Should You Buy Hims & Hers (HIMS) Stock? A Detailed Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Should You Buy Hims & Hers (HIMS) Stock? A Detailed Analysis

The telehealth market is booming, and Hims & Hers (HIMS) is a major player. But is this publicly traded company a smart investment for your portfolio? This detailed analysis explores the pros and cons of buying HIMS stock, helping you make an informed decision.

Hims & Hers: A Quick Overview

Hims & Hers offers a convenient and discreet way to access healthcare services online, specializing in men's and women's health products and treatments. Their offerings range from hair loss solutions and skincare to sexual health products and mental wellness services. This direct-to-consumer (DTC) model has disrupted traditional healthcare, attracting a significant customer base.

Arguments for Investing in HIMS Stock:

- Massive Market Opportunity: The telehealth industry is experiencing explosive growth, with more and more people seeking convenient and accessible healthcare options. Hims & Hers is well-positioned to capitalize on this trend. The increasing comfort level with online consultations and digital health solutions only strengthens their market position.

- Strong Brand Recognition: Hims & Hers has built a recognizable brand known for its straightforward marketing and focus on destigmatizing healthcare discussions. This strong brand presence is crucial for attracting and retaining customers.

- Diversified Product Portfolio: Their diverse product range reduces reliance on any single product line, mitigating risk and offering opportunities for growth across various health segments. This diversification is key to long-term stability.

- Subscription Model: The subscription-based model provides recurring revenue, enhancing predictability and financial stability for the company. This is a significant advantage compared to businesses relying solely on one-time purchases.

- Potential for Expansion: Hims & Hers has significant potential for expansion into new markets and product categories, further driving growth and revenue. This includes both geographic expansion and the addition of new healthcare services.

Arguments Against Investing in HIMS Stock:

- Competition: The telehealth market is becoming increasingly competitive, with established players and new entrants vying for market share. Hims & Hers faces significant competition, requiring ongoing innovation and adaptation to maintain its position.

- Regulatory Landscape: The healthcare industry is heavily regulated, and changes in regulations could impact Hims & Hers' operations and profitability. Staying ahead of and adapting to regulatory changes is crucial for long-term success.

- Profitability Concerns: While the company is growing rapidly, profitability has been a challenge. Investors should carefully analyze the company's financial statements and future projections before making a decision.

- Dependence on Marketing: Hims & Hers relies heavily on marketing and advertising to acquire new customers. This can be costly and may not always be effective in the long term. A shift in marketing strategies or decreased effectiveness could impact growth.

- Stock Market Volatility: The stock market is inherently volatile, and HIMS stock is no exception. Investors should be prepared for potential fluctuations in the stock price.

Conclusion: Should You Buy?

Hims & Hers presents a compelling investment opportunity for those bullish on the telehealth market's future. However, the company faces challenges, including competition and profitability concerns. Before investing, conduct thorough due diligence, analyzing financial statements, considering the risks, and aligning the investment with your overall risk tolerance and financial goals. Consider consulting a financial advisor for personalized advice.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Should You Buy Hims & Hers (HIMS) Stock? A Detailed Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Urgent Action Needed Assessing Corporate Preparedness For A 2 C World

