S&P 500 Climbs, Recovering 2023 Losses: Nvidia And Tech Stocks Lead

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 Climbs, Erasing 2023 Losses: Nvidia and Tech Stocks Lead the Charge

The S&P 500 has officially clawed its way back from its 2023 lows, fueled by a remarkable surge in technology stocks, particularly Nvidia. This impressive recovery marks a significant turning point for investors who weathered a turbulent first half of the year. The index's climb signals a potential shift in market sentiment and raises important questions about the future trajectory of the US economy.

Nvidia's Stellar Performance Drives Tech Sector:

Nvidia's outstanding performance has been a key driver of the S&P 500's resurgence. The chipmaker's stock has soared this year, exceeding expectations and solidifying its position as a market leader in artificial intelligence (AI). This surge is largely attributed to the booming demand for AI-powered solutions across various sectors, from gaming and data centers to autonomous vehicles. Other tech giants, benefiting from the AI boom and positive earnings reports, have also contributed significantly to the market's overall recovery.

-

AI's Impact: The undeniable influence of artificial intelligence on the tech sector and broader market cannot be overstated. Investments in AI infrastructure and development are driving substantial growth, attracting significant capital and bolstering investor confidence.

-

Earnings Season's Role: Strong earnings reports from major tech companies have played a crucial role in boosting investor sentiment. These positive results have not only reassured investors about the health of the tech sector but also provided a much-needed boost to overall market confidence.

Beyond Tech: A Broader Market Recovery?

While the tech sector has undoubtedly led the charge, the S&P 500's recovery suggests a broader market rebound may be underway. However, analysts caution against premature pronouncements of a sustained bull market. Several economic factors, including inflation, interest rates, and geopolitical uncertainties, continue to pose challenges.

Concerns Remain:

Despite the positive market movement, several concerns persist:

-

Inflationary Pressures: Persistent inflationary pressures could lead to further interest rate hikes by the Federal Reserve, potentially dampening economic growth and impacting stock valuations.

-

Geopolitical Instability: Global geopolitical instability, including the ongoing conflict in Ukraine, remains a significant source of uncertainty for the market.

-

Recessionary Fears: While the market shows signs of recovery, fears of a potential recession still linger, prompting investors to remain cautiously optimistic.

What's Next for the S&P 500?

The S&P 500's recovery is a significant development, but it's crucial to approach it with measured optimism. While the impressive gains are encouraging, several economic factors continue to cast shadows on the horizon. Investors should carefully analyze the market landscape, considering both the potential for further growth and the persistent risks before making any investment decisions. Staying informed about economic indicators and market trends is paramount for navigating this dynamic environment.

Further Reading:

- [Link to a reputable financial news source discussing current economic indicators]

- [Link to an analysis of Nvidia's recent performance]

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 Climbs, Recovering 2023 Losses: Nvidia And Tech Stocks Lead. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pm Modi Pakistan Must Acknowledge Po K For Any Kashmir Dialogue

