Should You Buy Oklo Stock? Evaluating The Risks And Rewards Of A Sustainable Energy Play

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy Oklo Stock? Evaluating the Risks and Rewards of a Sustainable Energy Play

The quest for sustainable energy solutions is driving significant investment, and Oklo Inc. (OKLO) is emerging as a key player in this rapidly evolving sector. This innovative company is pioneering advanced nuclear fission technology, promising a cleaner and potentially more efficient alternative to traditional energy sources. But is Oklo stock a worthwhile investment? This in-depth analysis weighs the potential rewards against the inherent risks, helping you decide if Oklo fits into your portfolio.

Oklo's Promise: Safe and Sustainable Nuclear Energy

Oklo's core business revolves around developing and deploying its proprietary, small modular reactors (SMRs). Unlike traditional nuclear power plants, these reactors are significantly smaller, more efficient, and designed with enhanced safety features. This technology aims to address some of the major concerns surrounding nuclear energy, including waste disposal and the risk of meltdowns. Their focus on reduced waste and improved safety is a compelling selling point for environmentally conscious investors. The company's vision is to offer a carbon-free energy source capable of powering communities and industries sustainably.

The Potential Rewards of Investing in Oklo:

- First-Mover Advantage: Oklo is at the forefront of advanced nuclear fission technology, potentially securing a substantial market share as the demand for sustainable energy grows exponentially. This first-mover advantage could translate into significant returns for early investors.

- Growing Market Demand: The global shift towards renewable and sustainable energy sources is undeniable. Governments worldwide are increasingly investing in clean energy initiatives, creating a favourable regulatory environment for companies like Oklo. This surge in demand for clean energy directly benefits Oklo's potential for growth.

- Technological Innovation: Oklo's innovative SMR technology has the potential to disrupt the energy sector. Its improved safety and efficiency could lead to widespread adoption, generating substantial revenue streams.

The Risks Associated with Oklo Stock:

- Regulatory Uncertainty: The nuclear energy sector is heavily regulated. Securing the necessary permits and approvals for deploying Oklo's reactors can be a lengthy and complex process, potentially delaying revenue generation.

- Technological Challenges: While promising, Oklo's technology is still relatively new. Unforeseen technological hurdles could impact development timelines and overall profitability. Successful commercialization is not guaranteed.

- Market Volatility: The renewable energy sector can be volatile, influenced by fluctuating government policies, technological advancements, and market demand. Oklo stock price is likely to experience significant swings.

- Competition: The sustainable energy market is becoming increasingly competitive. Oklo faces competition from established players and emerging startups in the renewable energy field, potentially hindering its market share.

Should You Invest? A Balanced Perspective

Oklo represents a high-risk, high-reward investment opportunity. While its innovative technology and the growing demand for sustainable energy offer substantial upside potential, investors must be aware of the significant risks involved. The company's success hinges on overcoming regulatory hurdles, successfully commercializing its technology, and navigating a competitive market.

Before investing in Oklo stock, consider:

- Your risk tolerance: Oklo is a speculative investment suitable only for those comfortable with substantial volatility.

- Diversification: Don't put all your eggs in one basket. Diversify your portfolio to mitigate potential losses.

- Due diligence: Thoroughly research the company's financials, technology, and market position before investing. Consult with a qualified financial advisor.

Oklo’s potential to revolutionize the energy sector is undeniable. However, a prudent investment strategy requires a careful assessment of both its potential and its risks. The decision to invest in Oklo stock is ultimately a personal one based on your individual financial situation and risk appetite. Remember to always conduct thorough research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Oklo Stock? Evaluating The Risks And Rewards Of A Sustainable Energy Play. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Baltimore Primetime And Burrow Mike Norths Take On The Bengals Schedule

May 28, 2025

Baltimore Primetime And Burrow Mike Norths Take On The Bengals Schedule

May 28, 2025 -

Central Florida Memorial Day Plans May Be Affected By Severe Weather

May 28, 2025

Central Florida Memorial Day Plans May Be Affected By Severe Weather

May 28, 2025 -

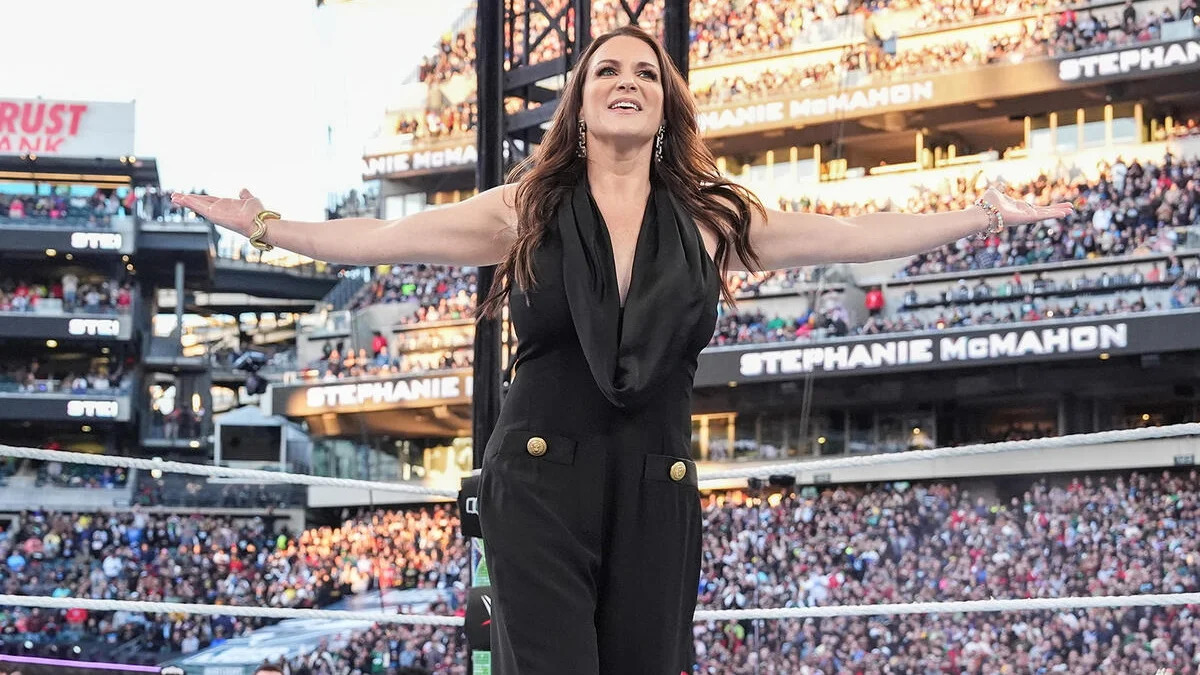

Stephanie Mc Mahons Regretted Tattoo A Thank God Moment Revealed

May 28, 2025

Stephanie Mc Mahons Regretted Tattoo A Thank God Moment Revealed

May 28, 2025 -

Chaos And Conflict Us Aid Distribution In Gaza Disrupted By Hunger Fueled Protests

May 28, 2025

Chaos And Conflict Us Aid Distribution In Gaza Disrupted By Hunger Fueled Protests

May 28, 2025 -

Winning Powerball Ticket Sold In Ohio Where And How To Claim

May 28, 2025

Winning Powerball Ticket Sold In Ohio Where And How To Claim

May 28, 2025