S&P 500 And Nasdaq Decline: Market Volatility Rises Amidst Fed Uncertainty And Geopolitical Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 and Nasdaq Decline: Market Volatility Rises Amidst Fed Uncertainty and Geopolitical Risks

The US stock market experienced a significant downturn this week, with both the S&P 500 and Nasdaq Composite indices experiencing notable declines. This increased market volatility reflects growing anxieties surrounding Federal Reserve policy and escalating geopolitical tensions. Investors are grappling with uncertainty, leading to a sell-off that has shaken confidence across various sectors.

Fed Uncertainty Fuels Market Jitters

The primary driver behind the recent market slump is the ongoing uncertainty surrounding the Federal Reserve's monetary policy. While the Fed has signaled a potential pause in interest rate hikes, the path forward remains unclear. Concerns persist about the persistence of inflation, prompting speculation about further rate increases later in the year. This uncertainty creates a challenging environment for investors attempting to predict future market trends. Many analysts are closely monitoring upcoming economic data releases, including inflation figures and employment reports, for clues about the Fed's next move. [Link to a relevant Federal Reserve news release].

Geopolitical Risks Add to the Pressure

Adding to the pressure on the market are escalating geopolitical risks. The ongoing conflict in Ukraine continues to create instability, impacting global energy markets and supply chains. Furthermore, rising tensions in other regions are contributing to a broader sense of uncertainty. This geopolitical instability adds another layer of complexity for investors already grappling with economic uncertainties. [Link to a reputable news source covering geopolitical events].

Sector-Specific Impacts

The recent market decline hasn't impacted all sectors equally. Technology stocks, heavily represented in the Nasdaq, have been particularly hard hit, reflecting investor concerns about future growth prospects in a higher interest rate environment. However, other sectors, such as energy and materials, have shown relative resilience due to factors such as sustained demand and supply constraints.

What Investors Should Do

The current market volatility presents challenges for investors. It's crucial to maintain a long-term perspective and avoid making rash decisions based on short-term market fluctuations. A diversified investment portfolio, tailored to individual risk tolerance and financial goals, remains a cornerstone of sound investment strategy. Consider consulting with a financial advisor to review your portfolio and adjust your strategy accordingly.

Understanding Market Volatility:

- Volatility is normal: Market fluctuations are an inherent part of investing. Short-term drops are common and often followed by periods of growth.

- Diversification is key: Spreading investments across different asset classes and sectors can help mitigate risk.

- Long-term perspective: Focus on your long-term financial goals and avoid emotional decision-making.

Looking Ahead:

The coming weeks will be crucial in determining the direction of the market. Close monitoring of economic data, Fed announcements, and geopolitical developments is essential. The market's reaction to these factors will significantly influence investor sentiment and future market performance. While predicting the market with certainty is impossible, understanding the underlying factors driving volatility can help investors make informed decisions.

Keywords: S&P 500, Nasdaq, market volatility, Federal Reserve, interest rates, inflation, geopolitical risks, stock market decline, investment strategy, economic uncertainty, Ukraine conflict, market outlook, financial advisor.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 And Nasdaq Decline: Market Volatility Rises Amidst Fed Uncertainty And Geopolitical Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

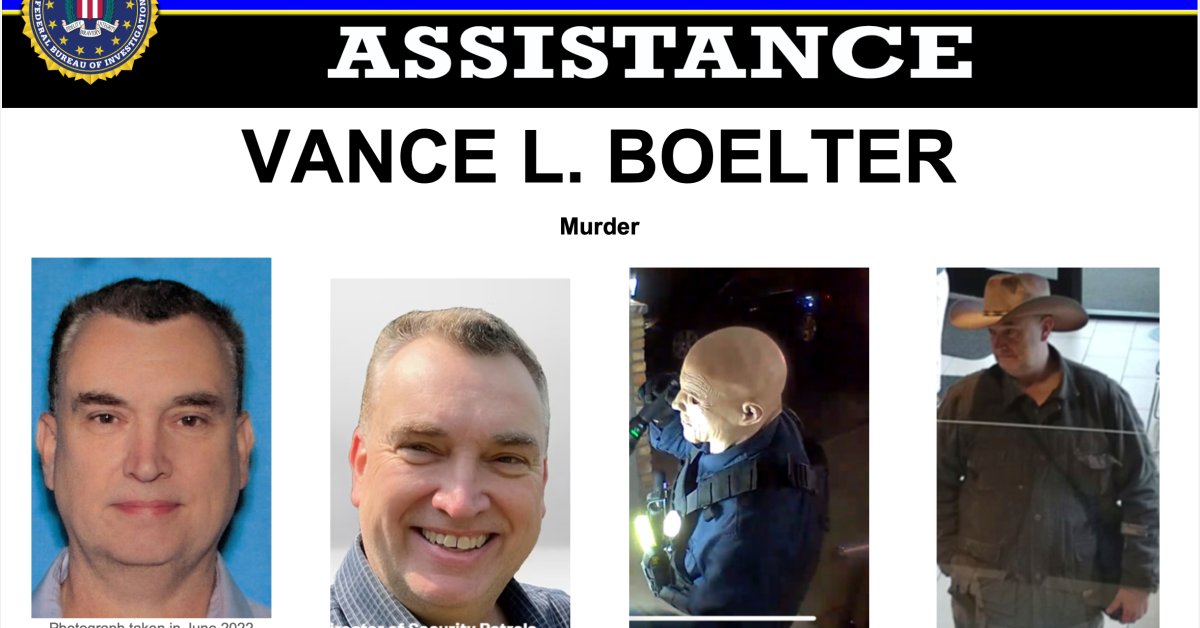

Who Is Vance L Boelter Suspect In Minnesota Shooting Of Lawmakers Identified

Jun 21, 2025

Who Is Vance L Boelter Suspect In Minnesota Shooting Of Lawmakers Identified

Jun 21, 2025 -

Hong Kongs Intensified Crackdown The Price Of U S Distraction

Jun 21, 2025

Hong Kongs Intensified Crackdown The Price Of U S Distraction

Jun 21, 2025 -

Hong Kong Crackdown Democracy Suffers As Us Distracted

Jun 21, 2025

Hong Kong Crackdown Democracy Suffers As Us Distracted

Jun 21, 2025 -

Mark Cuban Rejected Kamala Harris 2020 Vp Bid Heres Why

Jun 21, 2025

Mark Cuban Rejected Kamala Harris 2020 Vp Bid Heres Why

Jun 21, 2025 -

Trump Administration Sidelines Tulsi Gabbard On Critical Israel And Iran Policy Decisions

Jun 21, 2025

Trump Administration Sidelines Tulsi Gabbard On Critical Israel And Iran Policy Decisions

Jun 21, 2025