeniably strong, but the significant risks associated with its business model cannot be ignored. Investors should carefully weigh the potential for growth against the considerable challenges and uncertainties before making any investment decisions. Conduct thorough due diligence, consult with a financial advisor, and consider your own risk tolerance before deciding whether to ditch Uber stock or hold onto it. The future of the company, and its stock price, remains uncertain, requiring a cautious and informed approach.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Ditch Uber Stock? Analyzing The Investment Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Lincoln Financials Tender Offer Success 45 M Boost Yields 812 M In Securities

May 28, 2025

Lincoln Financials Tender Offer Success 45 M Boost Yields 812 M In Securities

May 28, 2025 -

First Day Of Us Aid In Gaza Marked By Clashes Amidst Severe Food Shortages

May 28, 2025

First Day Of Us Aid In Gaza Marked By Clashes Amidst Severe Food Shortages

May 28, 2025 -

French Open 2025 Juan Manuel Cernudolo Vs Hamad Medjedovic Match Preview

May 28, 2025

French Open 2025 Juan Manuel Cernudolo Vs Hamad Medjedovic Match Preview

May 28, 2025 -

Lincoln National Ups Cash Tender Offer A 420 Million Investment

May 28, 2025

Lincoln National Ups Cash Tender Offer A 420 Million Investment

May 28, 2025 -

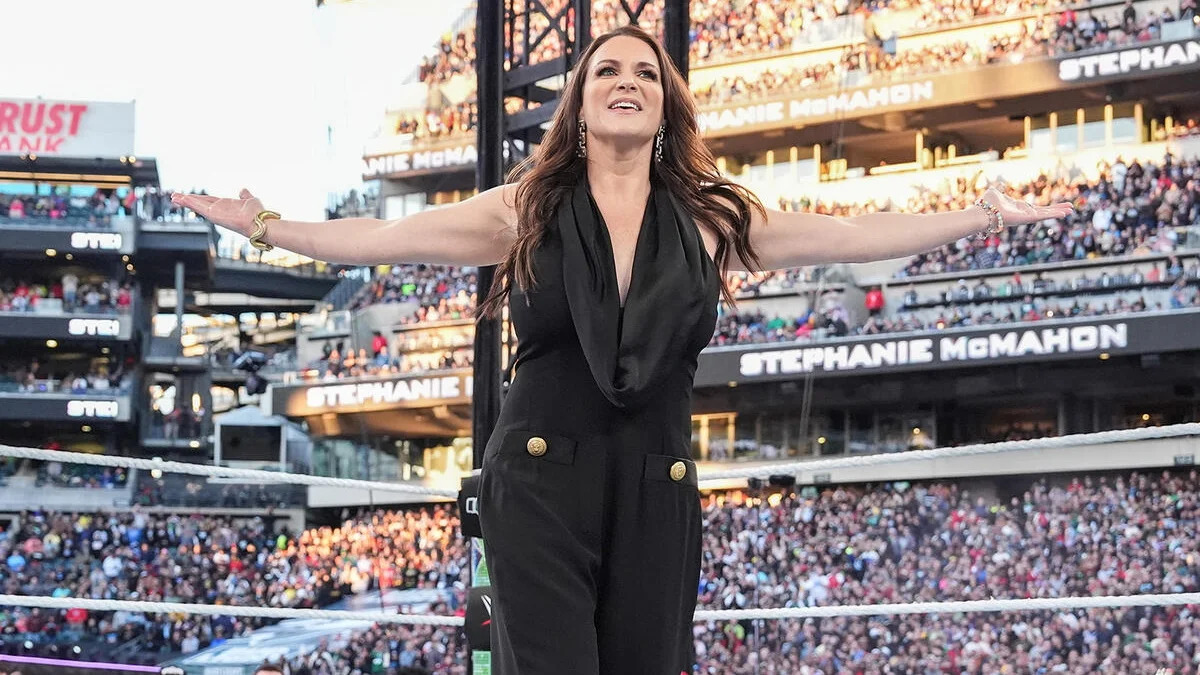

Stephanie Mc Mahon Reveals Regret Free Tattoo Decision Thank God

May 28, 2025

Stephanie Mc Mahon Reveals Regret Free Tattoo Decision Thank God

May 28, 2025