S&P 500, Nasdaq Fall: Market Volatility Driven By Fed Uncertainty And Geopolitical Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500, Nasdaq Fall: Market Volatility Driven by Fed Uncertainty and Geopolitical Risks

The stock market experienced a significant downturn today, with both the S&P 500 and Nasdaq Composite indices suffering substantial losses. This sharp decline underscores the growing unease among investors, fueled by persistent uncertainty surrounding the Federal Reserve's monetary policy and escalating geopolitical risks. The volatility highlights a challenging environment for investors navigating a complex interplay of economic and global factors.

Fed Uncertainty Shakes Investor Confidence

The Federal Reserve's recent hawkish stance on interest rates continues to be a primary driver of market volatility. While controlling inflation remains the Fed's top priority, investors are increasingly concerned about the potential for a more aggressive rate hike cycle than anticipated. This could lead to a sharper economic slowdown, potentially triggering a recession. The ambiguity surrounding the Fed's future actions leaves investors hesitant, prompting them to take a more cautious approach. Many analysts are closely monitoring upcoming economic data releases, including inflation figures and employment reports, for clues about the Fed's next move. This uncertainty is reflected in the increased volatility observed across various asset classes.

Geopolitical Risks Add to the Pressure

Adding to the market's anxieties are escalating geopolitical risks. The ongoing conflict in Ukraine, coupled with heightened tensions in other regions, creates a climate of uncertainty that impacts investor sentiment. These geopolitical events introduce unpredictable elements into the global economic landscape, potentially disrupting supply chains, impacting energy prices, and increasing inflationary pressures. This complex interplay of global events significantly contributes to the current market downturn.

Market Sectors Feeling the Pinch

The tech-heavy Nasdaq Composite experienced a particularly sharp decline, reflecting investor concerns about the sector's vulnerability to rising interest rates. Growth stocks, which typically thrive in low-interest-rate environments, are particularly susceptible to higher borrowing costs. Other sectors, including energy and consumer discretionary, also felt the pressure, highlighting the broad-based nature of this market correction.

What Investors Should Do

The current market volatility presents challenges for investors. A well-diversified portfolio, coupled with a long-term investment strategy, remains crucial. It's also vital to avoid panic selling and to carefully consider the risk tolerance of your investment strategy. Consult with a financial advisor to assess your current portfolio and adjust your strategy accordingly. Remember that market fluctuations are a normal part of the investment cycle, and a long-term perspective is essential for successful investing.

Looking Ahead: Navigating the Uncertainty

The coming weeks and months will likely see continued market volatility as investors grapple with these complex challenges. Close monitoring of economic data, Federal Reserve announcements, and geopolitical developments is crucial. Investors should be prepared for further fluctuations and maintain a disciplined approach to their investment strategies. Understanding the underlying factors driving market movements is key to navigating this uncertain period.

Keywords: S&P 500, Nasdaq, market volatility, Federal Reserve, interest rates, inflation, geopolitical risks, recession, stock market, investment strategy, economic uncertainty, investor confidence, growth stocks, market correction.

(Note: This article provides general information and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500, Nasdaq Fall: Market Volatility Driven By Fed Uncertainty And Geopolitical Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pressly Earns Save As Astros Edge Pirates In Close Game

Jun 21, 2025

Pressly Earns Save As Astros Edge Pirates In Close Game

Jun 21, 2025 -

Mexican Mafias Alleged Murder Plot 19 Face Charges In La Rap Artist Case

Jun 21, 2025

Mexican Mafias Alleged Murder Plot 19 Face Charges In La Rap Artist Case

Jun 21, 2025 -

Jaws And Shark Conservation Separating Fact From Fiction In The Wake Of A Hollywood Classic

Jun 21, 2025

Jaws And Shark Conservation Separating Fact From Fiction In The Wake Of A Hollywood Classic

Jun 21, 2025 -

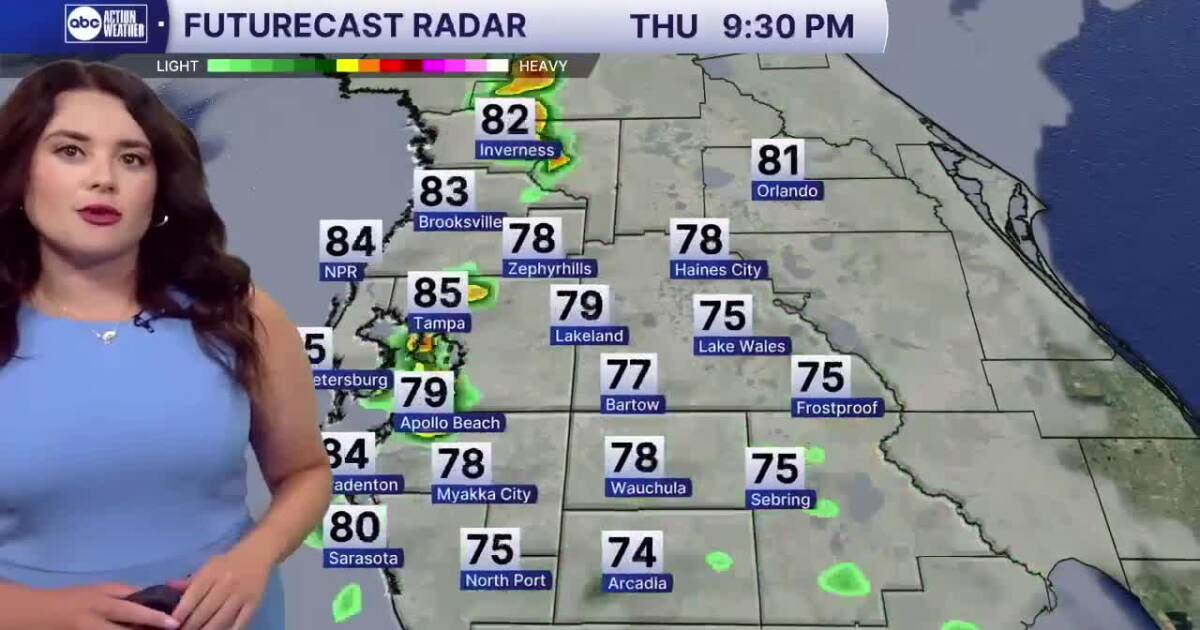

Weather Forecast Prepare For Late Day Showers And High Humidity

Jun 21, 2025

Weather Forecast Prepare For Late Day Showers And High Humidity

Jun 21, 2025 -

Bayern Munich Vs Boca Juniors Club World Cup Fixture Team News Lineups And Where To Watch

Jun 21, 2025

Bayern Munich Vs Boca Juniors Club World Cup Fixture Team News Lineups And Where To Watch

Jun 21, 2025