S&P 500 And Nasdaq Fall: Market Volatility Increases Amidst Fed Uncertainty And Geopolitical Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 and Nasdaq Fall: Market Volatility Increases Amidst Fed Uncertainty and Geopolitical Risks

Wall Street experienced a significant downturn today, with the S&P 500 and Nasdaq Composite indices suffering notable declines. This market volatility underscores growing investor anxieties surrounding the Federal Reserve's monetary policy and escalating geopolitical tensions. The uncertainty surrounding interest rates and global stability is causing ripples throughout the financial world, leaving investors on edge.

The S&P 500 closed down [insert percentage]% at [insert closing value], while the tech-heavy Nasdaq Composite fell [insert percentage]% to [insert closing value]. This marks a significant reversal from recent gains and highlights the fragility of the current market conditions. The decline wasn't isolated to the US; global markets also experienced a dip, reflecting the interconnected nature of the global economy.

<br>

Fed Rate Hikes and Inflation Concerns Fuel Market Uncertainty

The primary driver behind this market slump appears to be ongoing uncertainty surrounding the Federal Reserve's future interest rate hikes. While recent inflation data has shown some signs of cooling, the Fed remains committed to combating inflation, even at the risk of slowing economic growth. Investors are anxiously awaiting further guidance from the Fed, hoping for clarity on the trajectory of interest rates in the coming months. The fear is that aggressive rate hikes could trigger a recession, impacting corporate earnings and subsequently stock prices. This uncertainty is leading to increased volatility, making it difficult for investors to predict market direction.

<br>

Geopolitical Risks Exacerbate Market Fears

Adding to the pressure on markets are escalating geopolitical risks. The ongoing conflict in Ukraine continues to disrupt global supply chains and fuel inflationary pressures. Furthermore, tensions in other regions of the world add to the overall sense of instability. These geopolitical uncertainties create additional headwinds for investors, who are increasingly hesitant to take on risk in this uncertain climate. The resulting market volatility makes strategic long-term investment planning increasingly complex.

<br>

What This Means for Investors

This market downturn serves as a reminder of the inherent risks involved in investing. For long-term investors, this volatility may present opportunities to buy into quality stocks at discounted prices. However, it's crucial to adopt a cautious approach and maintain a well-diversified portfolio. Consider consulting with a financial advisor to develop an investment strategy that aligns with your risk tolerance and financial goals.

Key takeaways for investors:

- Diversification is key: Spread your investments across different asset classes to mitigate risk.

- Long-term perspective: Don't panic sell during market downturns. Focus on your long-term investment goals.

- Stay informed: Keep abreast of economic and geopolitical developments that could impact your investments.

- Seek professional advice: Consulting a financial advisor can provide valuable insights and guidance.

<br>

Looking Ahead: Potential Market Scenarios

Predicting the future of the market is always challenging. However, several potential scenarios could unfold in the coming weeks and months. These include a continued period of volatility, a potential market correction, or a stabilization of the market followed by renewed growth. The Fed's actions and the evolution of the geopolitical landscape will likely play significant roles in determining the market's trajectory. Closely monitoring these factors is crucial for investors navigating these uncertain times.

Further Reading:

- [Link to an article about the Federal Reserve's monetary policy]

- [Link to an article about the geopolitical situation in Ukraine]

This market downturn highlights the need for investors to remain vigilant and adaptable. The interplay between the Federal Reserve's actions, geopolitical uncertainty, and investor sentiment will continue to shape the market's direction. Stay informed and make informed decisions to navigate this period of volatility.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 And Nasdaq Fall: Market Volatility Increases Amidst Fed Uncertainty And Geopolitical Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

What Drives Mlbs Top Teams Analyzing The Strengths Of Playoff Contenders

Jun 21, 2025

What Drives Mlbs Top Teams Analyzing The Strengths Of Playoff Contenders

Jun 21, 2025 -

Summer Of Reckoning Trump Administrations Climate Actions Scrutinized

Jun 21, 2025

Summer Of Reckoning Trump Administrations Climate Actions Scrutinized

Jun 21, 2025 -

Ufc News Din Thomas Calls Jon Jones Behavior A Marketing Gimmick Set For Aspinall Clash

