Should You Buy NIO Stock After Its Q1 Earnings Pre-Release Drop?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy NIO Stock After its Q1 Earnings Pre-Release Drop?

NIO, a prominent player in the burgeoning electric vehicle (EV) market, experienced a significant stock price drop following a pre-release announcement regarding its Q1 2024 earnings. This unexpected downturn has left many investors wondering: is this a buying opportunity, or a sign of further trouble ahead? Let's delve into the details and explore the potential implications for NIO stock.

NIO's Q1 2024 Pre-Release Announcement: A Closer Look

NIO's pre-release announcement revealed lower-than-expected vehicle deliveries for Q1 2024, triggering a sell-off among investors. While the company cited various factors, including macroeconomic conditions and increased competition within the Chinese EV market, the market reacted negatively. This pre-release dip highlights the inherent volatility associated with investing in the EV sector, a market known for its rapid growth but also its susceptibility to market fluctuations and unforeseen challenges.

Analyzing the Factors Contributing to the Drop

Several factors contributed to the decline in NIO's stock price:

- Lower-than-anticipated vehicle deliveries: The shortfall in Q1 deliveries significantly impacted investor sentiment. This underscores the importance of consistent growth in the EV sector, where strong delivery numbers often dictate market valuation.

- Intensified competition: The Chinese EV market is fiercely competitive, with established players and new entrants vying for market share. This intense rivalry puts pressure on pricing and profitability, impacting individual company performance.

- Macroeconomic headwinds: Global economic uncertainty and concerns about potential recessionary pressures have also played a role in the overall market downturn, impacting investor risk appetite across sectors, including the EV industry.

Is This a Buying Opportunity? Weighing the Pros and Cons

The post-announcement drop presents a complex scenario for potential investors. While the lower stock price might seem attractive, a cautious approach is warranted.

Potential Pros:

- Discounted entry point: The price drop offers a potentially lower entry point for long-term investors who believe in NIO's long-term growth prospects.

- Strong brand recognition and technological advancements: NIO has established itself as a significant player in the EV market, known for its innovative technologies and design.

- Government support for the EV sector in China: The Chinese government's continued support for the EV industry could provide a positive tailwind for NIO in the long run.

Potential Cons:

- Uncertain market conditions: The overall economic climate and intense competition pose significant risks.

- Execution risks: NIO needs to successfully navigate the challenges posed by competition and market fluctuations to achieve its growth targets.

- Dependence on the Chinese market: NIO's primary market is China, exposing it to specific risks associated with the Chinese economy and regulatory environment.

What Should Investors Do?

The decision of whether to buy NIO stock after the Q1 earnings pre-release drop depends on individual risk tolerance and investment strategy. Thorough research and consideration of the aforementioned factors are crucial. Investors should carefully analyze NIO's financial statements, assess the competitive landscape, and consider their own investment timeline before making any decisions.

Seeking Professional Advice:

Before making any investment decisions, especially in volatile markets like the EV sector, it's highly recommended to consult with a qualified financial advisor. They can provide personalized guidance based on your financial situation and risk tolerance.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy NIO Stock After Its Q1 Earnings Pre-Release Drop?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

