S&P 500 And Nasdaq Fall: Fed Rate Uncertainty And Geopolitical Risks Shake Stock Market

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 and Nasdaq Fall: Fed Rate Uncertainty and Geopolitical Risks Shake Stock Market

The US stock market experienced a significant downturn on [Date], with the S&P 500 and Nasdaq Composite indices falling sharply. Investors reacted to heightened uncertainty surrounding the Federal Reserve's monetary policy and escalating geopolitical risks, creating a volatile trading environment. This downturn underscores the interconnectedness of global economic factors and their impact on investor sentiment.

Fed Rate Hikes and Inflation Concerns Fuel Market Volatility

The primary driver behind the market's decline is the ongoing debate surrounding the Federal Reserve's interest rate hikes. While recent inflation data showed a slight easing, concerns remain that persistent inflation may necessitate further, more aggressive rate increases. This uncertainty is unsettling investors, who are grappling with the potential impact on corporate earnings and economic growth. Higher interest rates typically increase borrowing costs for businesses, potentially slowing investment and hindering expansion plans. This translates to lower profits and a less optimistic outlook for future stock performance. Analysts are closely monitoring upcoming economic indicators for clues about the Fed's next move, anticipating further volatility until greater clarity emerges. [Link to relevant Fed news release].

Geopolitical Instability Adds to Investor Anxiety

Adding fuel to the fire, escalating geopolitical tensions are contributing to the market's instability. The ongoing [mention specific geopolitical event, e.g., conflict in Ukraine, tensions in the South China Sea] is injecting significant uncertainty into the global economic landscape. These events disrupt supply chains, increase energy prices, and generally foster an environment of risk aversion among investors. This uncertainty forces investors to reassess their portfolios, often leading to sell-offs in riskier assets like stocks.

What Does This Mean for Investors?

The recent market decline highlights the importance of a well-diversified investment strategy. Investors should carefully consider their risk tolerance and adjust their portfolios accordingly. This may involve rebalancing holdings or shifting towards more conservative investments. Seeking professional financial advice is crucial during times of market volatility to make informed decisions aligned with individual financial goals.

Sector-Specific Impacts:

The impact of the market decline wasn't uniform across all sectors. Technology stocks, particularly those in the Nasdaq, were disproportionately affected, reflecting their sensitivity to interest rate changes. Other sectors, such as energy and consumer staples, showed more resilience, highlighting the diverse responses to macroeconomic factors.

Looking Ahead: Potential for Recovery or Further Decline?

Predicting the future direction of the market is always challenging. However, several factors will likely influence the trajectory of the S&P 500 and Nasdaq in the coming weeks and months. These include the pace of future Fed rate hikes, the evolution of geopolitical events, and the release of key economic data. Analysts are divided on whether the current downturn signals a more significant correction or a temporary blip.

Key Takeaways:

- Market volatility is normal: Fluctuations in the stock market are expected, driven by various economic and geopolitical factors.

- Diversification is key: A diversified investment strategy can help mitigate risk.

- Long-term perspective is crucial: Short-term market fluctuations shouldn't dictate long-term investment strategies.

- Stay informed: Keep abreast of economic news and geopolitical developments to make informed investment decisions.

Call to Action: Stay tuned for updates and further analysis on the evolving market situation. Consider consulting a financial advisor to discuss your specific investment needs and risk tolerance. [Link to a relevant financial planning resource or article].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 And Nasdaq Fall: Fed Rate Uncertainty And Geopolitical Risks Shake Stock Market. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Kamala Harris Considered Mark Cuban For Vp His Response

Jun 21, 2025

Kamala Harris Considered Mark Cuban For Vp His Response

Jun 21, 2025 -

Club World Cup Match Preview Bayern Munich Vs Boca Juniors Key Players And Potential Lineups

Jun 21, 2025

Club World Cup Match Preview Bayern Munich Vs Boca Juniors Key Players And Potential Lineups

Jun 21, 2025 -

Gabbards Falling Out With Trump Administration A Cnn Report

Jun 21, 2025

Gabbards Falling Out With Trump Administration A Cnn Report

Jun 21, 2025 -

Cnn Sources Trump Intel Chief Views Gabbard As Off Message

Jun 21, 2025

Cnn Sources Trump Intel Chief Views Gabbard As Off Message

Jun 21, 2025 -

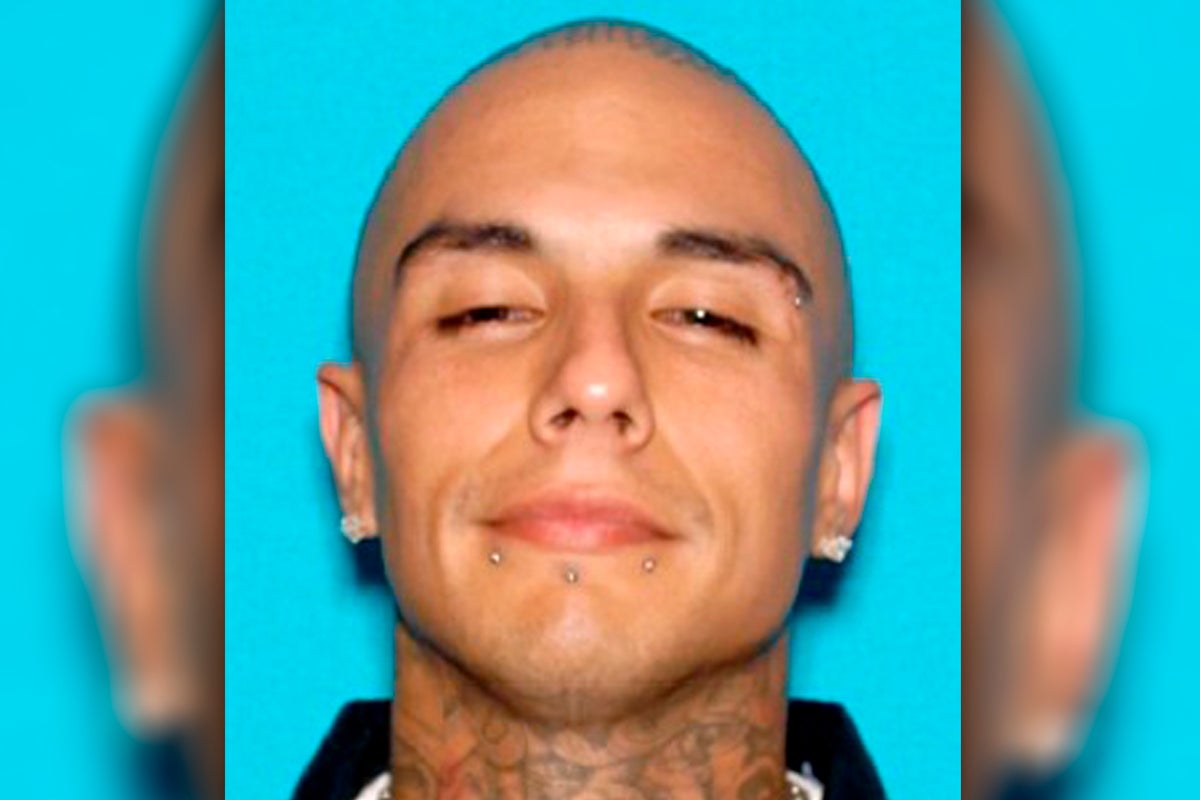

19 Alleged Mexican Mafia Members Face Charges In Attempted Rapper Killing

Jun 21, 2025

19 Alleged Mexican Mafia Members Face Charges In Attempted Rapper Killing

Jun 21, 2025