Jun 21, 2025

Ufc News Din Thomas Calls Jon Jones Behavior A Marketing Gimmick Set For Aspinall Clash

Jun 21, 2025 -

Mark Cubans Revelation A Request For Vp Vetting Documents From The Harris Campaign

Jun 21, 2025

Mark Cubans Revelation A Request For Vp Vetting Documents From The Harris Campaign

Jun 21, 2025 -

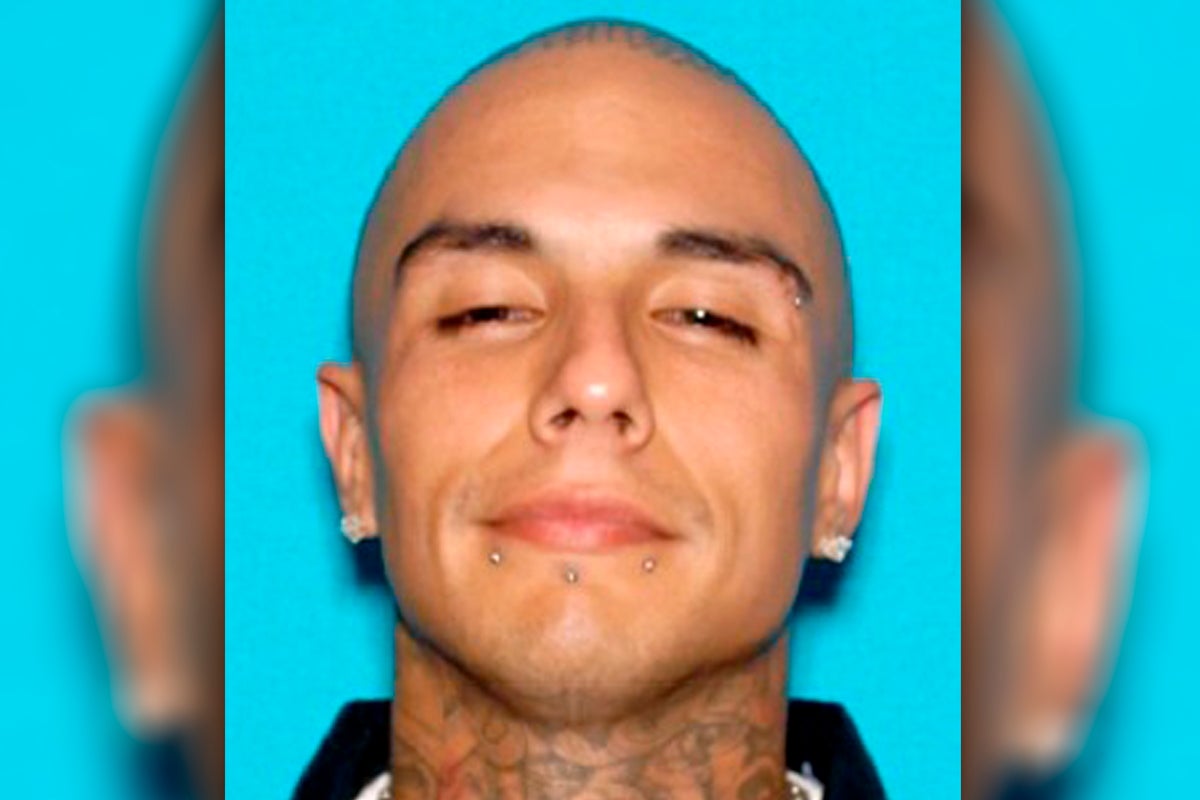

Major Charges Filed Against 19 Mexican Mafia Members In Rapper Assassination Attempt

Jun 21, 2025

Major Charges Filed Against 19 Mexican Mafia Members In Rapper Assassination Attempt

Jun 21, 2025