S&P 500, Dow, Nasdaq Rise: Stock Market Rebounds Despite Moody's Action

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500, Dow, Nasdaq Rise: Stock Market Rebounds Despite Moody's Downgrade

The US stock market staged a surprising rebound on Tuesday, with the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite all posting gains despite Moody's Investors Service downgrading 10 small and midsize US banking companies and placing six more on review for downgrade. This unexpected resilience suggests investor confidence remains relatively strong, at least for now.

This move by Moody's, citing concerns about the creditworthiness of smaller banks and the ongoing pressure from rising interest rates, had been anticipated to trigger a significant market downturn. However, the market's response defied expectations, indicating a possible decoupling between the credit rating agency's assessment and overall investor sentiment.

Market Movers: A Closer Look

The S&P 500 closed up [Insert Percentage]% at [Insert Closing Value], while the Dow Jones Industrial Average gained [Insert Percentage]% to finish at [Insert Closing Value]. The tech-heavy Nasdaq Composite also saw a positive day, climbing [Insert Percentage]% to close at [Insert Closing Value]. This broad-based rally suggests a degree of optimism across various sectors.

Several factors may have contributed to this unexpected market strength:

- Resilient Corporate Earnings: Stronger-than-expected earnings reports from key companies may have bolstered investor confidence, outweighing the negative impact of Moody's downgrade. Analysts are closely watching upcoming earnings seasons for further indicators.

- Lower-Than-Expected Inflation: Recent economic data pointing to a potential slowdown in inflation might have eased concerns about aggressive interest rate hikes by the Federal Reserve. This could provide a more stable environment for stock market growth.

- Technical Rebound: Some analysts suggest that the market's gains are a technical rebound following recent declines. This theory suggests the market was oversold and simply correcting itself.

- Selective Buying: Investors may be focusing on specific sectors perceived as less vulnerable to interest rate hikes or the banking sector's challenges. This selective approach could lead to a more fragmented market recovery.

Moody's Downgrade and its Implications

Moody's decision to downgrade several smaller banks highlights the ongoing challenges within the financial sector. The agency cited concerns about weakening profitability and the increasing pressure of higher interest rates on the banking system. While these concerns are valid, the market's reaction suggests investors may believe the impact will be limited to smaller institutions. It remains crucial to monitor the ripple effects of this action. For further analysis on the implications of Moody's downgrade, you can read [Link to relevant financial news source].

What to Watch For

The coming days and weeks will be crucial in determining whether this rebound is sustainable or just a temporary reprieve. Investors will be watching closely for:

- Further economic data releases: Inflation figures, employment reports, and consumer confidence indices will all offer further clues about the overall health of the US economy.

- Federal Reserve announcements: The Fed's next policy decision will be closely scrutinized for any indications regarding future interest rate adjustments.

- Corporate earnings reports: The performance of key companies in the coming earnings season will heavily influence market sentiment.

Investing in Times of Uncertainty:

Navigating the stock market, particularly during periods of uncertainty, requires careful planning and a diversified investment strategy. Consult with a qualified financial advisor before making any significant investment decisions. [Link to a reputable financial planning resource (optional)].

In Conclusion:

While the Moody's downgrade cast a shadow over the market, the S&P 500, Dow, and Nasdaq's rebound demonstrates the inherent resilience of the US stock market. However, caution remains warranted, and investors should closely monitor upcoming economic data and corporate earnings to gauge the market's long-term trajectory. The market's reaction to Moody's action presents a complex scenario requiring careful analysis and a long-term investment perspective.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500, Dow, Nasdaq Rise: Stock Market Rebounds Despite Moody's Action. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

North Texas Tornado Watch Over Severe Weather Risks And Safety Tips For Residents

May 20, 2025

North Texas Tornado Watch Over Severe Weather Risks And Safety Tips For Residents

