S&P 500 Climbs, Tech Sector Drives Recovery From 2025 Dip

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 Climbs: Tech Sector Leads Recovery from 2025 Dip

The S&P 500 has staged a remarkable comeback, climbing steadily after a significant dip in early 2025. This recovery is largely attributed to the robust performance of the technology sector, signaling a potential shift in market dynamics and investor sentiment. But is this rebound sustainable, or are we seeing a temporary reprieve before another market correction?

A Rocky Start to 2025:

The beginning of 2025 saw a considerable downturn in the S&P 500, fueled by concerns about [mention specific factors, e.g., rising interest rates, inflation concerns, geopolitical instability]. Many analysts predicted a prolonged period of market uncertainty, causing significant anxiety among investors. This period highlighted the volatility inherent in the stock market and the importance of diversification in investment portfolios. The tech sector, previously a stalwart of market growth, felt the impact acutely, with several major tech companies experiencing significant stock price declines.

The Tech Sector's Resurgence:

However, the narrative began to shift in [mention month/quarter]. The tech sector, surprisingly, spearheaded the recovery. Several factors contributed to this turnaround:

- Strong Earnings Reports: Several major tech companies released unexpectedly strong earnings reports, exceeding analyst expectations and boosting investor confidence. This positive news flow helped to alleviate some of the earlier concerns about the sector's overall health.

- AI-Driven Innovation: Continued advancements in artificial intelligence (AI) and related technologies fueled significant investment and propelled growth in many tech companies. This highlighted the transformative potential of AI and its impact on various sectors, driving investor enthusiasm.

- Increased Consumer Spending: A rebound in consumer spending, particularly in areas related to technology products and services, also contributed to the tech sector's recovery. This suggests a growing consumer confidence that extends beyond the tech industry itself.

Beyond the Tech Sector:

While the technology sector has played a dominant role, the broader market has also experienced positive momentum. This suggests that the recovery is not solely reliant on a single sector, indicating a more widespread improvement in market sentiment. However, it's crucial to monitor other key sectors, such as [mention other sectors, e.g., energy, healthcare], to gauge the overall health of the economy.

Looking Ahead: Sustainability and Potential Risks:

While the recent climb is encouraging, investors should remain cautious. Several factors could potentially hinder continued growth:

- Geopolitical Uncertainty: Ongoing global conflicts and geopolitical tensions continue to pose a risk to market stability.

- Inflationary Pressures: Persistently high inflation could lead to further interest rate hikes, potentially dampening economic growth and impacting stock prices.

- Regulatory Scrutiny: Increased regulatory scrutiny of the tech sector could also impact future growth and investor confidence.

Investing Strategically:

This period of market recovery underscores the importance of a well-defined investment strategy. Diversification remains crucial, and investors should carefully consider their risk tolerance before making any significant investment decisions. Consulting with a financial advisor can provide valuable guidance during periods of market volatility. For further insights into market trends and investment strategies, explore resources like [link to a reputable financial news source].

Conclusion:

The recent climb in the S&P 500, driven largely by the tech sector's recovery from its early 2025 dip, offers a glimmer of hope for investors. However, it's vital to maintain a balanced perspective and acknowledge the inherent risks associated with market fluctuations. Careful monitoring of economic indicators and a well-defined investment strategy are crucial for navigating the complexities of the stock market. The future remains uncertain, but the resilience of the tech sector and the broader market suggests a potential for continued growth – provided that potential risks are carefully managed.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 Climbs, Tech Sector Drives Recovery From 2025 Dip. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

