S&P 500 Climbs, Erasing 2023 Losses: Live Market Updates And Analysis

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 Climbs, Erasing 2023 Losses: Live Market Updates and Analysis

The S&P 500 has officially erased its losses for 2023, marking a significant turnaround in the market. This remarkable climb reflects a confluence of factors, from positive economic data to shifting investor sentiment. But what does this mean for the average investor? Let's delve into the live market updates and provide a comprehensive analysis.

A Year of Volatility, Culminating in a Triumphant Climb

The year began with considerable uncertainty. High inflation, rising interest rates, and geopolitical tensions cast a shadow over market performance. The S&P 500 experienced significant volatility, with periods of sharp decline interspersed with periods of growth. However, a recent surge in positive economic indicators, coupled with a more cautious approach by the Federal Reserve regarding interest rate hikes, has fueled this impressive recovery.

Key Factors Driving the S&P 500's Rise:

-

Easing Inflation Concerns: Recent data suggests inflation may be cooling faster than initially anticipated. This reduces pressure on the Federal Reserve to aggressively raise interest rates, a move that can stifle economic growth and negatively impact corporate earnings. Learn more about the latest inflation reports from the .

-

Strong Corporate Earnings: Many major corporations have reported better-than-expected earnings, bolstering investor confidence. This positive trend signals resilience in the face of economic headwinds and contributes to the overall market optimism. For detailed earnings reports, check out resources like .

-

Technological Advancements: Continued advancements in artificial intelligence and other technological sectors have injected significant momentum into the market. These innovations represent long-term growth opportunities, attracting substantial investment. Read more about the impact of AI on the market from leading financial news sources.

-

Shifting Investor Sentiment: A shift in investor sentiment from pessimism to cautious optimism is playing a crucial role. As fears of a recession ease, investors are becoming more willing to take on risk, leading to increased investment in equities.

What Does This Mean for Investors?

The S&P 500's recovery is undoubtedly good news, but it's crucial to remember that market performance is never guaranteed. While this climb is impressive, it's essential to maintain a balanced and diversified investment portfolio. Avoid making impulsive decisions based solely on short-term market fluctuations. Consider consulting with a financial advisor to create a personalized investment strategy aligned with your risk tolerance and long-term financial goals.

Live Market Updates and Ongoing Analysis:

The situation remains dynamic. Keep an eye on key economic indicators, including inflation data, interest rate announcements, and corporate earnings reports. Stay informed through reputable financial news sources for up-to-the-minute updates and expert analysis. Remember to always practice responsible investing.

Conclusion:

The S&P 500's remarkable recovery, erasing 2023 losses, is a testament to the resilience of the market and the influence of various economic and geopolitical factors. While celebrating this positive development, it's crucial for investors to remain informed, diversify their portfolios, and make informed decisions based on a long-term perspective. The journey continues, and careful monitoring and strategic planning are key to navigating the ever-evolving market landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 Climbs, Erasing 2023 Losses: Live Market Updates And Analysis. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

