S&P 500 And Nasdaq Decline: Market Volatility Rises Amidst Fed Uncertainty And Iran Tensions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 and Nasdaq Decline: Market Volatility Rises Amidst Fed Uncertainty and Iran Tensions

Wall Street experienced a significant downturn today, with both the S&P 500 and Nasdaq Composite indices suffering notable declines. This market volatility underscores growing investor anxieties surrounding the Federal Reserve's monetary policy and escalating geopolitical tensions in the Middle East, particularly concerning Iran. The uncertainty is causing ripples throughout the financial world, leaving investors grappling with a challenging market landscape.

Fed Uncertainty Fuels Market Jitters: The Federal Reserve's recent pronouncements on interest rates have left investors on edge. While the Fed has signaled a potential pause in its aggressive rate-hiking cycle, the persistent threat of inflation and the ongoing debate about the appropriate monetary policy stance have created a climate of uncertainty. This ambiguity is fueling speculation and contributing to the increased market volatility. Analysts are closely scrutinizing upcoming economic data releases, particularly inflation figures, for clues about the Fed's next move. [Link to a relevant article about the Federal Reserve's recent statements]

Geopolitical Risks Add to the Pressure: Adding to the economic concerns are escalating tensions in the Middle East. Recent events involving Iran have heightened geopolitical risks, prompting investors to seek safer havens and contributing to the sell-off in equities. The potential for further escalation is a significant concern, as it could disrupt global oil supplies and further destabilize the already fragile global economic outlook. [Link to a reputable news source covering Iran tensions]

Sector-Specific Impacts: The decline wasn't uniform across all sectors. Technology stocks, which are often more sensitive to interest rate changes, were particularly hard hit, leading to a significant drop in the Nasdaq. Meanwhile, the energy sector saw mixed results, reflecting the complex interplay of geopolitical risks and potential price fluctuations in the oil market. This divergence highlights the complexities of navigating the current market environment.

What Investors Should Consider:

- Diversification: Maintaining a well-diversified portfolio is crucial in times of market volatility. Spreading investments across different asset classes can help mitigate risk.

- Risk Tolerance: Investors should carefully assess their own risk tolerance and adjust their portfolios accordingly. A conservative approach might be warranted given the current uncertainty.

- Long-Term Perspective: While short-term market fluctuations can be unsettling, maintaining a long-term investment perspective is essential. History has shown that markets tend to recover over time.

- Professional Advice: Seeking advice from a qualified financial advisor can provide valuable insights and guidance during periods of market volatility.

Looking Ahead: The coming days and weeks will be crucial in determining the trajectory of the market. Further clarity on the Fed's monetary policy stance and the unfolding situation in Iran will be key factors influencing investor sentiment. For now, the market remains in a state of flux, underscoring the need for caution and careful risk management. Stay tuned for further updates as the situation unfolds.

Keywords: S&P 500, Nasdaq, market volatility, Federal Reserve, interest rates, inflation, Iran, geopolitical risk, stock market decline, investment strategy, risk management, economic uncertainty.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 And Nasdaq Decline: Market Volatility Rises Amidst Fed Uncertainty And Iran Tensions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Stock Market Dips S And P 500 And Nasdaq Fall On Fed Rate Hike Fears And Iran Tensions

Jun 21, 2025

Stock Market Dips S And P 500 And Nasdaq Fall On Fed Rate Hike Fears And Iran Tensions

Jun 21, 2025 -

Keshas Tits Out Tour Slayyyter Rose Gray Collaboration And Attention Song Details

Jun 21, 2025

Keshas Tits Out Tour Slayyyter Rose Gray Collaboration And Attention Song Details

Jun 21, 2025 -

How Jaws Misrepresented Sharks And Fueled Decades Of Misconceptions

Jun 21, 2025

How Jaws Misrepresented Sharks And Fueled Decades Of Misconceptions

Jun 21, 2025 -

Brazilian Beat Takes Over Nyc Fluminenses Big Apple Invasion

Jun 21, 2025

Brazilian Beat Takes Over Nyc Fluminenses Big Apple Invasion

Jun 21, 2025 -

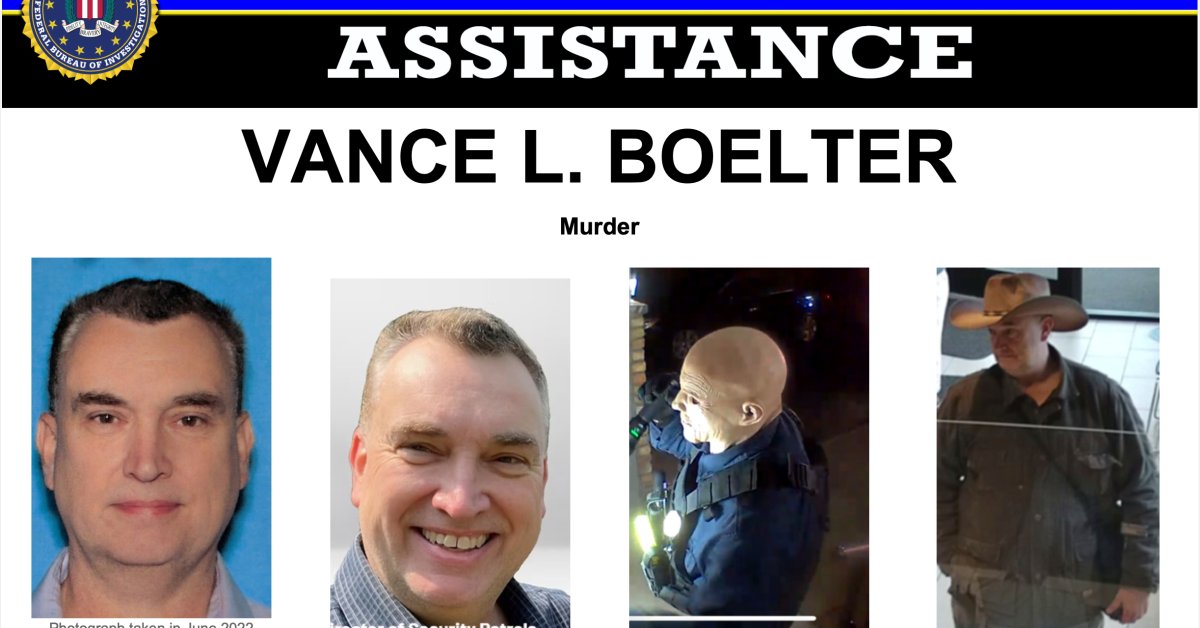

Who Is Vance L Boelter Suspect In Minnesota Lawmakers Shooting Incident Identified

Jun 21, 2025

Who Is Vance L Boelter Suspect In Minnesota Lawmakers Shooting Incident Identified

Jun 21, 2025