Seniors Targeted: FBI's Warning On Devastating Retirement Scam Using AI

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Seniors Targeted: FBI's Warning on Devastating Retirement Scam Using AI

The FBI has issued a stark warning about a new wave of retirement scams leveraging artificial intelligence (AI), leaving vulnerable seniors facing devastating financial losses. These sophisticated schemes are exploiting the trust and technological naiveté of older adults, highlighting the urgent need for increased awareness and proactive measures. The agency urges families and communities to educate their senior loved ones about these evolving threats.

The rise of AI has unfortunately opened doors for increasingly convincing and difficult-to-detect scams. This isn't your grandparents' Nigerian prince email; these are highly personalized, emotionally manipulative schemes powered by AI.

How the AI-Powered Retirement Scam Works

These scams often begin with seemingly legitimate phone calls or emails. The perpetrators, using AI-powered voice cloning and sophisticated phishing techniques, impersonate trusted figures such as financial advisors, family members, or even government officials. They create a sense of urgency, often claiming there's a problem with the victim's retirement account or an unexpected windfall requiring immediate action.

- Personalized Approach: AI allows scammers to tailor their approach to individual victims, using publicly available information to build rapport and credibility. They might mention details about the victim's financial situation, family, or even their hobbies, making the scam appear far more authentic.

- Emotional Manipulation: The scammers employ pressure tactics, exploiting the fear of losing retirement savings or missing out on a lucrative opportunity. This emotional manipulation can override rational thinking, making victims more susceptible to their demands.

- Complex Schemes: The scams often involve multiple steps, moving money through various accounts to obfuscate the trail and make tracking the perpetrators more difficult. This complexity can overwhelm victims and hinder their ability to identify the fraud.

Red Flags to Watch Out For

While the sophistication of these scams is increasing, there are still key indicators to watch out for:

- Unexpected Contact: Be wary of unsolicited calls or emails claiming to be from financial institutions or government agencies. Legitimate organizations rarely request sensitive information via phone or email.

- Sense of Urgency: Scammers often create a sense of urgency, pressuring victims to act quickly without giving them time to think or verify information.

- Requests for Personal Information: Legitimate organizations will never ask for your banking details, Social Security number, or other sensitive information over the phone or email.

- Unusual Investment Opportunities: Be skeptical of high-return investment opportunities that seem too good to be true.

Protecting Yourself and Your Loved Ones

The FBI recommends several preventative measures:

- Educate Yourself and Others: Stay informed about the latest scams and share this information with senior family members and friends.

- Verify Information: Never act on unsolicited requests for personal information. Always verify the identity of the caller or sender through independent means. Contact your financial institution directly using their official contact information, not the number provided by the caller.

- Use Strong Passwords and Multi-Factor Authentication: Protect your online accounts with strong, unique passwords and enable multi-factor authentication wherever possible.

- Report Suspicious Activity: Report any suspected scams to the FBI's Internet Crime Complaint Center (IC3) at .

This sophisticated use of AI in scams poses a significant threat to seniors' financial security. By increasing awareness and taking proactive steps, we can help protect our vulnerable populations from these devastating crimes. Share this information to help spread awareness and safeguard your community. Don't hesitate to report suspicious activity – your vigilance could save someone from financial ruin.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Seniors Targeted: FBI's Warning On Devastating Retirement Scam Using AI. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Yankees 10 4 Win Over White Sox Key Moments And Player Performances August 28 2025

Aug 31, 2025

Yankees 10 4 Win Over White Sox Key Moments And Player Performances August 28 2025

Aug 31, 2025 -

Rising Healthcare Costs The Impact On Obamacare Plans

Aug 31, 2025

Rising Healthcare Costs The Impact On Obamacare Plans

Aug 31, 2025 -

Nfl Players Heroic Act Rescuing I 15 Crash Victim In Temecula

Aug 31, 2025

Nfl Players Heroic Act Rescuing I 15 Crash Victim In Temecula

Aug 31, 2025 -

Will Trumps Tough On Crime Stance Reduce Youth Crime In D C

Aug 31, 2025

Will Trumps Tough On Crime Stance Reduce Youth Crime In D C

Aug 31, 2025 -

Redistricting In Missouri Governors Special Session To Reshape Congressional Boundaries