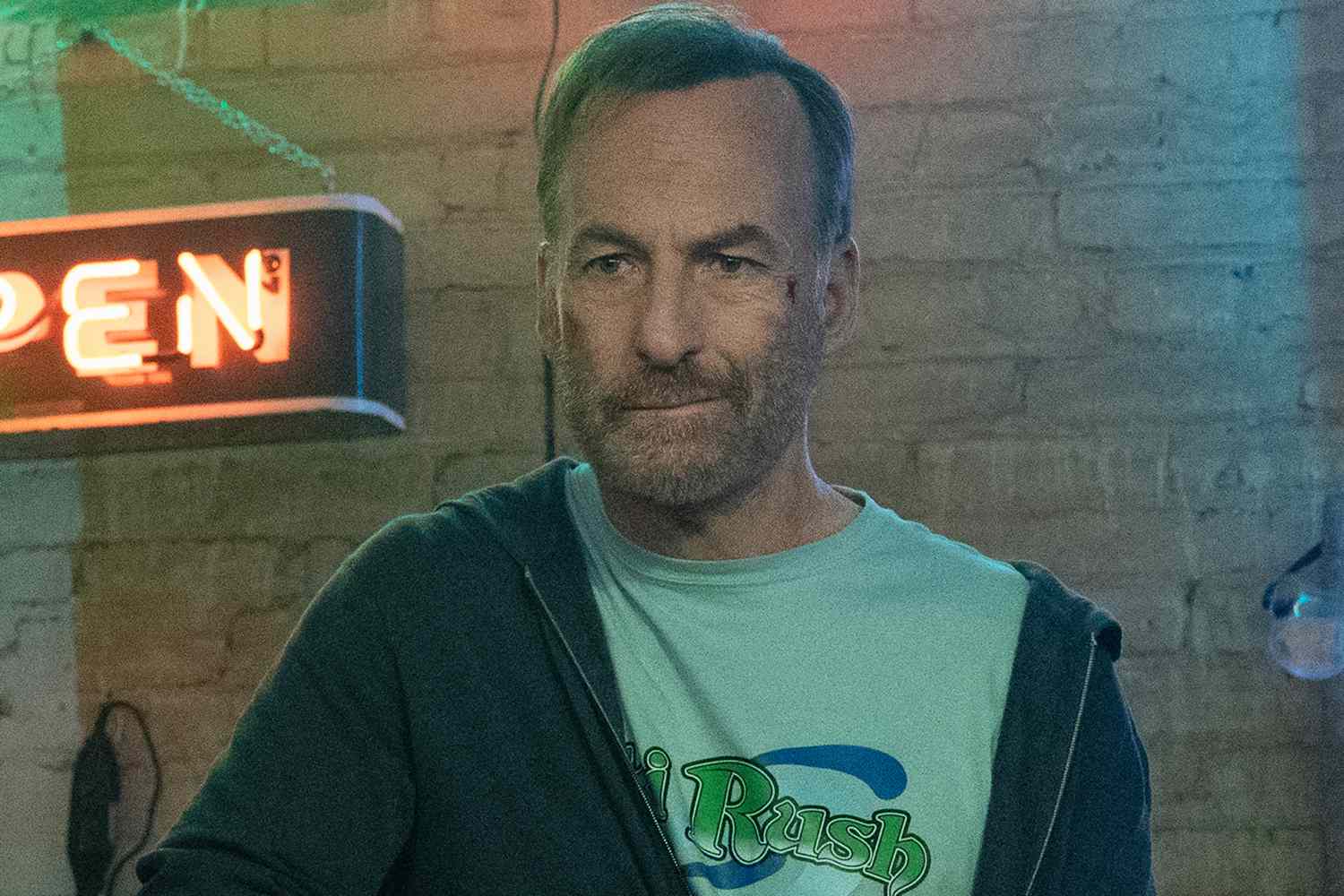

Bob Odenkirk Returns In Nobody 2 A Violent Family Vacation Trailer

May 14, 2025

Bob Odenkirk Returns In Nobody 2 A Violent Family Vacation Trailer

May 14, 2025 -

Alaves Vs Corberans Team A High Intensity Clash Predicted

May 14, 2025

Alaves Vs Corberans Team A High Intensity Clash Predicted

May 14, 2025 -

Times 2025 Influential List Who Made The Cut And Why

May 14, 2025

Times 2025 Influential List Who Made The Cut And Why

May 14, 2025 -

Seattle Area Tech Giants Layoffs The Impact On Thousands

May 14, 2025

Seattle Area Tech Giants Layoffs The Impact On Thousands

May 14, 2025 -

S And P 500 Recovers 2023 Losses Nvidia Leads Tech Sector Surge

May 14, 2025

S And P 500 Recovers 2023 Losses Nvidia Leads Tech Sector Surge

May 14, 2025