Should You Buy NIO Stock Before Or After Q1 Earnings Release?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy NIO Stock Before or After Q1 Earnings Release? A Smart Investor's Guide

The electric vehicle (EV) market is buzzing, and NIO (NIO) is a key player often making headlines. With Q1 2024 earnings looming, many investors are wondering: is it better to buy NIO stock before the release, hoping for a positive surprise, or after, assessing the actual results? This article will dissect the pros and cons of each approach, helping you make a more informed investment decision.

The Allure of Pre-Earnings Buying:

Buying NIO stock before the Q1 earnings release carries a degree of risk, but also potential for significant reward. The anticipation surrounding earnings often leads to volatility. If the pre-release sentiment is positive, fueled by positive industry news or analyst upgrades, the stock price might rise in expectation of strong results. This presents an opportunity to buy at a potentially lower price before a potential post-earnings surge. However, this strategy hinges entirely on accurate prediction. A disappointing earnings report could lead to a sharp price drop, potentially trapping you with a loss.

Weighing the Risks and Rewards:

- Potential for Higher Returns: Successful pre-earnings buys can lead to substantial profits if the results exceed expectations.

- Risk of Significant Losses: Conversely, negative surprises can result in steep losses, especially in a volatile market like the EV sector.

- Market Sentiment Matters: Pre-earnings sentiment is heavily influenced by broader market trends and news cycles, adding another layer of unpredictability.

The Cautious Approach: Post-Earnings Analysis:

Waiting until after the Q1 earnings release allows for a more data-driven investment strategy. You'll have access to concrete financial information, including sales figures, production numbers, and guidance for future quarters. This allows for a more rational assessment of NIO's performance and future prospects. While you might miss out on a potential pre-earnings price jump, you significantly reduce the risk of buying high and selling low.

Analyzing the Post-Earnings Landscape:

- Reduced Uncertainty: Waiting eliminates much of the speculation inherent in pre-earnings trading.

- Informed Decision-Making: You can base your investment on factual data rather than predictions.

- Potential for Buying the Dip: If the earnings report is disappointing, the stock price may drop, presenting a potential buying opportunity for long-term investors.

NIO's Q1 2024: What to Watch For:

Regardless of your chosen strategy, understanding the key performance indicators (KPIs) for NIO's Q1 2024 earnings is crucial. Pay close attention to:

- Vehicle Deliveries: A key metric reflecting NIO's market share and production capacity.

- Revenue Growth: Indicates the overall health and expansion of the business.

- Gross Margins: Illustrates NIO's profitability and pricing power.

- Guidance for Future Quarters: Provides insight into NIO's projected performance and future growth trajectory.

Conclusion: A Balanced Approach

The question of whether to buy NIO stock before or after Q1 earnings release isn't a simple yes or no. It depends on your risk tolerance and investment horizon. Conservative investors might favor a post-earnings approach, prioritizing data-driven decisions over speculative gains. More aggressive investors, willing to accept higher risk for potentially higher returns, might consider pre-earnings purchases but with a well-defined exit strategy. Regardless of your approach, thorough research and a clear understanding of NIO's performance indicators are paramount to making a sound investment decision. Remember to consult with a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy NIO Stock Before Or After Q1 Earnings Release?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Familys Ordeal The Wire Actors Son Injured In Henry County Tornado

Jun 03, 2025

Familys Ordeal The Wire Actors Son Injured In Henry County Tornado

Jun 03, 2025 -

Local Actors Son Battles Back After Severe Henry County Tornado Injuries

Jun 03, 2025

Local Actors Son Battles Back After Severe Henry County Tornado Injuries

Jun 03, 2025 -

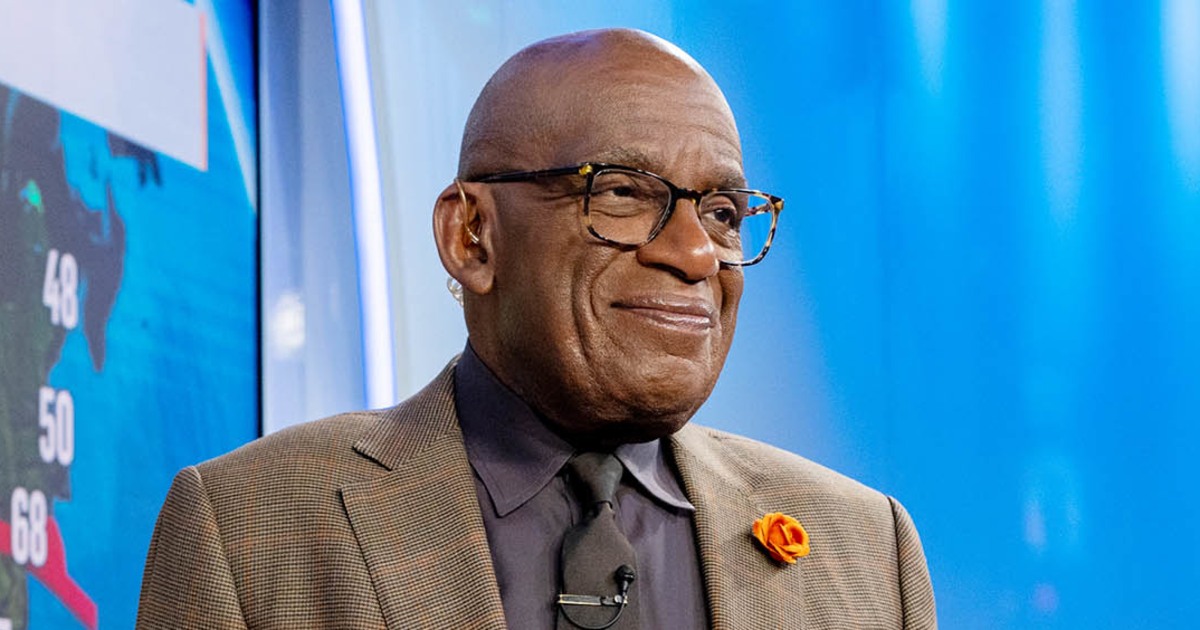

How Al Roker Kept Off 100 Pounds Two Decades Of Healthy Habits

Jun 03, 2025

How Al Roker Kept Off 100 Pounds Two Decades Of Healthy Habits

Jun 03, 2025 -

Successions Mountainhead Exploring The Influence Of Actual Tech Leaders

Jun 03, 2025

Successions Mountainhead Exploring The Influence Of Actual Tech Leaders

Jun 03, 2025 -

Sheinelle Jones Finds Solace In Colleagues Amidst Husbands Funeral

Jun 03, 2025

Sheinelle Jones Finds Solace In Colleagues Amidst Husbands Funeral

Jun 03, 2025