Aug 31, 2025

Redistricting In Missouri Governors Special Session To Reshape Congressional Boundaries

Aug 31, 2025

Latest Posts

-

Check The Nh Lottery Results Powerball And Lucky For Life Numbers For Sept 1 2025

Sep 04, 2025

Check The Nh Lottery Results Powerball And Lucky For Life Numbers For Sept 1 2025

Sep 04, 2025 -

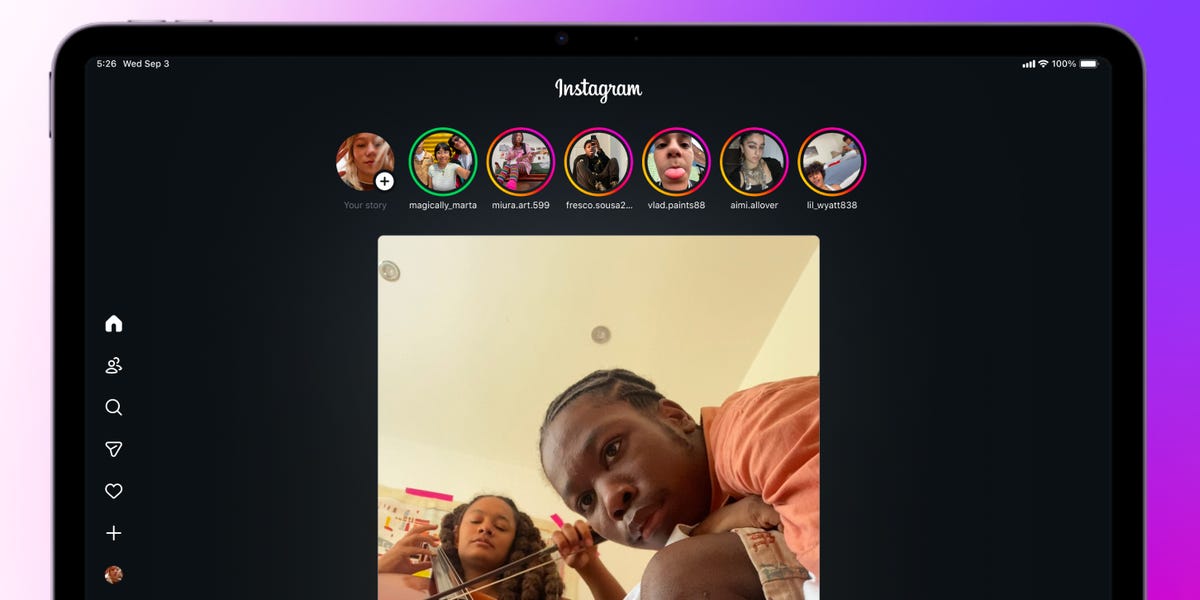

Is Instagrams New I Pad App Worth The Hype

Sep 04, 2025

Is Instagrams New I Pad App Worth The Hype

Sep 04, 2025 -

Desert Receives Unprecedented Precipitation Following Severe Storm

Sep 04, 2025

Desert Receives Unprecedented Precipitation Following Severe Storm

Sep 04, 2025 -

Who Is Jenna Ortega Dating Now A Look At Her Recent Love Life

Sep 04, 2025

Who Is Jenna Ortega Dating Now A Look At Her Recent Love Life

Sep 04, 2025 -

Paris Jackson Denies Involvement In Michael Jackson Biopic

Sep 04, 2025

Paris Jackson Denies Involvement In Michael Jackson Biopic

Sep 04, 2025