Sailing To Hawaii: An Oregonian's 401(k)-Funded Adventure

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Sailing to Hawaii: An Oregonian's 401(k)-Funded Adventure

Dreaming of turquoise waters and volcanic peaks? One Oregonian turned that dream into reality, funding their Hawaiian sailing adventure with their 401(k). This isn't your typical retirement plan story; it's a tale of calculated risk, meticulous planning, and the ultimate reward of a life less ordinary. Read on to discover how this intrepid sailor navigated the financial seas and charted a course towards paradise.

The allure of Hawaii is undeniable. Its stunning beaches, vibrant culture, and breathtaking landscapes draw millions of visitors each year. But for many, the idea of experiencing this paradise remains just a dream. Not for Sarah Miller, an Oregonian who decided to trade spreadsheets for sailboats and embark on a life-changing journey. Miller, a former accountant, meticulously planned her escape, leveraging a unique financial strategy to achieve her audacious goal.

From Spreadsheets to Sailboats: The 401(k) Conversion

Miller's story isn't about impulsive spending or reckless abandon. Instead, it's a testament to careful financial planning and a strategic approach to retirement savings. She utilized a little-known provision within her 401(k) plan that allowed for a partial early withdrawal without incurring significant penalties. This required extensive research and consultation with financial advisors – a crucial step often overlooked by those considering similar ventures.

Key elements of her financial strategy included:

- Consulting a financial advisor: Miller emphasizes the importance of expert advice. A qualified professional can help navigate the complexities of 401(k) withdrawals and potential tax implications. [Link to a resource on 401k withdrawals]

- Creating a detailed budget: A realistic budget is essential for any long-term adventure. This included factoring in boat maintenance, provisioning, potential emergencies, and ongoing living expenses in Hawaii.

- Minimizing additional debt: Avoiding unnecessary debt before and during the trip was crucial to financial stability.

- Exploring alternative income streams: While the 401(k) provided a significant portion of the funding, Miller also explored potential remote work opportunities to supplement her finances.

Navigating the Open Waters and Financial Seas

The journey wasn't without its challenges. Miller faced numerous hurdles, from unexpected repairs to navigating unpredictable weather conditions. These experiences highlight the importance of thorough preparation and a resilient mindset for anyone considering a similar undertaking. Beyond the physical challenges, she also had to manage her finances carefully, sticking to her budget and making smart spending choices.

The Rewards of Calculated Risk

Miller's story isn't just about the financial aspects; it's a powerful narrative about pursuing one's dreams. It's a testament to the potential for innovative thinking and calculated risk-taking in achieving personal fulfillment. Her adventure serves as an inspiration for others who may feel trapped by conventional life paths, reminding us that with careful planning and a strong will, seemingly impossible dreams can become a reality.

Considering a Similar Adventure? Key Takeaways

- Consult financial professionals: Don't go it alone. Seeking professional advice is paramount.

- Create a comprehensive budget: Thorough planning is critical for success.

- Research all options: Explore all possible avenues for funding and income generation.

- Assess your risk tolerance: Understand the potential consequences of early 401(k) withdrawals.

Miller's journey is a compelling case study in non-traditional retirement planning and the pursuit of personal fulfillment. While her approach may not be suitable for everyone, her story serves as a powerful reminder that with careful planning and a willingness to embrace risk, dreams can indeed come true. What's your dream adventure? Share your thoughts in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Sailing To Hawaii: An Oregonian's 401(k)-Funded Adventure. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

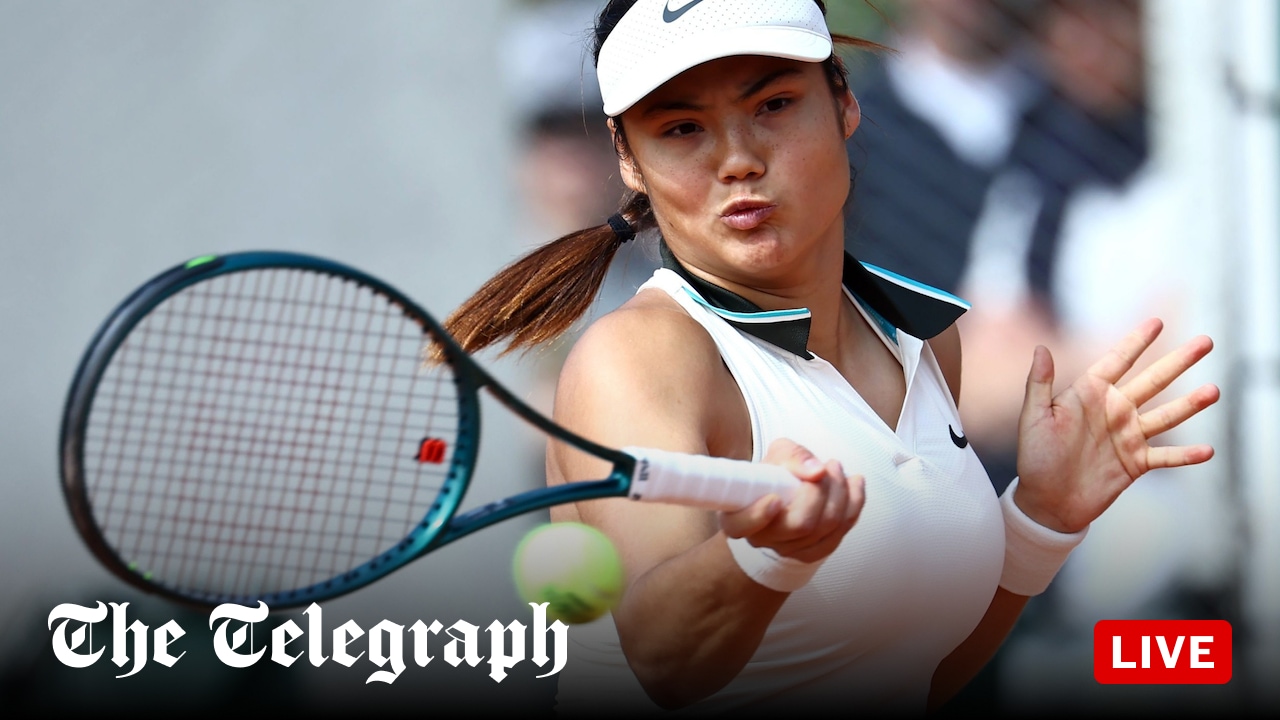

Raducanu Vs Wang French Open 2025 Live Scores Radio Commentary And Roland Garros Updates

May 26, 2025

Raducanu Vs Wang French Open 2025 Live Scores Radio Commentary And Roland Garros Updates

May 26, 2025 -

Roland Garros Raducanu Vs Wang Xinyu Match Updates And Score

May 26, 2025

Roland Garros Raducanu Vs Wang Xinyu Match Updates And Score

May 26, 2025 -

Saturday Storm Aftermath Outage Updates And Recovery Efforts In Green Country

May 26, 2025

Saturday Storm Aftermath Outage Updates And Recovery Efforts In Green Country

May 26, 2025 -

Predicting The French Open Womens Matches Day 2 Analysis And Betting Odds

May 26, 2025

Predicting The French Open Womens Matches Day 2 Analysis And Betting Odds

May 26, 2025 -

Trumps West Point Remarks Boasting Of A Strengthened Military

May 26, 2025

Trumps West Point Remarks Boasting Of A Strengthened Military

May 26, 2025