S&P 500 And Nasdaq Fall: Market Reaction To Fed Uncertainty And Trump's Iran Stance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 and Nasdaq Plunge: Market Jitters Over Fed Policy and Iran Tensions

The US stock market experienced a significant downturn on [Date], with both the S&P 500 and Nasdaq Composite indices suffering notable losses. This sharp decline reflects growing investor anxiety stemming from the Federal Reserve's uncertain monetary policy trajectory and escalating geopolitical tensions fueled by former President Trump's recent comments on Iran. The market's reaction underscores the delicate balance between economic data, interest rate expectations, and international relations, highlighting the interconnectedness of global finance.

Fed Uncertainty Shakes Investor Confidence:

The Federal Reserve's recent pronouncements on interest rates have left investors in a state of flux. While the Fed has signaled a potential pause in its rate-hiking cycle, ambiguity surrounding future policy decisions has created considerable market volatility. Concerns persist about the possibility of further rate increases to combat persistent inflation, even as the economy shows signs of slowing. This uncertainty is driving investors towards safer assets, leading to a sell-off in equities. [Link to a relevant Fed statement or news article].

Trump's Iran Rhetoric Adds Fuel to the Fire:

Adding to the market's woes are the escalating tensions surrounding Iran, largely fueled by comments from former President Trump. His recent statements regarding potential military action against Iran have injected a significant dose of geopolitical risk into an already fragile market environment. Investors are wary of the potential for conflict to disrupt global energy markets and further strain already stretched supply chains. This uncertainty is prompting risk-aversion, pushing investors away from riskier assets like stocks. [Link to a news article about Trump's comments on Iran].

Market Impact and Sectoral Performance:

The sell-off was widespread, with both large-cap and technology stocks feeling the brunt of the decline. The tech-heavy Nasdaq Composite experienced a steeper drop than the broader S&P 500, reflecting the sector's higher sensitivity to interest rate changes and economic uncertainty. Energy stocks, often seen as a safe haven during times of geopolitical instability, showed mixed performance. [Include data on percentage drops for S&P 500 and Nasdaq, citing source].

What's Next for Investors?

The current market situation presents a complex challenge for investors. Navigating the uncertainties surrounding Fed policy and geopolitical risks requires a cautious approach. Diversification remains key, as does a thorough understanding of individual company fundamentals. Investors should carefully consider their risk tolerance and investment horizons before making any significant portfolio adjustments. Seeking advice from a qualified financial advisor is always recommended during periods of heightened market volatility.

Key Takeaways:

- Interest rate uncertainty: The Fed's ambiguous stance on future rate hikes is a major driver of market anxiety.

- Geopolitical risks: Former President Trump's comments on Iran have increased geopolitical uncertainty and fueled market instability.

- Sectoral impact: Technology stocks have been particularly hard hit, reflecting their sensitivity to economic conditions.

- Investor response: Risk aversion is driving investors towards safer assets, leading to a sell-off in equities.

This volatile market underscores the importance of staying informed and adapting investment strategies accordingly. Keeping abreast of economic news, geopolitical developments, and Federal Reserve pronouncements is crucial for making sound investment decisions. [Consider adding a call to action, e.g., "Stay tuned for further updates on market trends."]

Keywords: S&P 500, Nasdaq, stock market, Federal Reserve, interest rates, inflation, Iran, geopolitical risk, market volatility, investment strategy, economic uncertainty, Trump, risk aversion.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 And Nasdaq Fall: Market Reaction To Fed Uncertainty And Trump's Iran Stance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Keshas Tits Out Tour Slayyyter Rose Gray And Attention Collaboration Details

