Secure Your Clean Energy Tax Credits Before They Expire

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Secure Your Clean Energy Tax Credits Before They Expire!

The Inflation Reduction Act (IRA) unleashed a wave of incentives for clean energy, offering substantial tax credits to homeowners and businesses investing in renewable energy solutions. But time is running out! Many of these crucial tax credits have deadlines rapidly approaching, meaning you need to act now to secure your share of these significant savings. Don't miss out on thousands of dollars in potential tax breaks – learn how to capitalize on these opportunities before it's too late.

What Clean Energy Tax Credits Are Available?

The IRA offers a diverse range of tax credits designed to accelerate the transition to clean energy. Some key incentives include:

-

Residential Clean Energy Credit: This credit covers 30% of the cost of qualified renewable energy improvements, including solar panels, wind turbines, and fuel cells. This is a significant incentive for homeowners looking to reduce their carbon footprint and energy bills. [Link to IRS Publication on Residential Clean Energy Credit]

-

Clean Vehicle Tax Credit: Thinking about going electric? The IRA expands the clean vehicle tax credit, offering up to $7,500 for new electric vehicles and $4,000 for used electric vehicles. Eligibility requirements, such as vehicle price limits and domestic sourcing of battery components, apply. [Link to relevant government website detailing Clean Vehicle Tax Credit]

-

Energy Efficient Home Improvement Tax Credits: Beyond renewable energy, the IRA also provides credits for energy-efficient home improvements. These include upgrades like insulation, heat pumps, and energy-efficient windows. These credits can significantly reduce your home's energy consumption and lower your utility bills. [Link to resource explaining energy-efficient home improvement tax credits]

-

Commercial Clean Energy Tax Credits: Businesses aren't left out. The IRA offers substantial tax credits for commercial solar installations, energy storage, and other clean energy investments. These credits can significantly reduce the upfront costs associated with adopting sustainable practices. [Link to resources for commercial clean energy tax credits]

Understanding the Deadlines and Eligibility Requirements:

While the IRA provides long-term support for clean energy, specific credits may have shorter deadlines. It's crucial to review the specific requirements and deadlines for each credit you're interested in. Factors like the date of installation, the type of equipment, and your income level can influence eligibility.

Here's how to avoid missing out:

-

Consult a Tax Professional: A qualified tax advisor can help you navigate the complexities of the IRA's clean energy tax credits and ensure you claim all eligible deductions. They can assess your specific circumstances and guide you through the application process.

-

Start the Process Now: Don't wait until the last minute. Many of these credits require significant lead time for installation, permitting, and documentation. Beginning the process early is crucial to meeting deadlines.

-

Gather Necessary Documentation: Keep meticulous records of all expenses related to your clean energy investments. This includes invoices, receipts, and any other supporting documentation.

The Bottom Line:

The clean energy tax credits offered under the Inflation Reduction Act represent a historic opportunity to save money while contributing to a more sustainable future. However, these incentives have deadlines. Don't let valuable tax breaks slip away – act now to secure your share before it's too late! Contact a qualified professional today to start the process.

Call to Action: Learn more about the specific tax credits applicable to your situation by visiting [Link to a reputable source providing comprehensive information on IRA clean energy tax credits].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Secure Your Clean Energy Tax Credits Before They Expire. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Legality Of Flag Burning Trumps Order And The Supreme Courts Precedent

Aug 27, 2025

The Legality Of Flag Burning Trumps Order And The Supreme Courts Precedent

Aug 27, 2025 -

From Sorry To This Man To Viral Queen Keke Palmers Meme Legacy

Aug 27, 2025

From Sorry To This Man To Viral Queen Keke Palmers Meme Legacy

Aug 27, 2025 -

Death Toll Rises In Gaza Hospital Airstrike Trump Condemns Attack On Medics And Journalists

Aug 27, 2025

Death Toll Rises In Gaza Hospital Airstrike Trump Condemns Attack On Medics And Journalists

