S&P 500, Nasdaq Fall: Market Volatility Driven By Fed Uncertainty And Iran Tensions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 and Nasdaq Plunge Amidst Fed Uncertainty and Iran Tensions

Market volatility gripped Wall Street on Tuesday, as the S&P 500 and Nasdaq Composite experienced significant declines. Investors grapple with uncertainty surrounding the Federal Reserve's next moves on interest rates and escalating tensions in the Middle East following recent events in Iran. This double whammy sent shockwaves through the market, leaving many wondering what the future holds for the already fragile economic landscape.

The S&P 500 fell by [insert percentage] while the tech-heavy Nasdaq plummeted by [insert percentage]. This sharp downturn marks a significant reversal from recent gains and underscores the fragility of the current market conditions. The decline wasn't limited to major indices; many individual stocks, particularly in the technology and energy sectors, suffered substantial losses.

Fed Rate Hikes: The Looming Uncertainty

The primary driver behind Tuesday's market downturn appears to be lingering uncertainty surrounding the Federal Reserve's monetary policy. While recent inflation data has shown signs of cooling, the Fed's commitment to curbing inflation remains steadfast. Investors are anxiously awaiting further clues about the trajectory of future interest rate hikes. Will the Fed maintain its aggressive stance, potentially triggering a recession? Or will they opt for a more cautious approach? This ambiguity is fueling market volatility and prompting investors to adopt a more risk-averse strategy.

- Key questions remain: What will the next FOMC meeting decide? How will inflation trends impact future rate hikes? These questions continue to dominate discussions among market analysts and investors alike.

Iran Tensions Add Fuel to the Fire

Adding to the market's anxieties are escalating geopolitical tensions stemming from recent events in Iran. [Insert concise and factual summary of the relevant Iran-related news, citing credible sources]. This instability introduces a significant geopolitical risk premium into the market, prompting investors to seek safer havens and further contributing to the sell-off. Energy prices also experienced fluctuations reflecting the potential for supply chain disruptions.

- Geopolitical risks: Uncertainty surrounding the situation in Iran adds a layer of complexity to the already challenging economic environment. This uncertainty is likely to persist until the situation clarifies.

What Lies Ahead for Investors?

The current market volatility underscores the need for a cautious approach to investing. Experts advise investors to carefully review their portfolios and consider diversifying their holdings to mitigate risk. While the short-term outlook remains uncertain, the long-term prospects for the market will depend largely on how the Federal Reserve manages inflation and the resolution (or de-escalation) of geopolitical tensions.

For further insights into market trends and investment strategies, consider consulting with a financial advisor. Staying informed about macroeconomic factors and geopolitical events is crucial for navigating the complexities of the current market landscape. Remember to conduct thorough research before making any significant investment decisions.

Keywords: S&P 500, Nasdaq, market volatility, Fed, Federal Reserve, interest rates, inflation, Iran, geopolitical risk, stock market, investment, recession, economic uncertainty, FOMC, monetary policy

(Note: Remember to replace bracketed information with accurate and up-to-date details before publishing.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500, Nasdaq Fall: Market Volatility Driven By Fed Uncertainty And Iran Tensions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Gabbard Omitted Analysis Of Trumps Approach To Iran And Israel Policy

