S&P 500 And Nasdaq Decline: Market Volatility Driven By Fed Uncertainty And Geopolitical Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

S&P 500 and Nasdaq Decline: Market Volatility Driven by Fed Uncertainty and Geopolitical Risks

The US stock market experienced a significant downturn this week, with both the S&P 500 and Nasdaq Composite indices recording substantial declines. This market volatility is largely attributed to lingering uncertainty surrounding the Federal Reserve's monetary policy and escalating geopolitical risks. Investors are grappling with a complex interplay of factors, leaving many wondering what the future holds for the market.

Fed Rate Hikes and Inflation Concerns Fuel Market Uncertainty

The Federal Reserve's ongoing efforts to combat inflation through interest rate hikes remain a primary driver of market instability. While recent inflation data has shown some signs of cooling, the pace of these rate increases and their potential impact on economic growth remain unclear. Investors are nervously anticipating the Fed's next move, fearing that aggressive rate hikes could trigger a recession. This uncertainty is prompting investors to adopt a more cautious approach, leading to a sell-off in equities. The fear of a potential economic slowdown is a significant factor influencing the current market downturn, impacting sectors sensitive to interest rate changes.

Geopolitical Risks Exacerbate Market Volatility

Adding to the uncertainty, escalating geopolitical tensions are further fueling market volatility. The ongoing conflict in Ukraine, coupled with rising tensions in other regions, introduces significant uncertainty into the global economic outlook. These geopolitical risks disrupt supply chains, increase commodity prices, and contribute to overall market anxiety. Investors are seeking safe haven assets, further pressuring equity markets.

Specific Sector Impacts:

The decline wasn't uniform across all sectors. Tech stocks, heavily represented in the Nasdaq, were particularly hard hit, reflecting their sensitivity to interest rate hikes. This sector, often considered growth-oriented, tends to underperform in a rising rate environment. However, other sectors also experienced losses, indicating a broad-based market correction.

-

Technology: The tech sector saw the most significant decline, with many high-growth companies experiencing substantial share price drops. This is partly due to the increased cost of borrowing, making future growth less attractive to investors.

-

Energy: While energy prices remain elevated, the sector also saw some correction, likely reflecting profit-taking after a period of strong performance.

-

Financials: The financial sector, often viewed as a beneficiary of rising interest rates, experienced a mixed performance, highlighting the overall complexity of the market's response.

What's Next for Investors?

The current market volatility underscores the importance of a well-diversified investment strategy. Investors should carefully consider their risk tolerance and adjust their portfolios accordingly. Seeking professional financial advice is crucial during periods of market uncertainty. [Link to a relevant financial advice resource - Example: Investopedia's guide to risk management]

Looking Ahead:

Predicting the market's short-term direction is impossible. However, understanding the underlying factors – Fed policy, inflation, and geopolitical events – is crucial for navigating the current climate. Closely monitoring economic indicators and staying informed about geopolitical developments will be critical for investors in the coming weeks and months. It's a time to exercise caution, review your investment strategy, and perhaps consider opportunities presented by the current market correction.

Keywords: S&P 500, Nasdaq, market volatility, Federal Reserve, interest rates, inflation, geopolitical risks, stock market decline, economic uncertainty, investment strategy, market correction.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on S&P 500 And Nasdaq Decline: Market Volatility Driven By Fed Uncertainty And Geopolitical Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

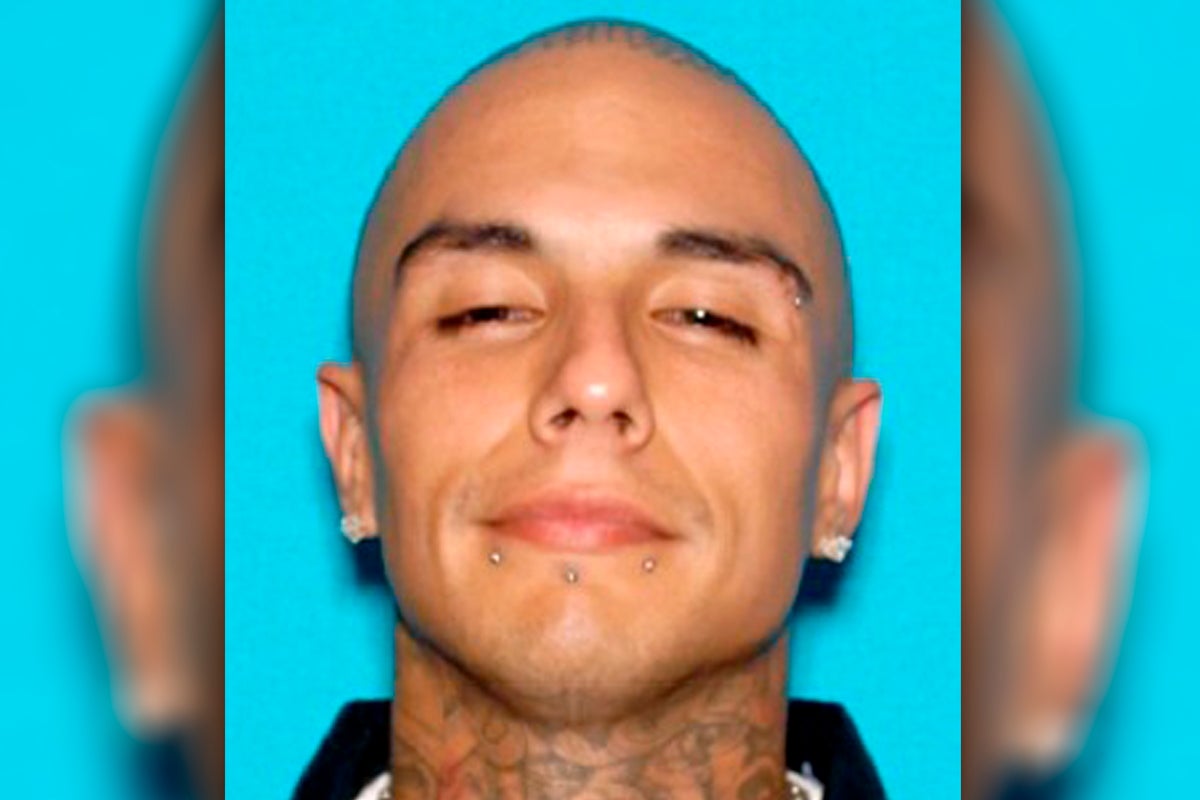

19 Charged In Mexican Mafias Attempted Murder Of Prominent Rapper

Jun 21, 2025

19 Charged In Mexican Mafias Attempted Murder Of Prominent Rapper

Jun 21, 2025 -

The Future Of Climate Science Examining Trumps Summer Actions

Jun 21, 2025

The Future Of Climate Science Examining Trumps Summer Actions

Jun 21, 2025 -

Gabbards Political Standing A Source Of Tension Within Trumps Circle

Jun 21, 2025

Gabbards Political Standing A Source Of Tension Within Trumps Circle

Jun 21, 2025 -

Devers Trade Stuns Baseball Experts Analyze The Surprising Timing

Jun 21, 2025

Devers Trade Stuns Baseball Experts Analyze The Surprising Timing

Jun 21, 2025 -

How Steven Spielbergs Jaws Changed Public Perception Of Sharks

Jun 21, 2025

How Steven Spielbergs Jaws Changed Public Perception Of Sharks

Jun 21, 2025