Aug 27, 2025 -

Trump Administrations Impact 175 Million Slashed From California Bullet Train

Aug 27, 2025

Trump Administrations Impact 175 Million Slashed From California Bullet Train

Aug 27, 2025 -

Monsoon Storms Plunge Thousands In The Valley Into Darkness

Aug 27, 2025

Monsoon Storms Plunge Thousands In The Valley Into Darkness

Aug 27, 2025

Latest Posts

-

Finding Inter Miami Vs Seattle Sounders Leagues Cup Final Tickets A Step By Step Guide

Aug 28, 2025

Finding Inter Miami Vs Seattle Sounders Leagues Cup Final Tickets A Step By Step Guide

Aug 28, 2025 -

Cathay Pacific Aria Suite Review Luxury Redefined

Aug 28, 2025

Cathay Pacific Aria Suite Review Luxury Redefined

Aug 28, 2025 -

Governor Newsom Launches Counter Maga Merchandise Line

Aug 28, 2025

Governor Newsom Launches Counter Maga Merchandise Line

Aug 28, 2025 -

Usc Hopeful For Long Term Deal To Perpetuate Notre Dame Football Rivalry

Aug 28, 2025

Usc Hopeful For Long Term Deal To Perpetuate Notre Dame Football Rivalry

Aug 28, 2025 -

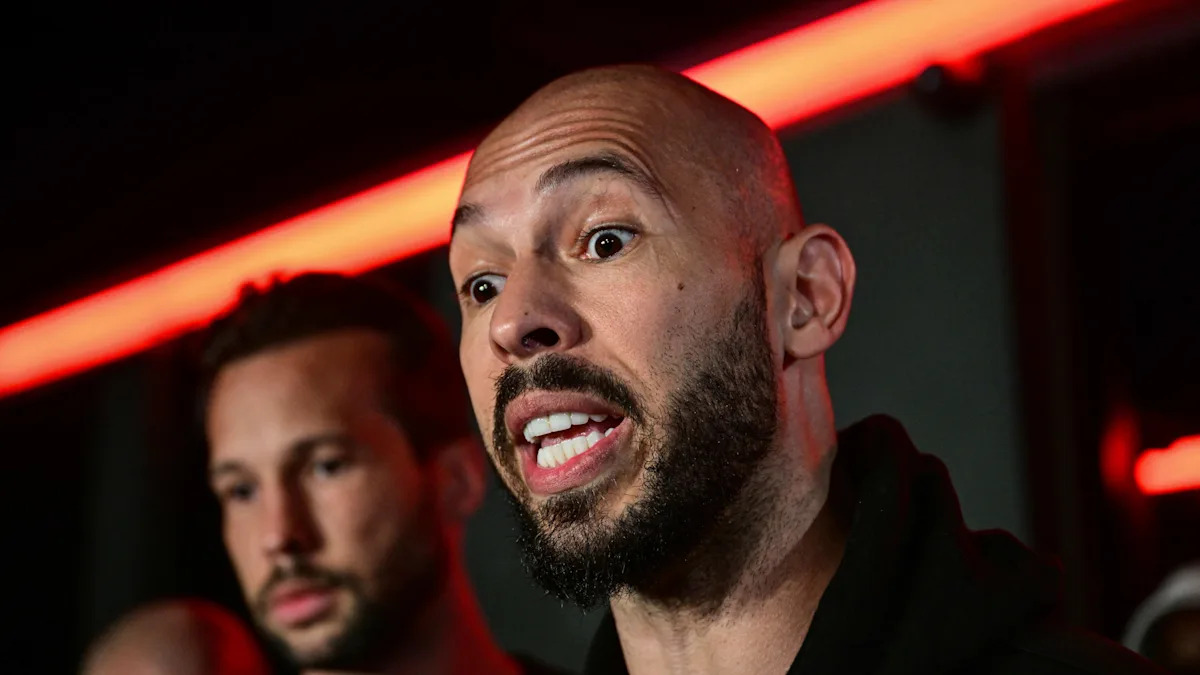

Andrew Tates Boxing Future Advanced Talks With Misfits Amidst Ongoing Charges

Aug 28, 2025

Andrew Tates Boxing Future Advanced Talks With Misfits Amidst Ongoing Charges

Aug 28, 2025