Should You Buy NIO Stock Following Its Q1 Earnings Report?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy NIO Stock Following its Q1 Earnings Report?

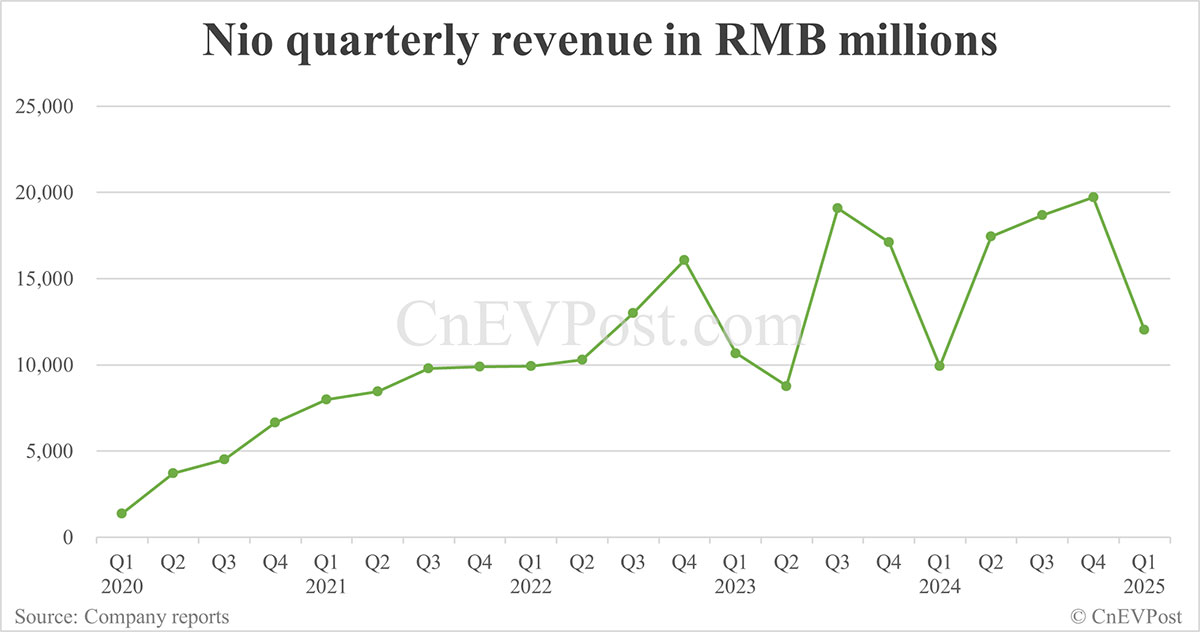

NIO, a leading Chinese electric vehicle (EV) maker, recently released its Q1 2024 earnings report, sending ripples through the investment community. The results were a mixed bag, leaving many investors wondering: is now the time to buy NIO stock? This article delves into the key takeaways from the report, analyzing the positives and negatives to help you make an informed decision.

NIO's Q1 2024 Earnings: A Closer Look

NIO's Q1 earnings revealed a complex picture. While the company exceeded delivery expectations, surpassing analyst predictions, other key metrics raised concerns. Vehicle deliveries surged, demonstrating strong consumer demand, but profitability remained elusive. Increased competition in the burgeoning Chinese EV market, coupled with ongoing supply chain challenges, contributed to a less-than-stellar bottom line.

Positive Highlights:

- Strong Delivery Numbers: NIO's Q1 vehicle deliveries significantly outperformed expectations, indicating a robust market appetite for its vehicles. This is a crucial indicator of future growth potential.

- New Model Launches: The successful launch of new models and variants broadened NIO's product portfolio, catering to a wider range of customer preferences and price points. This diversification strategy is a positive sign for long-term growth.

- Expanding Infrastructure: NIO's continued investment in its charging infrastructure, including battery swap stations, strengthens its competitive advantage and enhances customer convenience. This strategic move is vital in the fast-evolving EV landscape.

Areas of Concern:

- Profitability Challenges: Despite strong sales, NIO continues to struggle with profitability. Increased operating costs and intense competition are key factors contributing to this ongoing challenge.

- Supply Chain Disruptions: The global supply chain continues to pose significant hurdles for NIO, impacting production efficiency and potentially delaying future growth.

- Intense Competition: The Chinese EV market is fiercely competitive, with established players and new entrants vying for market share. NIO needs to maintain its innovative edge to stay ahead of the curve.

Should You Buy NIO Stock? A Balanced Perspective

The decision of whether or not to buy NIO stock following its Q1 earnings report is not straightforward. The strong delivery numbers and new model launches paint a positive picture for future growth. However, the persistent profitability issues and intense competition present significant risks.

Factors to Consider:

- Long-term Growth Potential: The EV market is expected to experience explosive growth in the coming years. NIO's position as a leading player in China gives it significant long-term growth potential.

- Risk Tolerance: Investing in NIO stock involves significant risk, given the company's current financial situation and the volatile nature of the EV market. Only investors with a high-risk tolerance should consider investing.

- Market Analysis: Thoroughly research the current market conditions and industry trends before making any investment decisions. Consider consulting with a financial advisor.

Conclusion:

NIO's Q1 earnings report presents a mixed bag. While strong delivery numbers suggest a healthy demand for its vehicles, profitability remains a concern. Whether or not to buy NIO stock ultimately depends on your individual risk tolerance and investment strategy. Conduct thorough due diligence and consider seeking professional financial advice before making any investment decisions. Remember to always diversify your portfolio to mitigate risk.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy NIO Stock Following Its Q1 Earnings Report?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Collective Bargaining Rights The Uncertain Future For Federal Employees

Jun 04, 2025

Collective Bargaining Rights The Uncertain Future For Federal Employees

Jun 04, 2025 -

Ukraines Drone Strikes Harbinger Of Future Combat

Jun 04, 2025

Ukraines Drone Strikes Harbinger Of Future Combat

Jun 04, 2025 -

Nios Q1 2024 Financial Report 21 Revenue Growth Highlights Key Performance

Jun 04, 2025

Nios Q1 2024 Financial Report 21 Revenue Growth Highlights Key Performance

Jun 04, 2025 -

Federal Layoff Announcement Met With Opposition From Rep Khanna And Labor Groups

Jun 04, 2025

Federal Layoff Announcement Met With Opposition From Rep Khanna And Labor Groups

Jun 04, 2025 -

Nio Q1 Earnings Loom Is The Stocks Decline A Buying Opportunity

Jun 04, 2025

Nio Q1 Earnings Loom Is The Stocks Decline A Buying Opportunity

Jun 04, 2025