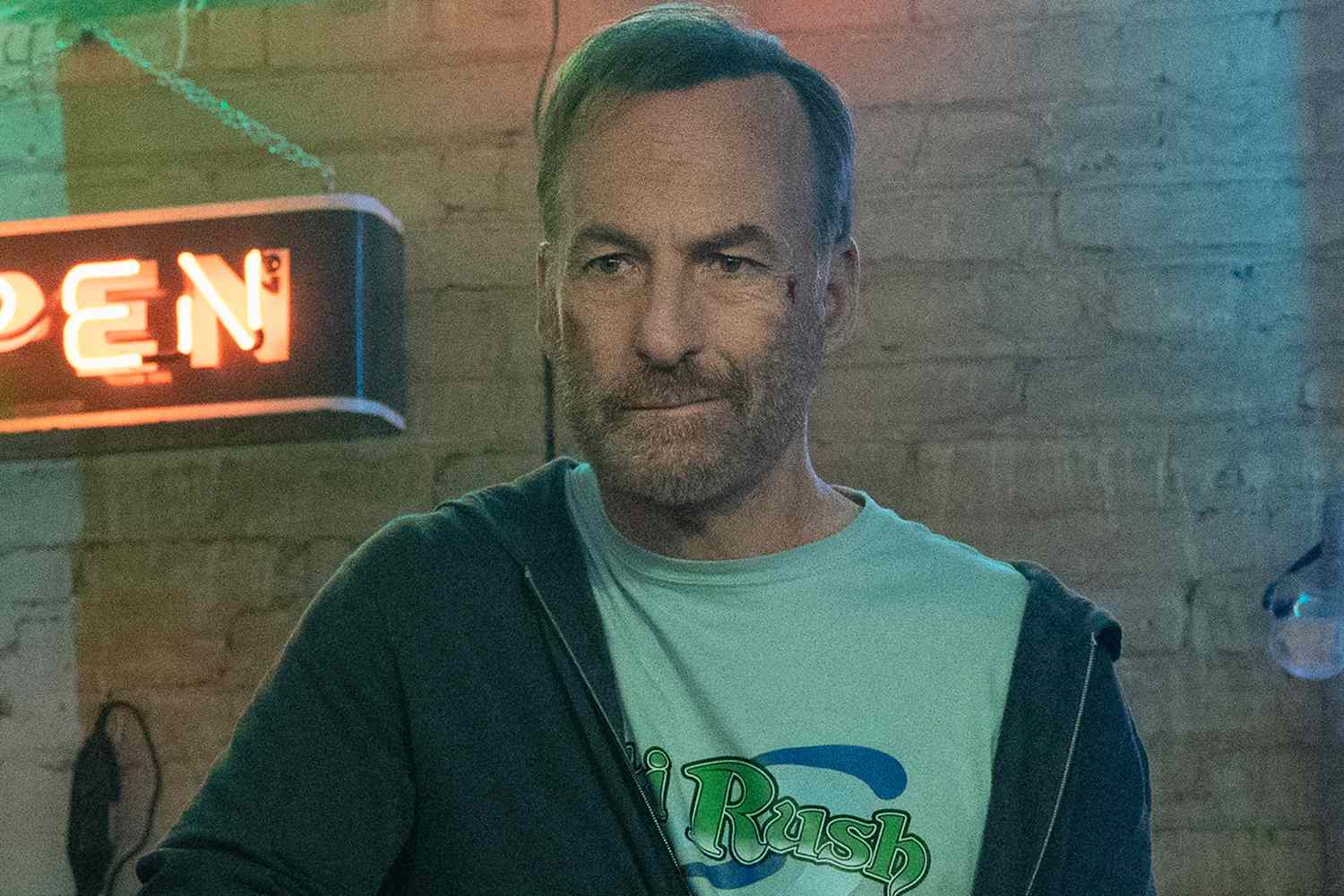

Action Packed Nobody 2 Trailer Bob Odenkirk Faces Danger On Vacation

May 14, 2025

Action Packed Nobody 2 Trailer Bob Odenkirk Faces Danger On Vacation

May 14, 2025 -

Flyers Rebuild Rick Tocchet Era Begins In Philadelphia

May 14, 2025

Flyers Rebuild Rick Tocchet Era Begins In Philadelphia

May 14, 2025 -

89 Million Steam Accounts Leaked Time To Secure Your Account

May 14, 2025

89 Million Steam Accounts Leaked Time To Secure Your Account

May 14, 2025 -

Seattle Tech Layoffs Impact And Analysis Of The Upcoming Job Cuts

May 14, 2025

Seattle Tech Layoffs Impact And Analysis Of The Upcoming Job Cuts

May 14, 2025 -

Reports Of Bidens Declining Health The Inside Story

May 14, 2025

Reports Of Bidens Declining Health The Inside Story

May 14, 2025