Jun 21, 2025

Gabbard Omitted Analysis Of Trumps Approach To Iran And Israel Policy

Jun 21, 2025 -

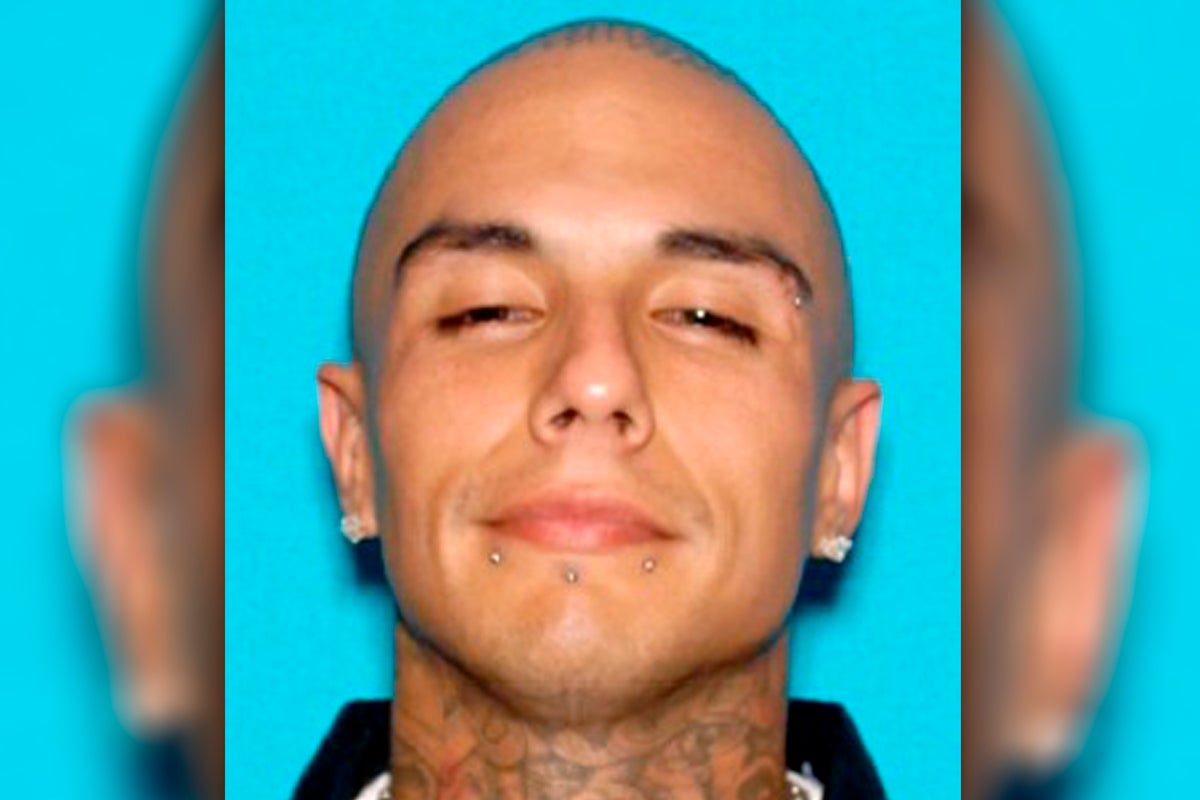

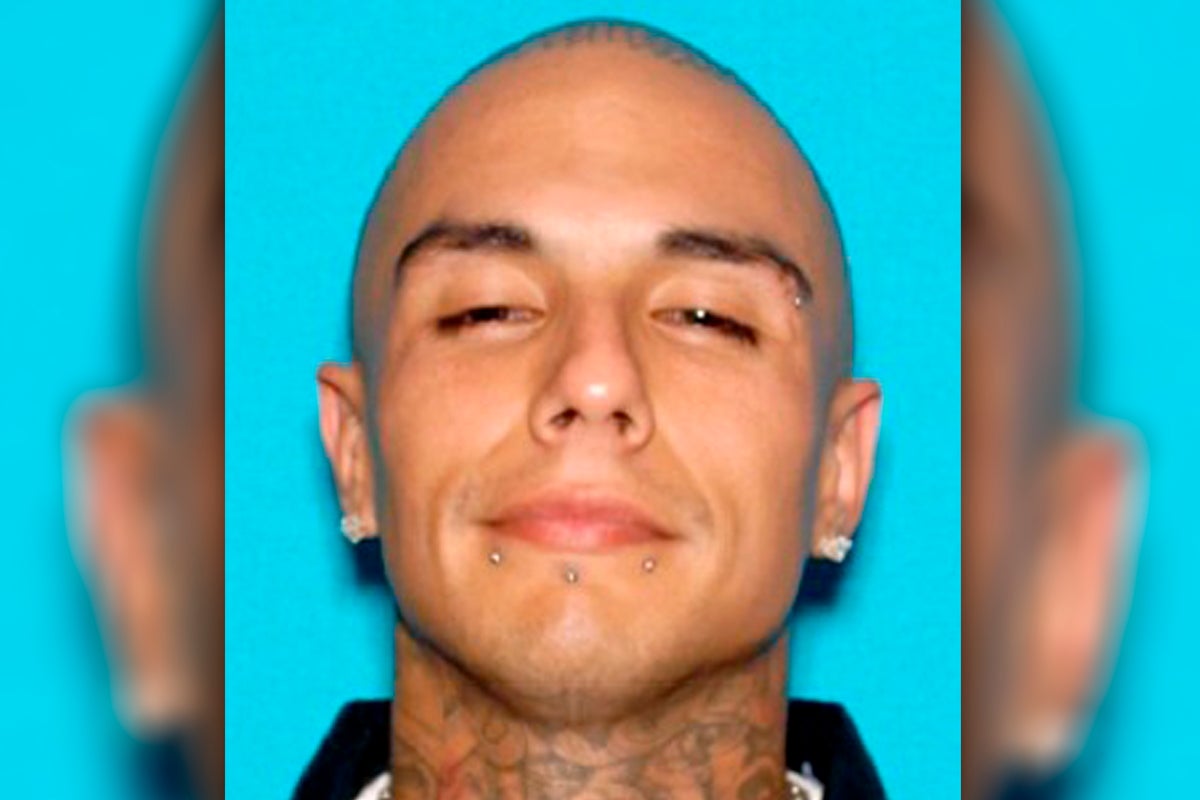

Rapper Targeted In Mexican Mafia Conspiracy 19 Arrests

Jun 21, 2025

Rapper Targeted In Mexican Mafia Conspiracy 19 Arrests

Jun 21, 2025 -

June 20th 2025 A Closer Look At Bayern Munich Vs Boca Juniors

Jun 21, 2025

June 20th 2025 A Closer Look At Bayern Munich Vs Boca Juniors

Jun 21, 2025 -

Mexican Mafias Alleged Plot To Kill Rapper 19 Indicted

Jun 21, 2025

Mexican Mafias Alleged Plot To Kill Rapper 19 Indicted

Jun 21, 2025 -

Mark Cuban Rejects Kamala Harris Vp Offer Heres Why

Jun 21, 2025

Mark Cuban Rejects Kamala Harris Vp Offer Heres Why

Jun 21, 2025