May 13, 2025

Pm Modi Pakistan Must Acknowledge Po K For Any Kashmir Dialogue

May 13, 2025 -

Habeas Corpus Rights Erosion Under The Trump Administration And Its Implications

May 13, 2025

Habeas Corpus Rights Erosion Under The Trump Administration And Its Implications

May 13, 2025 -

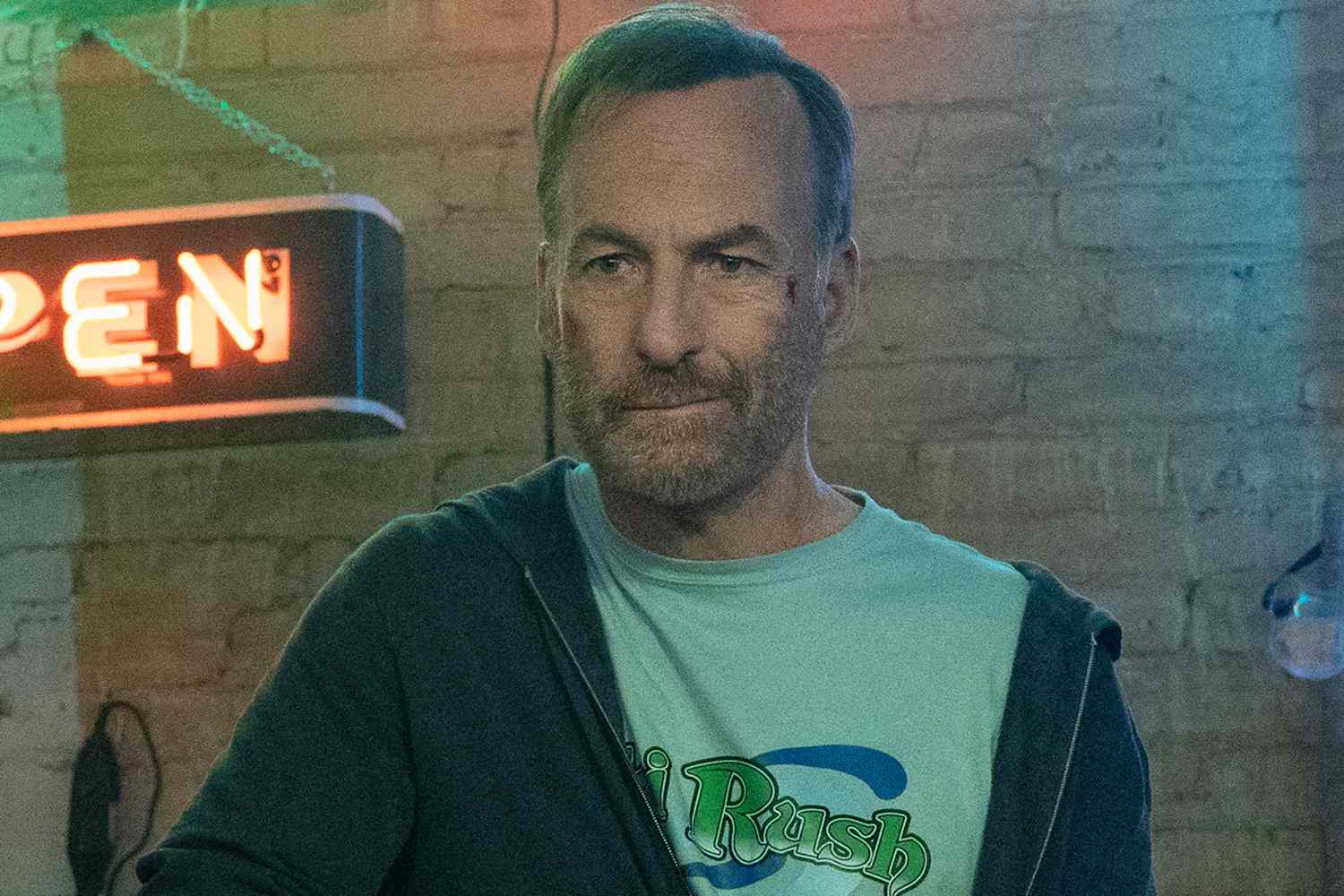

Nobody 2 Trailer Unveiled Bob Odenkirks Vacation Turns Deadly

May 13, 2025

Nobody 2 Trailer Unveiled Bob Odenkirks Vacation Turns Deadly

May 13, 2025 -

Sinner Conduce 6 4 3 1 Contro De Jong Vittoria Vicina

May 13, 2025

Sinner Conduce 6 4 3 1 Contro De Jong Vittoria Vicina

May 13, 2025 -

Afrikaner Refugee Resettlement The First Group Heads To The Us

May 13, 2025

Afrikaner Refugee Resettlement The First Group Heads To The Us

May 13, 2025