Should You Buy NIO Stock After Its Q1 Earnings Preview Dip?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy NIO Stock After its Q1 Earnings Preview Dip?

NIO, the Chinese electric vehicle (EV) maker, experienced a dip following its Q1 2024 earnings preview. This naturally leaves investors wondering: is this a buying opportunity, or a sign of further trouble ahead? The answer, as with most investment decisions, is complex and depends on several factors. Let's delve into the details to help you make an informed decision.

NIO's Q1 2024 Earnings Preview: A Mixed Bag

NIO's preview revealed a challenging quarter, marked by weaker-than-expected deliveries and revenue. While the company attributed some of this to seasonal factors and increased competition within the burgeoning Chinese EV market, the market reacted negatively. The stock price took a hit, prompting concerns amongst investors already grappling with broader economic uncertainties. However, a closer look reveals a more nuanced picture.

Factors to Consider Before Investing in NIO

Several key factors should inform your decision regarding NIO stock:

-

Competition: The Chinese EV market is fiercely competitive. Established players like BYD and newer entrants are constantly vying for market share, putting pressure on NIO's sales and profitability. Understanding this competitive landscape is crucial. Research competitors like XPeng and Li Auto to gauge the overall market trends and NIO's position within it.

-

Delivery Numbers: While Q1 deliveries were below expectations, it's essential to analyze the reasons behind the shortfall. Were these purely market-driven, or were there internal issues affecting production or supply chain? Looking beyond a single quarter's performance to understand long-term trends is vital.

-

Government Policies: China's government plays a significant role in shaping the EV industry. Changes in subsidies, regulations, or infrastructure development can significantly impact NIO's performance. Staying informed about these policies is crucial for any investor. Resources like the official website of the Ministry of Industry and Information Technology of China can provide valuable insights.

-

Technological Innovation: NIO's success hinges on its ability to innovate and offer competitive vehicles. Analyzing their upcoming product pipeline, battery technology advancements, and autonomous driving capabilities can reveal the company's long-term growth potential.

-

Global Expansion: NIO's ambitions extend beyond the Chinese market. Its progress in international expansion will be a key driver of future growth. Monitoring its success (or lack thereof) in new markets is an important aspect of evaluating the investment.

Is the Dip a Buying Opportunity?

The recent dip presents a potential buying opportunity for long-term investors with a high risk tolerance. However, it's crucial to remember that investing in the stock market always involves risk. NIO operates in a rapidly evolving and highly competitive market.

Before making any investment decisions, consult with a qualified financial advisor. They can help you assess your risk tolerance and determine if NIO aligns with your overall investment strategy. Remember to conduct thorough due diligence and research before investing in any stock.

Further Reading:

- [Link to NIO's official investor relations page]

- [Link to a reputable financial news source covering NIO]

Disclaimer: This article is for informational purposes only and should not be construed as financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research and consult with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy NIO Stock After Its Q1 Earnings Preview Dip?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How Lucy Guo Became The Youngest Self Made Woman Billionaire

Jun 04, 2025

How Lucy Guo Became The Youngest Self Made Woman Billionaire

Jun 04, 2025 -

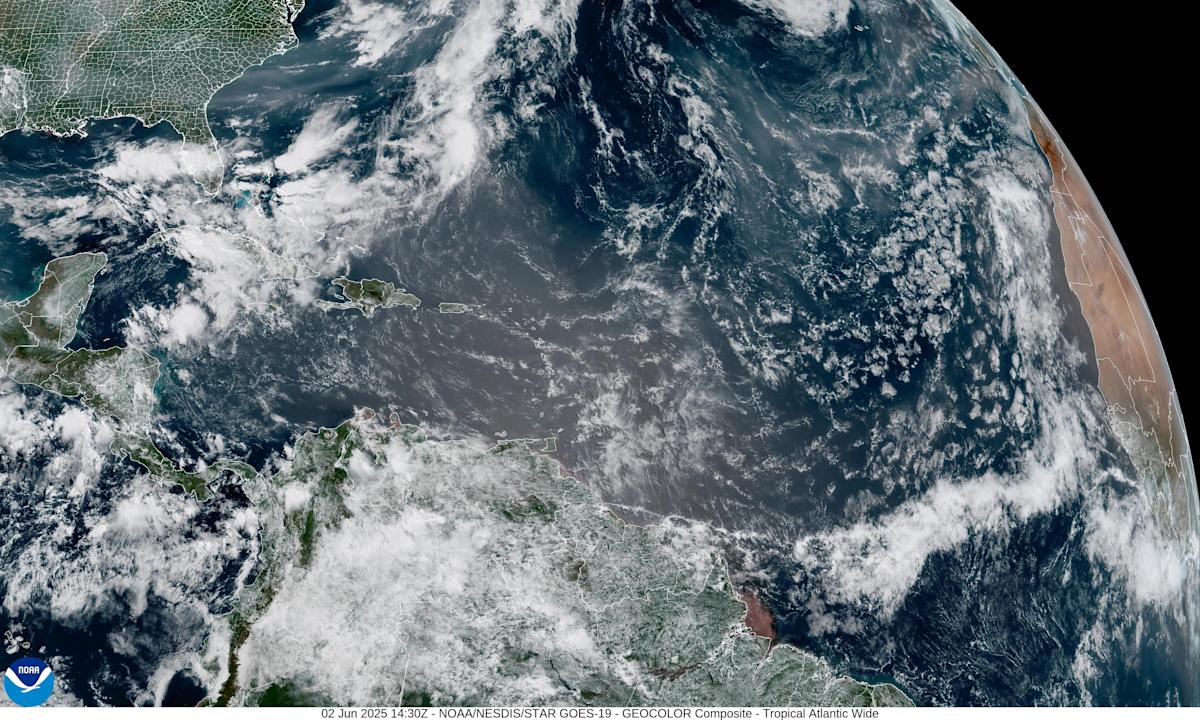

Wall Of Dust How Saharan Dust And Wildfire Smoke Affect Florida

Jun 04, 2025

Wall Of Dust How Saharan Dust And Wildfire Smoke Affect Florida

Jun 04, 2025 -

India Vs Thailand Both Teams Transformed Ahead Of Friendly

Jun 04, 2025

India Vs Thailand Both Teams Transformed Ahead Of Friendly

Jun 04, 2025 -

Hollywood Mourns Jonathan Joss Star Of King Of The Hill And Parks And Recreation Passes Away

Jun 04, 2025

Hollywood Mourns Jonathan Joss Star Of King Of The Hill And Parks And Recreation Passes Away

Jun 04, 2025 -

India Vs Thailand International Friendly Live Score Result Commentary

Jun 04, 2025

India Vs Thailand International Friendly Live Score Result Commentary

Jun 04, 2025