Jun 03, 2025

Urgent Action Needed Assessing Corporate Preparedness For A 2 C World

Jun 03, 2025 -

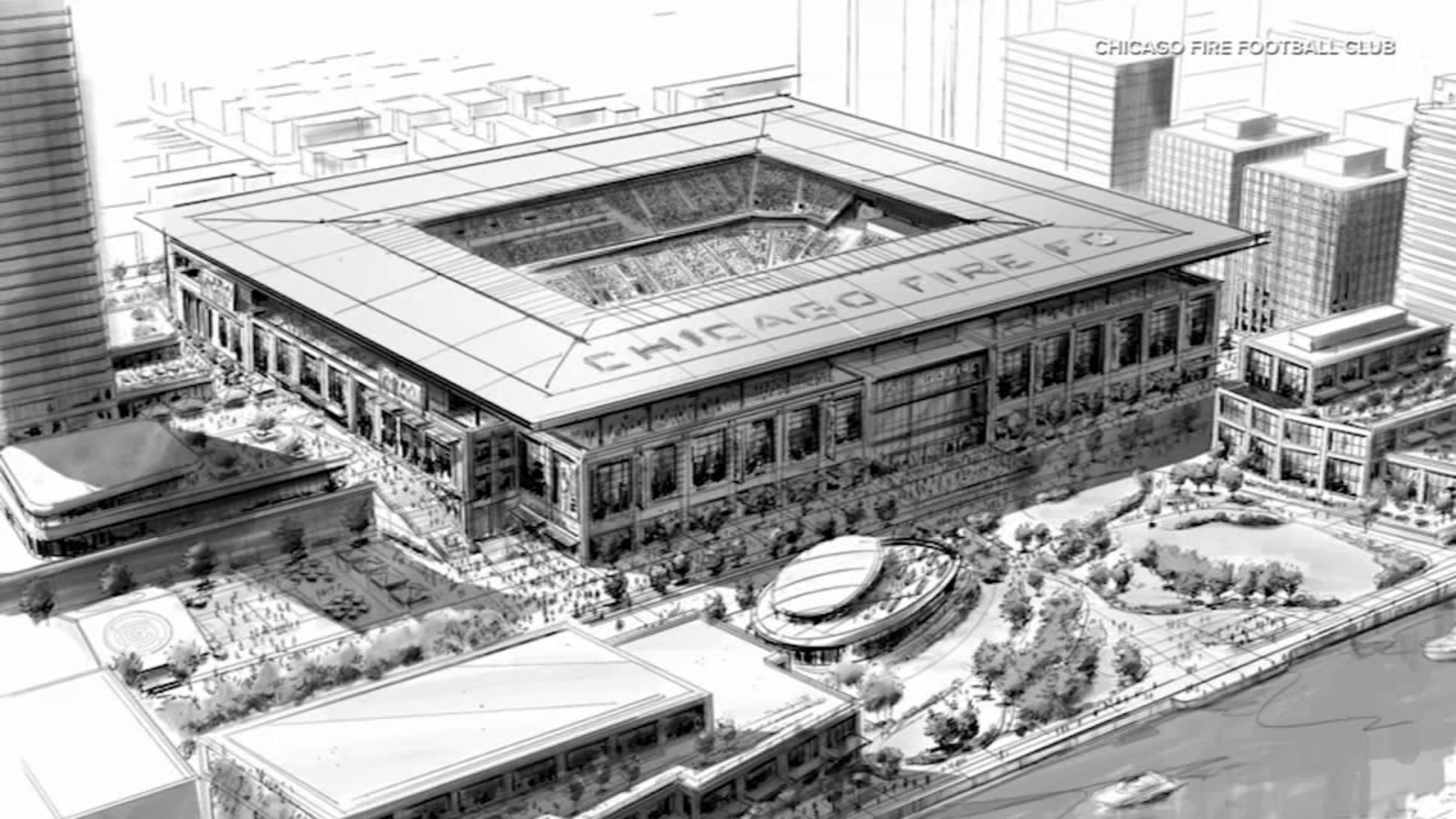

Chicago Fire Fc Stadium Project Details On The South Loop Venue

Jun 03, 2025

Chicago Fire Fc Stadium Project Details On The South Loop Venue

Jun 03, 2025 -

South Loop To Host New Chicago Fire Fc Soccer Stadium

Jun 03, 2025

South Loop To Host New Chicago Fire Fc Soccer Stadium

Jun 03, 2025 -

Minnesota Governor Walz Democrats Need A Stronger Approach Against Trump

Jun 03, 2025

Minnesota Governor Walz Democrats Need A Stronger Approach Against Trump

Jun 03, 2025 -

Ukraine Targets Crimea Bridge Underwater Explosions Reported

Jun 03, 2025

Ukraine Targets Crimea Bridge Underwater Explosions Reported

Jun 03, 2025