S&P 500 Gains Momentum: Nvidia-Driven Tech Surge Erases Year's Losses

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 Gains Momentum: Nvidia-Driven Tech Surge Erases Year's Losses

The S&P 500 index has staged a remarkable comeback, erasing its year-to-date losses thanks to a powerful surge in the technology sector, largely driven by the phenomenal performance of Nvidia. This unexpected rally has injected a dose of optimism into a market previously grappling with inflation concerns and interest rate hikes. But is this a sustainable trend, or just a temporary reprieve?

Nvidia's Stellar Performance Fuels the Rally

Nvidia's recent earnings report, showcasing explosive growth in its AI-related businesses, sent shockwaves through the market. The company's groundbreaking advancements in artificial intelligence, particularly its high-demand GPUs crucial for AI development and deployment, have catapulted its stock price to record highs. This success isn't just benefiting Nvidia; it's acting as a powerful catalyst for the broader tech sector, lifting other tech giants and related companies. The ripple effect is undeniable, with investors pouring money into technology stocks, anticipating continued growth in the AI sector.

Beyond Nvidia: A Broader Tech Sector Revival?

While Nvidia's performance is undeniably a major factor, the S&P 500's recovery isn't solely reliant on one company. Other tech companies are also experiencing renewed investor confidence, fueled by positive earnings reports and promising future outlooks. This broader-based recovery suggests a potential shift in market sentiment, with investors becoming more optimistic about the long-term prospects of the technology sector. However, it's crucial to analyze this growth cautiously, considering potential external factors.

What Fueled the Market Reversal?

Several factors have contributed to this positive shift:

- Strong Earnings Reports: Beyond Nvidia, several other major companies have reported better-than-expected earnings, boosting investor confidence.

- Easing Inflation Concerns: While inflation remains a concern, recent data suggests a potential slowing of price increases, lessening pressure on the Federal Reserve to aggressively raise interest rates.

- Increased Investor Appetite for Risk: With potential easing of inflation and interest rate hikes, investors seem more willing to embrace riskier assets like technology stocks.

- The AI Boom: The undeniable surge in the AI industry, led by companies like Nvidia, is injecting significant capital and optimism into the market.

Looking Ahead: Sustainability and Potential Risks

While the current market performance is encouraging, investors should approach this rally with caution. Several potential risks remain:

- Geopolitical Uncertainty: Global geopolitical instability remains a significant threat to market stability.

- Interest Rate Hikes: Although the pace of interest rate hikes might be slowing, further increases could still dampen market growth.

- Inflationary Pressures: While inflation seems to be cooling, persistent inflationary pressures could still impact market performance.

- Overvaluation: The rapid rise in certain tech stocks, particularly in the AI sector, raises concerns about potential overvaluation.

Conclusion: A Cautiously Optimistic Outlook

The S&P 500's recent gains, largely fueled by Nvidia's success and a broader tech sector revival, present a cautiously optimistic outlook. While the current momentum is encouraging, it's essential to acknowledge the potential risks and avoid over-exuberance. Investors should continue to monitor macroeconomic factors and individual company performance closely before making any significant investment decisions. Further analysis of the AI market and its long-term potential is crucial for a comprehensive understanding of the current market dynamics. Stay informed and consult with financial advisors for personalized guidance.

Keywords: S&P 500, Nvidia, Technology Sector, AI, Artificial Intelligence, Stock Market, Market Rally, Earnings Report, Inflation, Interest Rates, Investment, Market Volatility, Economic Outlook, Tech Stocks, GPU, AI Investment.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 Gains Momentum: Nvidia-Driven Tech Surge Erases Year's Losses. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Understanding Habeas Corpus Challenges Under The Trump Administration