Jun 21, 2025

Keshas Tits Out Tour Slayyyter Rose Gray And Attention Collaboration Details

Jun 21, 2025 -

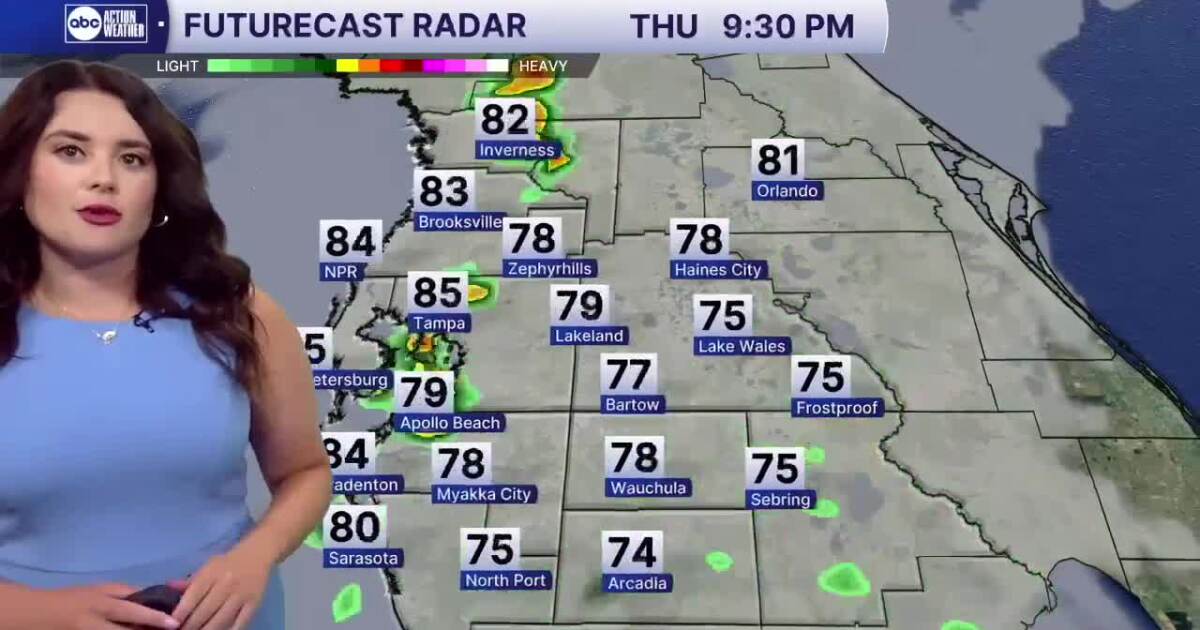

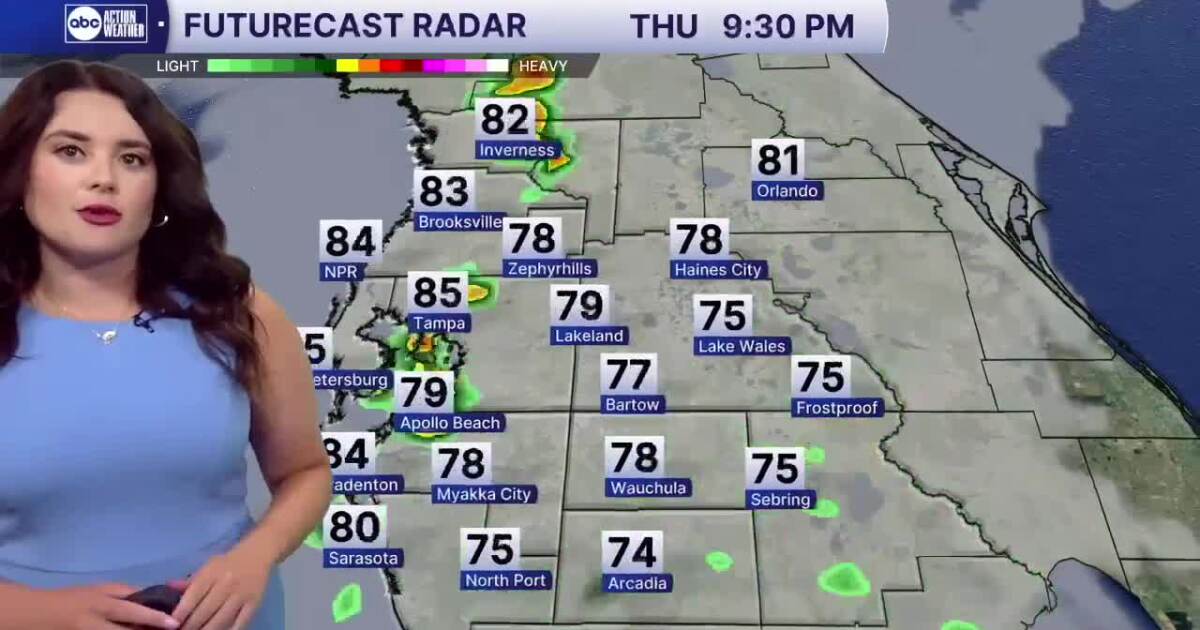

Weather Forecast Prepare For Afternoon Showers And High Humidity

Jun 21, 2025

Weather Forecast Prepare For Afternoon Showers And High Humidity

Jun 21, 2025 -

Market Downturn S And P 500 And Nasdaq Losses Driven By Fed Rate Expectations And Iran Concerns

Jun 21, 2025

Market Downturn S And P 500 And Nasdaq Losses Driven By Fed Rate Expectations And Iran Concerns

Jun 21, 2025 -

Unlocking Taylor Jenkins Reids Publishing Power An Analysis Of Her Career

Jun 21, 2025

Unlocking Taylor Jenkins Reids Publishing Power An Analysis Of Her Career

Jun 21, 2025 -

Expect Afternoon Showers And High Humidity Todays Weather Outlook

Jun 21, 2025

Expect Afternoon Showers And High Humidity Todays Weather Outlook

Jun 21, 2025