Secure Your Clean Energy Tax Credits: A Guide To Federal Incentives

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Secure Your Clean Energy Tax Credits: A Guide to Federal Incentives

The Inflation Reduction Act (IRA) unleashed a wave of unprecedented federal tax credits designed to accelerate the transition to clean energy. But navigating the complexities of these incentives can feel daunting. This guide breaks down the key tax credits available, offering clear steps to ensure you don't miss out on potentially significant savings. Don't let valuable financial opportunities slip through your fingers – let's explore how you can secure your share of these vital clean energy incentives.

Understanding the Inflation Reduction Act's Impact on Clean Energy

The IRA represents a monumental shift in U.S. energy policy, offering substantial financial incentives for individuals and businesses to invest in clean energy technologies. This landmark legislation aims to combat climate change while boosting the domestic clean energy sector. Key incentives include credits for:

- Residential Clean Energy: Tax credits for solar panels, wind turbines, heat pumps, and other energy-efficient home improvements.

- Commercial Clean Energy: Significant tax credits for businesses investing in renewable energy projects, energy storage, and energy efficiency upgrades.

- Electric Vehicles (EVs): Tax credits for purchasing new and used electric vehicles, helping to accelerate the adoption of electric transportation.

- Clean Energy Manufacturing: Incentives aimed at boosting domestic manufacturing of clean energy technologies, creating jobs and reducing reliance on foreign sources.

Key Tax Credits to Consider:

1. Residential Clean Energy Credit: This credit covers a significant portion of the cost of installing solar, wind, and other renewable energy systems in your home. The credit is a direct offset against your tax liability, potentially reducing your tax bill considerably. Crucially, the IRA extended and significantly boosted this credit. [Link to IRS website for Residential Clean Energy Credit details]

2. Clean Vehicle Tax Credit: The credit for purchasing a new clean vehicle (EV or fuel cell vehicle) depends on several factors, including the vehicle's manufacturer's suggested retail price (MSRP) and the vehicle's battery capacity. The credit for used clean vehicles offers significant savings for those seeking more affordable options. [Link to IRS website for Clean Vehicle Tax Credit details]

3. Energy Efficient Home Improvement Tax Credit: This credit incentivizes homeowners to upgrade their homes with energy-efficient improvements, such as insulation, windows, and doors. These improvements can lead to substantial long-term savings on energy bills. [Link to IRS website for Energy Efficient Home Improvement Credit details]

4. Commercial Clean Energy Tax Credits: Businesses can benefit from a range of tax credits for investing in clean energy projects, including solar, wind, and geothermal energy systems. These credits can significantly reduce the upfront costs of these projects, making them more financially viable. [Link to relevant government website for business tax credits]

How to Maximize Your Clean Energy Tax Credits:

- Consult a Tax Professional: A qualified tax professional can help you navigate the complexities of these credits and ensure you claim all eligible deductions.

- Keep Detailed Records: Maintain meticulous records of all expenses related to your clean energy investments. This documentation is crucial for claiming the credits.

- Understand the Requirements: Each credit has specific requirements. Familiarize yourself with these requirements to ensure eligibility.

- Act Quickly: Some credits may have deadlines or limitations. Don't delay in exploring your options.

- Explore State and Local Incentives: Many states and localities offer additional incentives for clean energy investments. Check with your state and local governments to see what additional benefits are available.

Don't Miss Out!

The Inflation Reduction Act presents a unique opportunity to save money while contributing to a cleaner environment. By understanding and utilizing these tax credits effectively, you can significantly reduce the cost of transitioning to clean energy. Take the initiative today and secure your share of these valuable incentives! [Link to a resource page with more detailed information, perhaps a checklist].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Secure Your Clean Energy Tax Credits: A Guide To Federal Incentives. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Unpaid Leave For Rhode Island Prosecutor Following Newport Incident

Aug 27, 2025

Unpaid Leave For Rhode Island Prosecutor Following Newport Incident

Aug 27, 2025 -

Keke Palmers 4 Most Memorable Meme Moments A Birthday Tribute

Aug 27, 2025

Keke Palmers 4 Most Memorable Meme Moments A Birthday Tribute

Aug 27, 2025 -

California High Speed Rail Project Suffers Setback 175 Million Funding Cut By Trump Administration

Aug 27, 2025

California High Speed Rail Project Suffers Setback 175 Million Funding Cut By Trump Administration