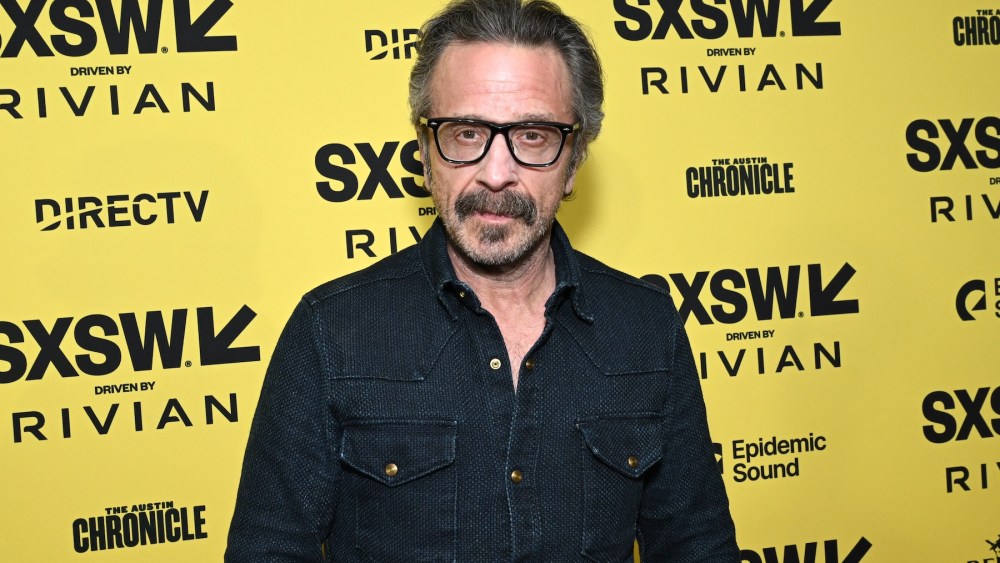

Marc Maron To Conclude Long Running Wtf Podcast

Jun 03, 2025

Marc Maron To Conclude Long Running Wtf Podcast

Jun 03, 2025 -

Adulting 101 Miley Cyruss Reaction To Billy Rays Romance With Elizabeth Hurley

Jun 03, 2025

Adulting 101 Miley Cyruss Reaction To Billy Rays Romance With Elizabeth Hurley

Jun 03, 2025 -

Broadway Uproar 500 Artists Accuse Patti Lu Pone Of Racially Charged Conduct

Jun 03, 2025

Broadway Uproar 500 Artists Accuse Patti Lu Pone Of Racially Charged Conduct

Jun 03, 2025 -

Familys Ordeal The Wire Actor On Sons Near Fatal Tornado Experience

Jun 03, 2025

Familys Ordeal The Wire Actor On Sons Near Fatal Tornado Experience

Jun 03, 2025 -

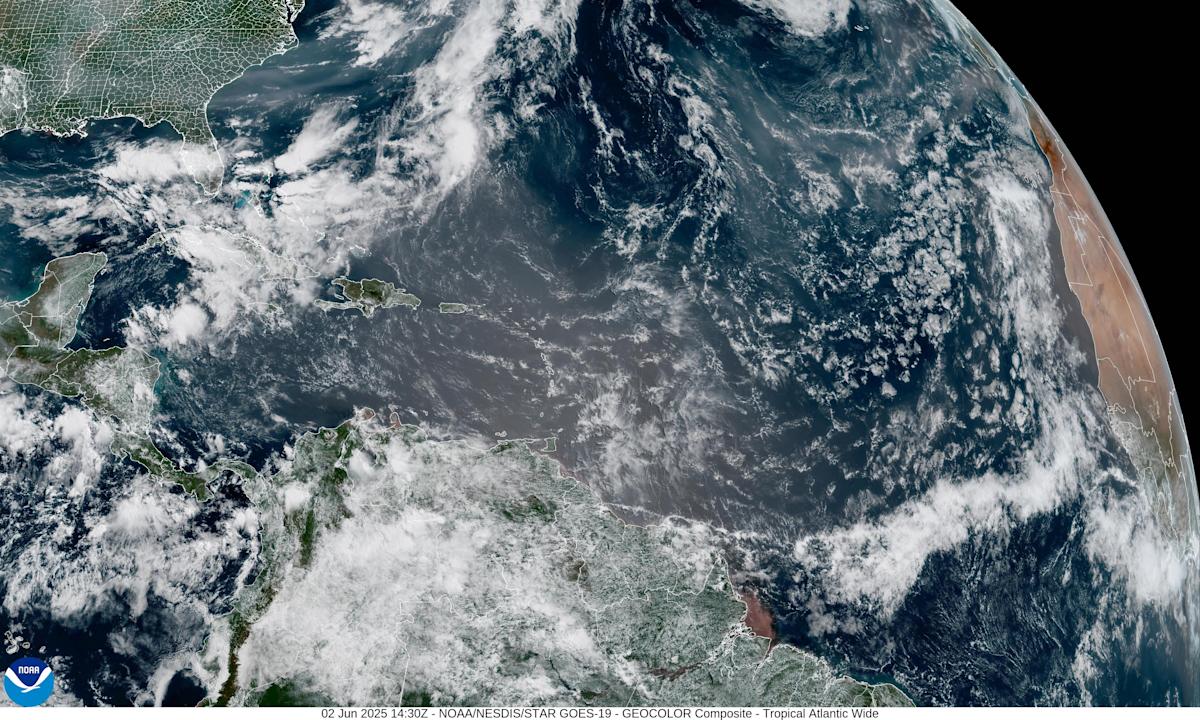

Wall Of Dust Exploring The Impact Of Saharan Dust And Canadian Wildfire Smoke On Florida

Jun 03, 2025

Wall Of Dust Exploring The Impact Of Saharan Dust And Canadian Wildfire Smoke On Florida

Jun 03, 2025