Should You Ditch Uber Stock? Analyzing The Current Market Trends

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Ditch Uber Stock? Analyzing Current Market Trends

The ride-sharing giant, Uber, has experienced a rollercoaster ride since its IPO. While it initially captivated investors with its disruptive business model, recent market trends have left many questioning whether it's time to ditch Uber stock. This article dives deep into the current market analysis, exploring the factors influencing Uber's stock price and helping you determine if it's still a worthwhile investment.

Uber's Recent Performance: A Mixed Bag

Uber's stock performance has been anything but predictable. While the company has demonstrated significant growth in its core ride-hailing business and food delivery service, Uber Eats, several challenges persist. Recent earnings reports have shown a mixed bag, with periods of strong growth followed by periods of slower-than-expected progress. This volatility makes assessing its long-term potential a complex task for investors.

Factors Influencing Uber's Stock Price:

Several key factors are currently impacting Uber's stock price and future prospects. These include:

-

Increased Competition: The ride-sharing market is increasingly competitive, with rivals like Lyft and emerging players constantly vying for market share. This fierce competition puts pressure on Uber's pricing strategies and profitability.

-

Driver Shortages and Labor Costs: The ongoing struggle to secure and retain enough drivers is a significant concern. Higher driver wages and benefits are essential to attract and retain talent, impacting Uber's bottom line. This is a persistent challenge impacting profitability across the industry. Read more about the impact of (replace with a relevant link).

-

Economic Uncertainty: Global economic uncertainty and potential recessions cast a shadow over discretionary spending. As consumers tighten their belts, demand for ride-sharing and food delivery services might decline, affecting Uber's revenue.

-

Technological Advancements and Autonomous Vehicles: The long-term potential of autonomous vehicles presents both opportunities and threats. While autonomous vehicles could significantly reduce operational costs, their widespread adoption remains uncertain and could disrupt Uber's current business model.

-

Regulatory Scrutiny: Uber continues to face regulatory hurdles and scrutiny in various markets regarding worker classification, safety regulations, and data privacy. These legal and regulatory battles add to the company's operational costs and uncertainties.

Should You Sell or Hold? A Deeper Dive

Deciding whether to sell or hold Uber stock requires careful consideration of your individual investment goals, risk tolerance, and long-term outlook. While the company faces significant challenges, its vast market presence and potential for future growth in areas like freight and delivery remain attractive.

Before making any decisions, consider:

-

Your Investment Timeline: Are you a long-term or short-term investor? Uber's stock is likely more suitable for long-term investors who can weather short-term market fluctuations.

-

Diversification: Do you have a well-diversified portfolio? Over-reliance on a single stock, even a seemingly promising one like Uber, is risky.

-

Fundamental Analysis: Thoroughly research Uber's financial statements, earnings reports, and future growth projections. Understand the company's strengths and weaknesses before making any investment decisions.

Conclusion:

The decision to ditch Uber stock is highly individual and depends on your personal circumstances and investment strategy. While the current market trends present challenges, Uber's position in a rapidly growing industry and its ongoing diversification efforts offer potential for long-term growth. However, thorough due diligence and a comprehensive understanding of the risks involved are essential before making any investment choices. Always consult with a financial advisor for personalized advice tailored to your specific financial situation.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Ditch Uber Stock? Analyzing The Current Market Trends. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Climate Change A Financial Boon For Brazil Minister Unveils New Strategy

May 27, 2025

Climate Change A Financial Boon For Brazil Minister Unveils New Strategy

May 27, 2025 -

Beyond Palantir Discovering 3 Promising Ai Investments

May 27, 2025

Beyond Palantir Discovering 3 Promising Ai Investments

May 27, 2025 -

Uber Stock Performance Is Now The Time To Cut Your Losses

May 27, 2025

Uber Stock Performance Is Now The Time To Cut Your Losses

May 27, 2025 -

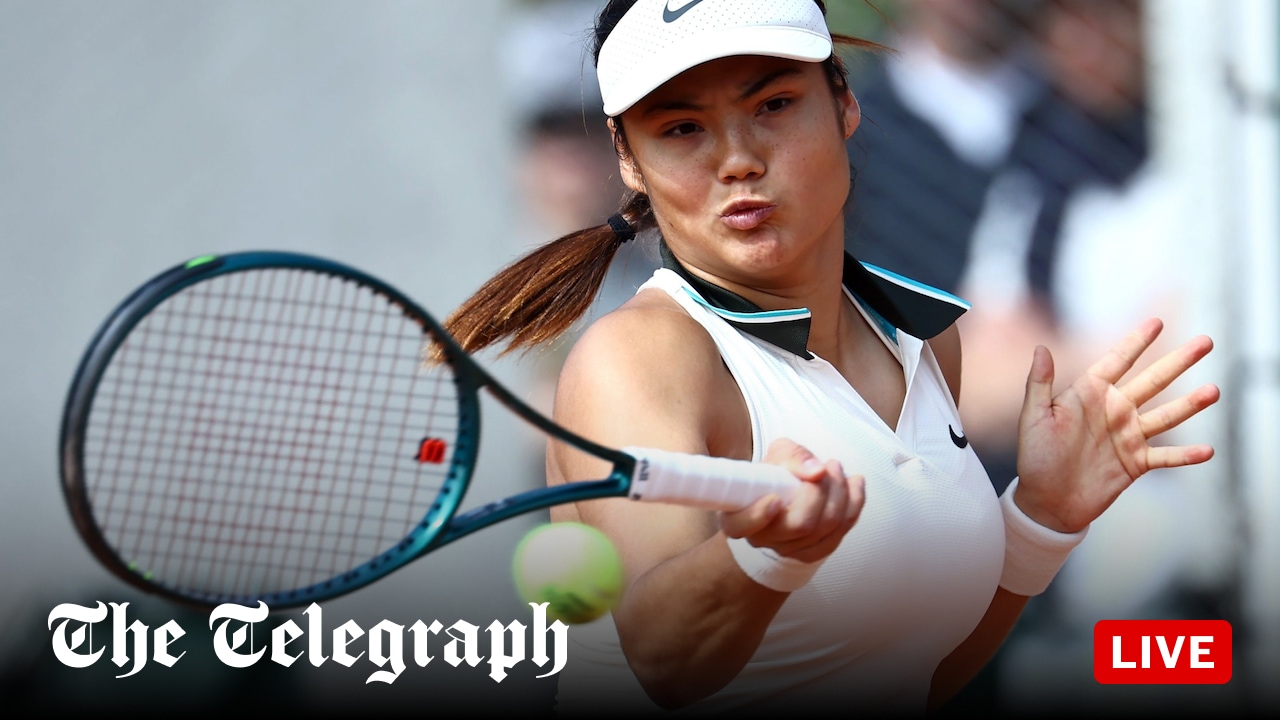

French Open Raducanu And Wang Xinyu Face Off Live Match Updates

May 27, 2025

French Open Raducanu And Wang Xinyu Face Off Live Match Updates

May 27, 2025 -

Did You Win Powerball Numbers For May 24 Drawing 167 Million Jackpot

May 27, 2025

Did You Win Powerball Numbers For May 24 Drawing 167 Million Jackpot

May 27, 2025