Aug 27, 2025 -

Dodgers Six Million Dollar Pitcher Velocity Problems End October Hopes

Aug 27, 2025

Dodgers Six Million Dollar Pitcher Velocity Problems End October Hopes

Aug 27, 2025 -

Unbelievable Defense Tatiss Catch Robs Devers Of A Blast

Aug 27, 2025

Unbelievable Defense Tatiss Catch Robs Devers Of A Blast

Aug 27, 2025

Latest Posts

-

Usc Hopeful For Long Term Deal To Perpetuate Notre Dame Football Rivalry

Aug 28, 2025

Usc Hopeful For Long Term Deal To Perpetuate Notre Dame Football Rivalry

Aug 28, 2025 -

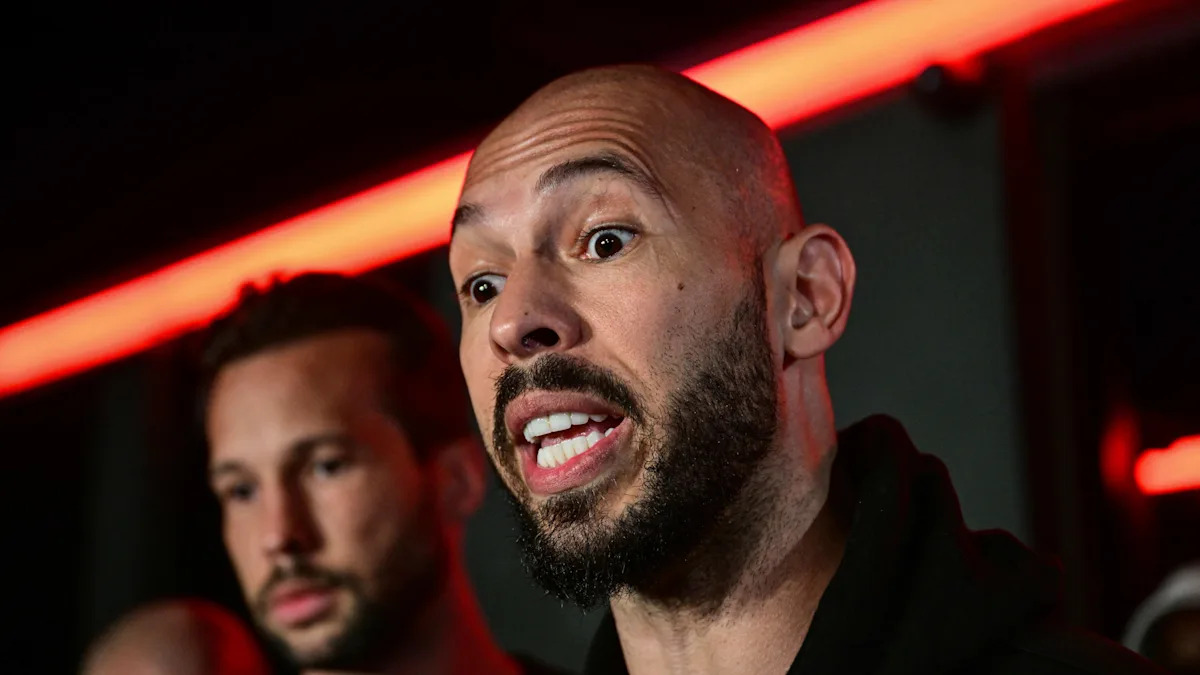

Andrew Tates Boxing Future Advanced Talks With Misfits Amidst Ongoing Charges

Aug 28, 2025

Andrew Tates Boxing Future Advanced Talks With Misfits Amidst Ongoing Charges

Aug 28, 2025 -

Western European Iron Age Evidence Of Egalitarian Societies Unveiled

Aug 28, 2025

Western European Iron Age Evidence Of Egalitarian Societies Unveiled

Aug 28, 2025 -

Big West Action Csun Faces Utah Tech Then Travels To San Diego

Aug 28, 2025

Big West Action Csun Faces Utah Tech Then Travels To San Diego

Aug 28, 2025 -

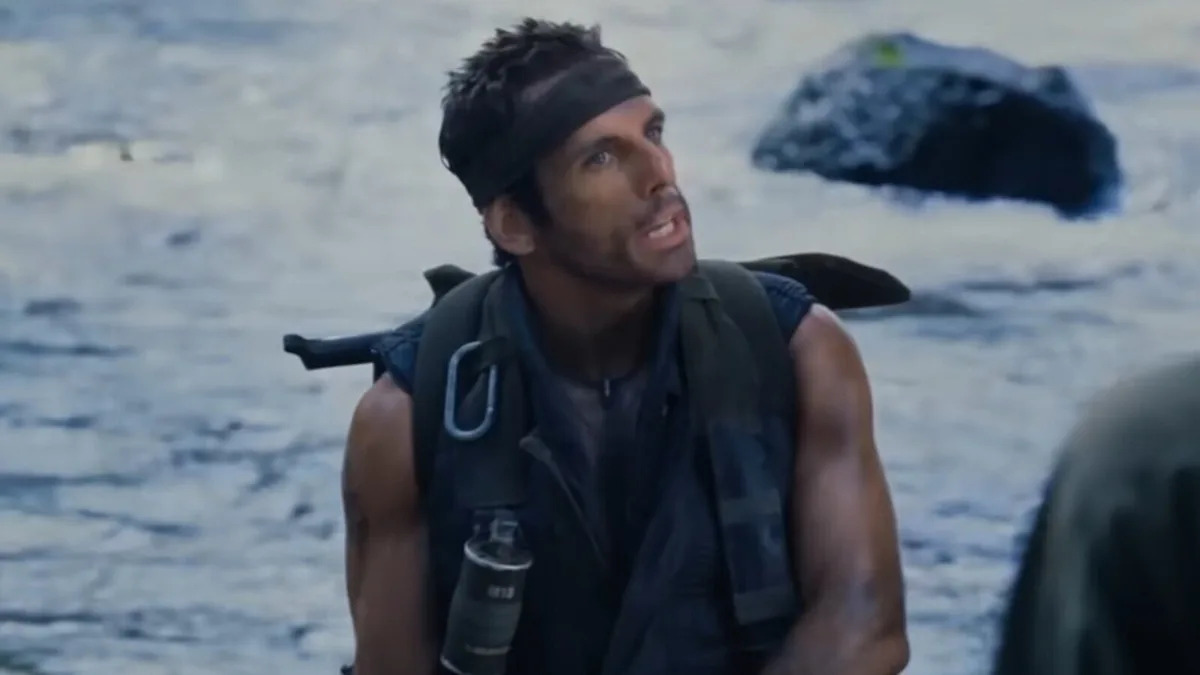

Tropic Thunder Ben Stillers Commentary On Seriousness In War Films

Aug 28, 2025

Tropic Thunder Ben Stillers Commentary On Seriousness In War Films

Aug 28, 2025