S&P 500 And Nasdaq Decline: Market Volatility Driven By Fed Uncertainty And Trump's Iran Stance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 and Nasdaq Tumble: Market Volatility Fueled by Fed Uncertainty and Trump's Iran Actions

The US stock market experienced a significant downturn on [Date], with the S&P 500 and Nasdaq Composite both recording notable declines. This market volatility is largely attributed to lingering uncertainty surrounding the Federal Reserve's monetary policy and President Trump's increasingly hawkish stance on Iran. Investors are grappling with a confluence of factors, creating a climate of apprehension and prompting significant sell-offs.

The Fed's Tightrope Walk: Interest Rates and Inflation

The Federal Reserve's recent actions and pronouncements regarding interest rates are a major driver of market anxiety. While the Fed has paused its rate hike cycle, concerns remain about the potential for future increases to combat inflation. [Link to relevant Fed statement/article]. Investors are nervously watching inflation data and economic indicators, trying to gauge the Fed's next move. Any perceived hawkish shift could trigger further sell-offs, as higher interest rates typically dampen economic growth and reduce corporate profitability. The delicate balance the Fed is attempting to strike between controlling inflation and avoiding a recession is creating significant uncertainty for market participants. This uncertainty is further exacerbated by conflicting signals from different Fed officials, leading to widespread speculation and market volatility.

Trump's Iran Policy: Geopolitical Risks and Market Sentiment

President Trump's recent actions and statements regarding Iran have added another layer of complexity to the already volatile market environment. Increased tensions in the Middle East, including [mention specific recent events, e.g., seizure of tankers, escalating rhetoric], have heightened geopolitical risks. These risks directly impact investor sentiment, prompting a flight to safety and pushing down riskier assets like stocks. The potential for further escalation in the region introduces significant uncertainty, making it difficult for investors to assess future market prospects. [Link to relevant news article on Trump's Iran policy]. The unpredictability inherent in this geopolitical situation contributes significantly to the current market downturn.

Sector-Specific Impacts: Technology Takes a Hit

The technology sector, heavily represented in the Nasdaq, has been particularly hard hit during this recent decline. The combination of increased interest rate risks and the broader geopolitical uncertainty has weighed heavily on tech stocks, many of which are considered growth stocks sensitive to higher interest rates. [Mention specific examples of tech company stock performance]. This sector's sensitivity to changing economic conditions makes it particularly vulnerable to market downturns.

What Lies Ahead? Analyzing Market Forecasts

Predicting short-term market movements is notoriously difficult. However, several factors suggest continued volatility in the near term. [Mention insights from financial analysts or economists about future market trends]. Investors are advised to monitor economic indicators closely, pay attention to developments in the US-Iran situation, and carefully consider their own risk tolerance before making any investment decisions.

Diversification and Risk Management: Key Strategies

In times of heightened market volatility, diversification and prudent risk management are paramount. Investors should carefully review their portfolios and ensure they are appropriately diversified across various asset classes. [Link to article on portfolio diversification or risk management]. Furthermore, considering a long-term investment strategy and avoiding impulsive reactions to short-term market fluctuations is crucial.

Call to Action: Stay informed about market developments and consult with a qualified financial advisor before making any significant investment decisions. Understanding the underlying factors driving market volatility is key to navigating these challenging times.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 And Nasdaq Decline: Market Volatility Driven By Fed Uncertainty And Trump's Iran Stance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Beyond The Blockbuster Assessing The Long Term Environmental Consequences Of Jaws

Jun 21, 2025

Beyond The Blockbuster Assessing The Long Term Environmental Consequences Of Jaws

Jun 21, 2025 -

Update Barry Morphew Rearrested In Connection With Suzanne Morphews Death

Jun 21, 2025

Update Barry Morphew Rearrested In Connection With Suzanne Morphews Death

Jun 21, 2025 -

Mark Cuban Rejects Kamala Harris Vp Offer Heres Why

Jun 21, 2025

Mark Cuban Rejects Kamala Harris Vp Offer Heres Why

Jun 21, 2025 -

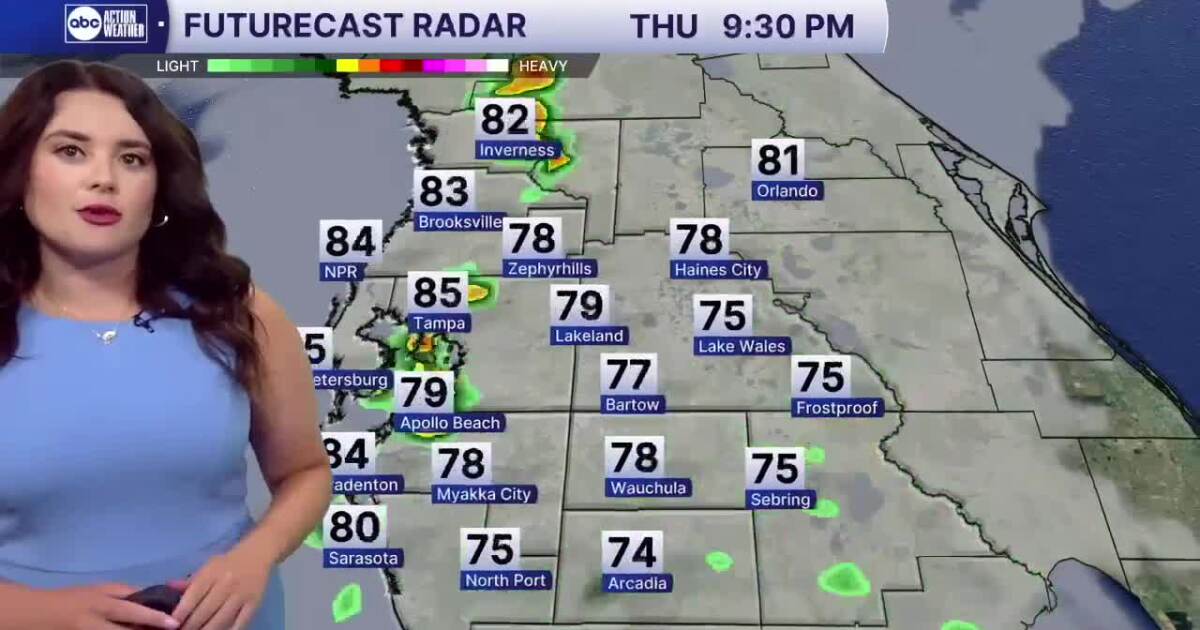

Todays Forecast Muggy Conditions With A Chance Of Late Day Showers

Jun 21, 2025

Todays Forecast Muggy Conditions With A Chance Of Late Day Showers

Jun 21, 2025 -

Hong Kongs Democratic Erosion A Growing Crisis Under The Radar

Jun 21, 2025

Hong Kongs Democratic Erosion A Growing Crisis Under The Radar

Jun 21, 2025