S&P 500, Nasdaq Fall: Market Volatility Driven By Fed Uncertainty And Trump's Iran Stance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 and Nasdaq Plunge: Market Volatility Fueled by Fed Uncertainty and Trump's Iran Actions

Wall Street experienced a significant downturn today, with the S&P 500 and Nasdaq Composite suffering substantial losses. This market volatility is largely attributed to two key factors: ongoing uncertainty surrounding the Federal Reserve's monetary policy and President Trump's increasingly assertive stance on Iran. The Dow Jones Industrial Average also saw a decline, though less dramatic than its tech-heavy counterparts.

The market's anxiety is palpable. Investors are grappling with conflicting signals from the Federal Reserve regarding interest rate hikes and the future trajectory of quantitative easing. This uncertainty, coupled with escalating geopolitical tensions in the Middle East, has created a perfect storm of negative sentiment.

The Fed's Tightrope Walk:

The Federal Reserve's recent pronouncements have been less than clear-cut. While inflation remains relatively subdued, concerns about potential overheating of the economy continue to fuel speculation regarding future interest rate adjustments. This ambiguity is making it difficult for investors to predict the market's direction, leading to increased volatility and risk aversion. Analysts are closely watching upcoming economic data releases, such as the Consumer Price Index (CPI) and employment figures, for clues about the Fed's next move. The lack of clear guidance is prompting many investors to adopt a wait-and-see approach, contributing to the current market downturn.

Trump's Iran Policy: A Geopolitical Wildcard:

Adding fuel to the fire is President Trump's recent actions and rhetoric concerning Iran. His administration's strong stance on the Iranian nuclear deal and the escalating tensions in the region are creating significant geopolitical uncertainty. This uncertainty is impacting investor confidence, particularly in sectors sensitive to global political instability. The potential for further escalation in the Middle East presents a considerable risk to global economic growth and market stability. Many investors are viewing the situation as a major headwind, leading them to reduce their risk exposure and contributing to the sell-off.

What This Means for Investors:

The current market volatility underscores the importance of a diversified investment strategy. Investors should carefully consider their risk tolerance and adjust their portfolios accordingly. This could involve rebalancing their holdings, diversifying across asset classes, or seeking professional financial advice. It is crucial to remember that market fluctuations are a normal part of the investment landscape, and long-term investors should avoid making rash decisions based on short-term market movements.

Looking Ahead:

The coming weeks will be crucial in determining the market's future trajectory. The release of key economic data, further pronouncements from the Federal Reserve, and the unfolding situation in Iran will all play a significant role in shaping investor sentiment. Experts suggest maintaining vigilance and staying informed about developments both domestically and internationally to navigate this period of uncertainty. The combination of economic and geopolitical factors makes predicting the market's short-term movements challenging, but long-term strategic planning remains crucial for success.

Keywords: S&P 500, Nasdaq, Market Volatility, Federal Reserve, Interest Rates, Iran, Geopolitical Risk, Stock Market, Investment Strategy, Trump, Economic Uncertainty, Dow Jones.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500, Nasdaq Fall: Market Volatility Driven By Fed Uncertainty And Trump's Iran Stance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Game Recap Ramos Homer Leads Giants Offensive Charge Against Guardians

Jun 21, 2025

Game Recap Ramos Homer Leads Giants Offensive Charge Against Guardians

Jun 21, 2025 -

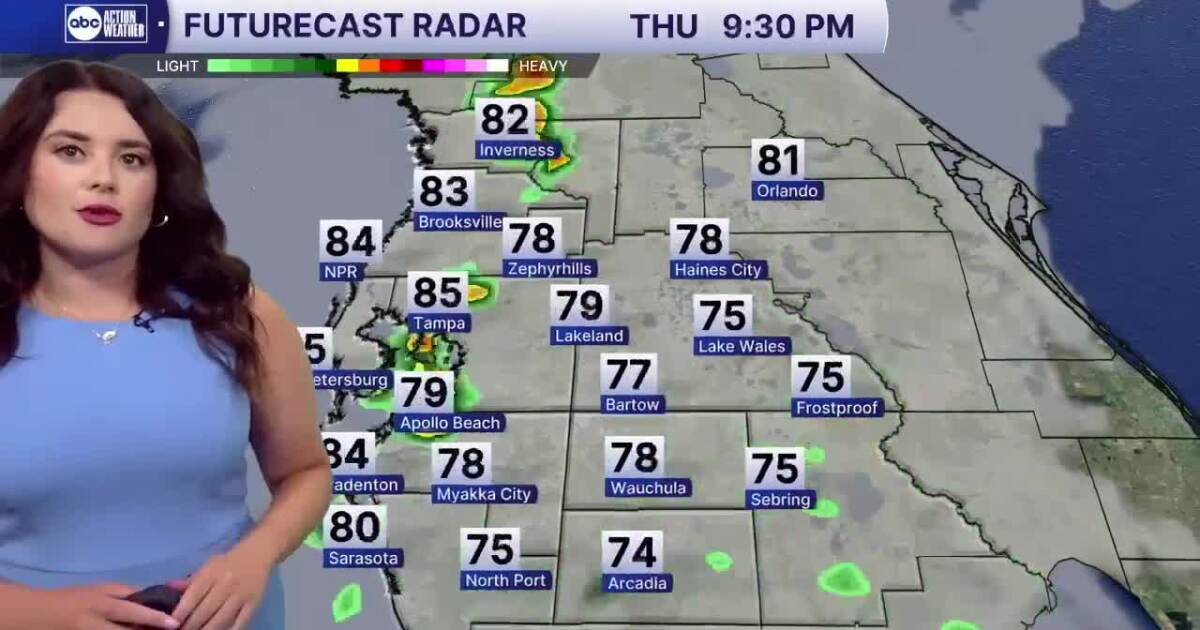

Todays Forecast Prepare For Muggy Air And Potential Late Day Showers

Jun 21, 2025

Todays Forecast Prepare For Muggy Air And Potential Late Day Showers

Jun 21, 2025 -

Conspiracy To Kill La Rapper 19 Mexican Mafia Members Arrested And Charged

Jun 21, 2025

Conspiracy To Kill La Rapper 19 Mexican Mafia Members Arrested And Charged

Jun 21, 2025 -

Harry Kane Boca Juniors Fans And Club World Cup Challenge Await

Jun 21, 2025

Harry Kane Boca Juniors Fans And Club World Cup Challenge Await

Jun 21, 2025 -

Tight Game Tight Finish Pressly Saves Astros Win Over Pirates

Jun 21, 2025

Tight Game Tight Finish Pressly Saves Astros Win Over Pirates

Jun 21, 2025