May 14, 2025

Understanding Habeas Corpus Challenges Under The Trump Administration

May 14, 2025 -

Job Cuts In Seattle Tech Company Layoffs Affect Thousands

May 14, 2025

Job Cuts In Seattle Tech Company Layoffs Affect Thousands

May 14, 2025 -

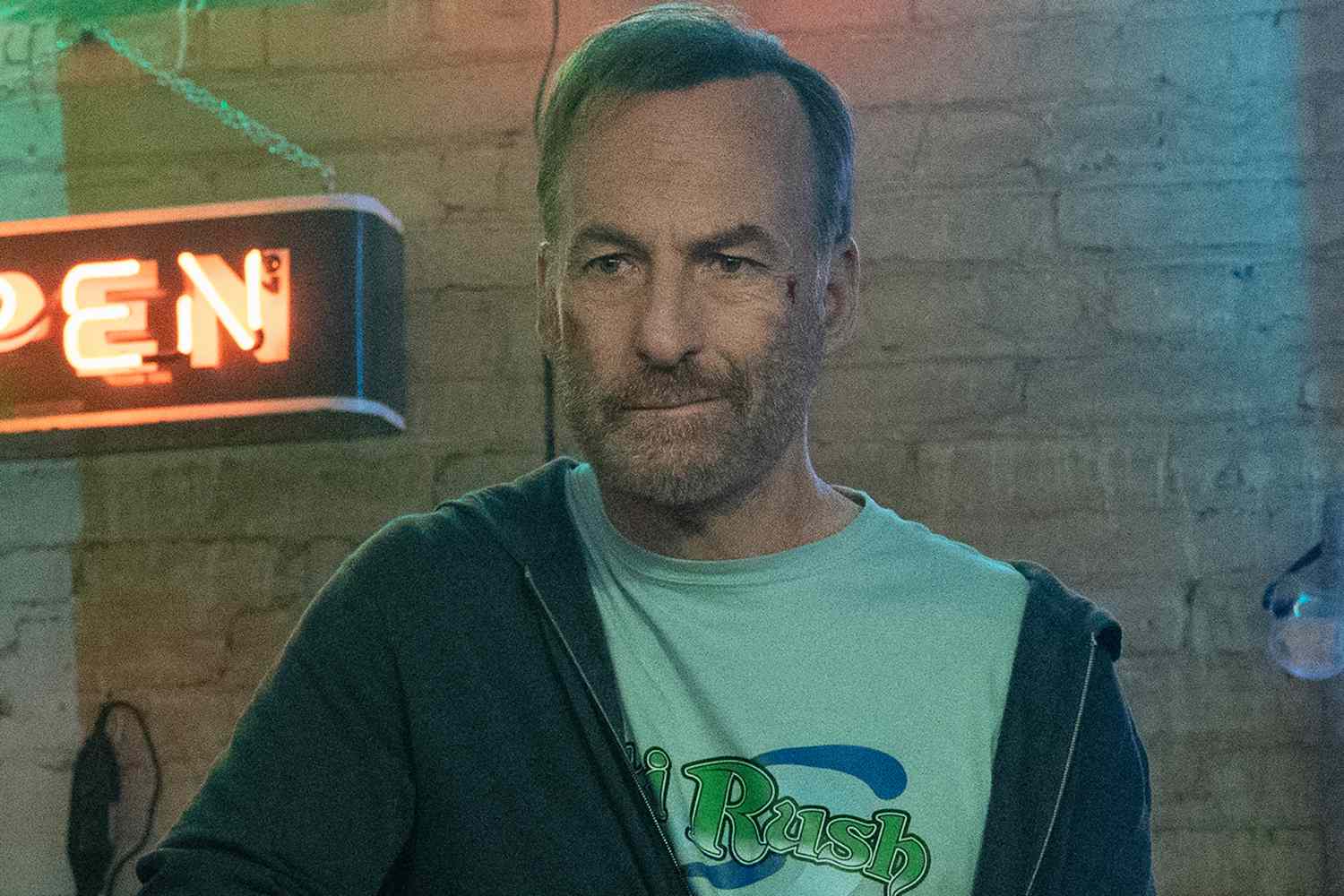

Bob Odenkirk Returns In Nobody 2 A Dangerous Family Getaway

May 14, 2025

Bob Odenkirk Returns In Nobody 2 A Dangerous Family Getaway

May 14, 2025 -

Trade War Eases Us And Chinas Tariff Pause A Temporary Solution

May 14, 2025

Trade War Eases Us And Chinas Tariff Pause A Temporary Solution

May 14, 2025 -

Steam Users Urged To Change Passwords Following Major Data Breach

May 14, 2025

Steam Users Urged To Change Passwords Following Major Data Breach

May 14, 2025