SBA Leaders Detail Disaster Recovery And Small Business Aid

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

SBA Leaders Detail Disaster Recovery and Small Business Aid: Navigating the Aftermath

Record-breaking storms, wildfires, and other natural disasters are leaving a trail of devastation across the nation, impacting countless small businesses. The Small Business Administration (SBA) is playing a crucial role in the recovery effort, offering vital financial assistance and resources to entrepreneurs struggling to rebuild. Recent statements from SBA leaders highlight the agency's commitment and the crucial support available to affected businesses.

Understanding the SBA's Disaster Assistance Program

The SBA's disaster assistance program is a lifeline for small business owners facing unforeseen challenges. This program offers a range of crucial resources, including:

-

Low-interest disaster loans: These loans provide crucial capital for businesses to repair or replace damaged property, equipment, and inventory. The terms are designed to be manageable, even during challenging recovery periods. Learn more about eligibility requirements on the .

-

Economic Injury Disaster Loans (EIDLs): These loans offer working capital to help businesses cover operating expenses during the recovery process. This can cover payroll, rent, and other vital costs, helping to keep businesses afloat while they rebuild.

-

Technical assistance: Beyond financial aid, the SBA offers valuable guidance and support to help businesses navigate the complex recovery process. This can include assistance with insurance claims, business planning, and regulatory compliance.

Recent SBA Initiatives and Key Statements

SBA Administrator [Insert Name of current SBA Administrator] recently addressed [mention specific event, e.g., a press conference, congressional hearing], emphasizing the agency's commitment to providing swift and efficient assistance to disaster-stricken communities. Key takeaways from the statement include:

-

Streamlined application process: The SBA is actively working to simplify the application process for disaster loans, making it easier for businesses to access the funding they need. This includes [mention specific examples of streamlined processes, if available].

-

Increased outreach efforts: The SBA is expanding its outreach efforts to ensure that all eligible businesses, particularly those in underserved communities, are aware of the available assistance. This includes partnerships with [mention any relevant organizations or groups].

-

Focus on long-term recovery: The SBA acknowledges that recovery is a long-term process and is committed to providing ongoing support to businesses throughout the rebuilding phase. This includes [mention any long-term support programs or initiatives].

H2: Tips for Small Businesses Seeking Disaster Relief

Navigating the disaster relief process can be overwhelming. Here are some key steps for small businesses seeking SBA assistance:

-

Act quickly: The sooner you apply for assistance, the sooner you can begin the recovery process.

-

Gather necessary documentation: Having all required documentation readily available will streamline the application process.

-

Contact the SBA directly: Don't hesitate to reach out to the SBA with any questions or concerns. Their dedicated customer service representatives are available to assist you.

-

Explore additional resources: Remember to explore other avenues of support, such as insurance claims and local community assistance programs.

Conclusion:

The SBA's role in disaster recovery is invaluable, providing critical financial and technical assistance to small businesses facing unprecedented challenges. By understanding the available programs and taking proactive steps, business owners can navigate the recovery process effectively and rebuild their businesses stronger than before. Stay informed about SBA updates and resources by regularly checking their [link to SBA website]. Remember to document all damages thoroughly and keep accurate records for your application. Don't hesitate to seek professional advice if needed. The road to recovery may be challenging, but with the right support and resources, small businesses can overcome adversity and thrive once again.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on SBA Leaders Detail Disaster Recovery And Small Business Aid. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

The Memphis Communitys Resistance To X Ai Displacement And The Future Of The Neighborhood

Sep 01, 2025

The Memphis Communitys Resistance To X Ai Displacement And The Future Of The Neighborhood

Sep 01, 2025 -

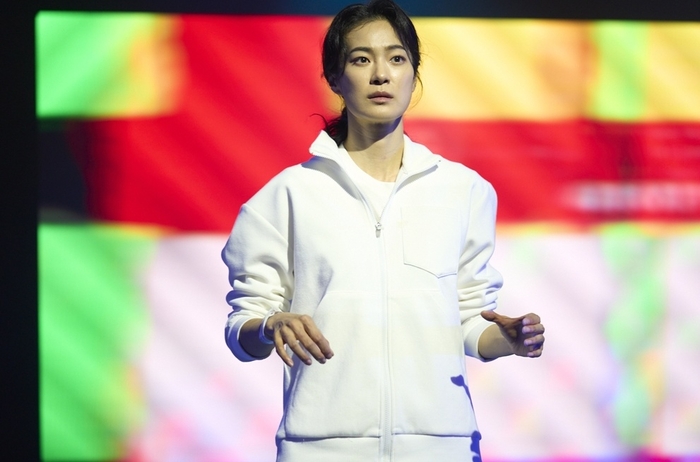

The Effect Play Concludes Ok Ja Yeons Performance A Resounding Success

Sep 01, 2025

The Effect Play Concludes Ok Ja Yeons Performance A Resounding Success

Sep 01, 2025 -

I Phone 17 Pro Vs I Phone 17 Air Vs I Phone 17 What To Expect In New Features

Sep 01, 2025

I Phone 17 Pro Vs I Phone 17 Air Vs I Phone 17 What To Expect In New Features

Sep 01, 2025 -

Apple September Event 7 New Products We Expect

Sep 01, 2025

Apple September Event 7 New Products We Expect

Sep 01, 2025 -

Ted Lasso Casting Controversy Keeley Hazells Claim On The Keeley Jones Role

Sep 01, 2025

Ted Lasso Casting Controversy Keeley Hazells Claim On The Keeley Jones Role

Sep 01, 2025