S&P 500 Climbs, Wipes Out 2025 Losses: Tech Sector Leads The Charge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 Climbs, Wiping Out 2023 Losses: Tech Sector Leads the Charge

The S&P 500 surged higher this week, completely erasing its year-to-date losses and igniting optimism amongst investors. This remarkable rebound, fueled largely by a strong performance in the technology sector, marks a significant shift in market sentiment after a period of uncertainty and volatility. But is this rally sustainable, or is it merely a temporary reprieve before further market corrections?

Tech Titans Power the Surge

The technology sector was the undisputed champion of this week's rally. Giants like Apple (AAPL), Microsoft (MSFT), and Nvidia (NVDA) saw significant gains, contributing heavily to the overall S&P 500 performance. This resurgence in tech stocks is attributed to several factors, including positive earnings reports, renewed investor confidence in AI-driven growth, and a potential easing of interest rate hikes by the Federal Reserve.

The impressive performance of these mega-cap tech companies is not solely responsible for the market's overall positive sentiment. Stronger-than-expected economic data, including positive consumer spending figures and a robust jobs market, have also boosted investor confidence. This combination of positive corporate performance and favorable economic indicators created a perfect storm for a significant market upswing.

Interest Rate Hikes and Market Volatility

The Federal Reserve's monetary policy continues to play a crucial role in shaping market trends. While recent interest rate hikes aimed to curb inflation, they also introduced volatility into the market. The current rally suggests a potential easing of these hikes or even a pause, potentially paving the way for further growth. However, the Fed's future decisions remain a key factor influencing market sentiment and the sustainability of the current upswing. Analysts are closely watching economic indicators like inflation and unemployment rates to predict the Fed's next move.

What Does This Mean for Investors?

This S&P 500 climb offers a glimmer of hope for investors who have weathered a challenging year. However, it's crucial to remember that market fluctuations are a natural part of the investment cycle. While the current rally is encouraging, it's too early to declare a complete market recovery.

-

Diversification is Key: Maintaining a diversified portfolio remains crucial to mitigate risk. Investing in a variety of asset classes can help buffer against potential downturns in any single sector.

-

Long-Term Perspective: Investors should maintain a long-term perspective and avoid making impulsive decisions based on short-term market movements.

-

Professional Advice: Seeking advice from a qualified financial advisor can help investors develop a personalized investment strategy aligned with their risk tolerance and financial goals.

Looking Ahead: Sustainability of the Rally

The sustainability of this S&P 500 rally remains a subject of debate among market analysts. While the current positive momentum is encouraging, several factors could potentially trigger a reversal. Geopolitical instability, persistent inflation, and unexpected economic downturns could all impact market performance. Continued monitoring of these factors is crucial for informed investment decisions.

This recent surge underscores the dynamic nature of the stock market and the importance of staying informed about market trends and economic indicators. While the S&P 500 wiping out its 2023 losses is positive news, investors should proceed with caution and maintain a well-diversified, long-term investment strategy. For more in-depth analysis and market insights, check out reputable financial news sources like [link to a reputable financial news source].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 Climbs, Wipes Out 2025 Losses: Tech Sector Leads The Charge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trump Receives Warm Welcome In Country Name First Stop On Middle East Journey

May 14, 2025

Trump Receives Warm Welcome In Country Name First Stop On Middle East Journey

May 14, 2025 -

Us And China Reach Tariff Agreement A Significant Step Back From Trade War

May 14, 2025

Us And China Reach Tariff Agreement A Significant Step Back From Trade War

May 14, 2025 -

Sources Confirm Flyers In Advanced Talks With Rick Tocchet For Head Coaching Role

May 14, 2025

Sources Confirm Flyers In Advanced Talks With Rick Tocchet For Head Coaching Role

May 14, 2025 -

Us China De Escalate Trade War With Tariff Freeze Agreement

May 14, 2025

Us China De Escalate Trade War With Tariff Freeze Agreement

May 14, 2025 -

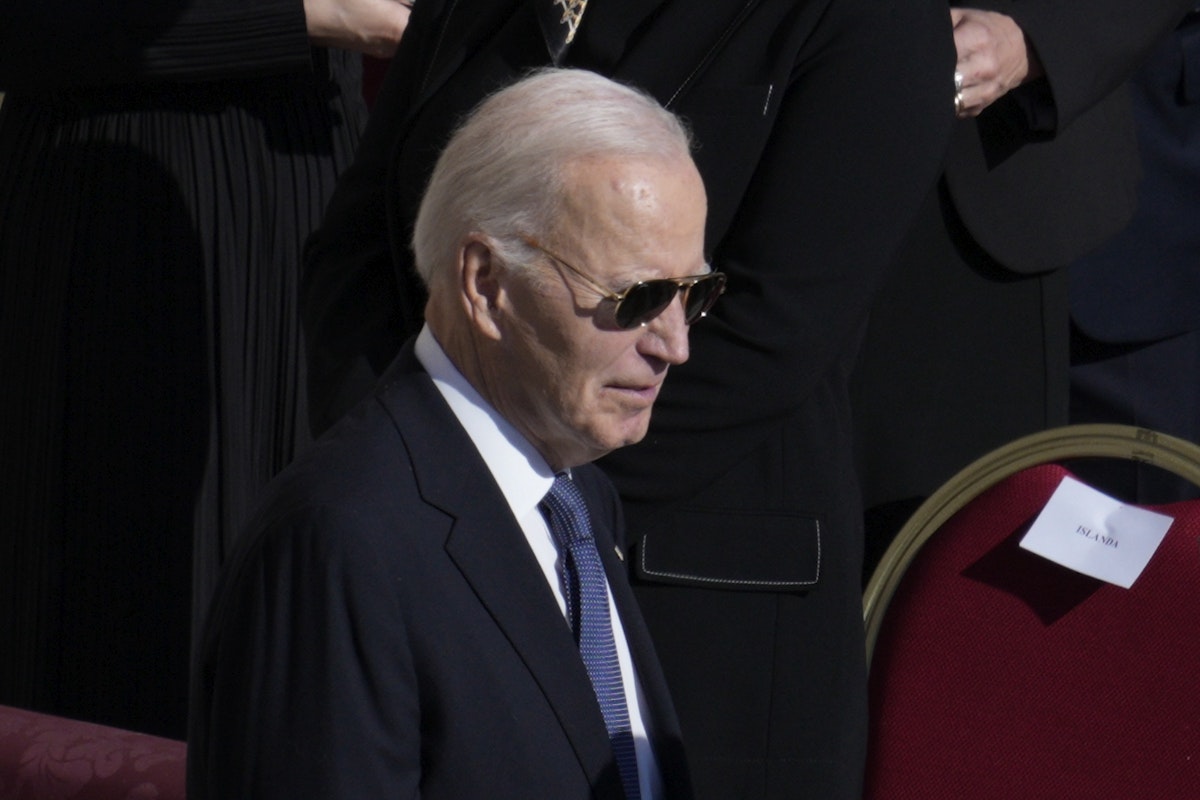

White House Staff Unprepared For Bidens Deterioration

May 14, 2025

White House Staff Unprepared For Bidens Deterioration

May 14, 2025