May 20, 2025 -

Strip The Duck Jon Jones Aspinall Comments Spark Intense Debate Among Mma Fans

May 20, 2025

Strip The Duck Jon Jones Aspinall Comments Spark Intense Debate Among Mma Fans

May 20, 2025 -

Alexander Skarsgard Bills Nosferatu Vampire Is Hotter Than True Blood Eric

May 20, 2025

Alexander Skarsgard Bills Nosferatu Vampire Is Hotter Than True Blood Eric

May 20, 2025 -

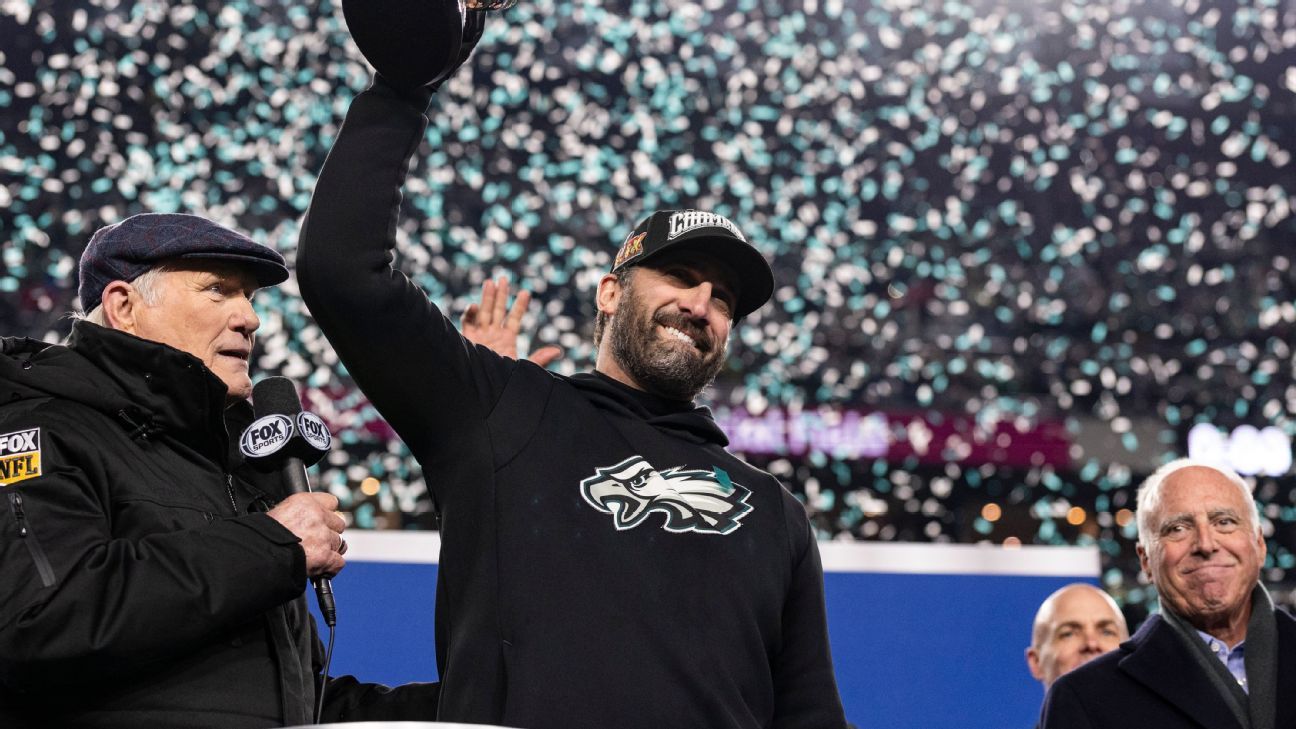

Philadelphia Eagles Reward Sirianni With Deserved Contract Extension

May 20, 2025

Philadelphia Eagles Reward Sirianni With Deserved Contract Extension

May 20, 2025 -

Untold Brett Favre Controversy A J Perez Recounts Intimidation

May 20, 2025

Untold Brett Favre Controversy A J Perez Recounts Intimidation

May 20, 2025