Roblox Stock Drops: Analyzing The 4.4% Plunge

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Roblox Stock Drops 4.4%: Analyzing the Plunge and What it Means for Investors

Roblox Corporation (RBLX), the popular online gaming platform, experienced a significant stock drop of 4.4% on [Date of Stock Drop], leaving investors wondering about the cause and the future implications. This sharp decline follows a period of relative stability and raises questions about the platform's ongoing growth trajectory. Understanding the factors behind this plunge is crucial for anyone invested in or considering investing in Roblox.

What Triggered the Stock Drop?

While a single definitive cause hasn't been pinpointed, several factors likely contributed to the 4.4% drop in Roblox stock:

-

Concerns about slowing user growth: While Roblox continues to boast millions of daily active users, recent reports suggest a potential slowdown in growth compared to previous quarters. Investors are keenly watching these user metrics, as sustained growth is vital for the company's long-term success. Any indication of a plateau or decline in user engagement can negatively impact investor confidence.

-

Increased competition: The online gaming market is highly competitive, with established players and emerging platforms vying for users' attention. Roblox faces competition from established names like Minecraft and Fortnite, as well as newer entrants constantly innovating within the metaverse space. This competitive landscape puts pressure on Roblox to maintain its innovative edge and attract new users.

-

Economic headwinds: The current economic climate, characterized by inflation and potential recessionary pressures, can significantly impact consumer spending on entertainment. Roblox, as a primarily entertainment-focused platform, is susceptible to these macroeconomic factors. Reduced discretionary spending might lead to decreased in-app purchases and a subsequent impact on revenue.

-

Market Sentiment: The overall market sentiment can influence individual stock performance. A general downturn in the tech sector or broader market volatility could contribute to the decline even if Roblox's fundamentals remain strong. This emphasizes the interconnectedness of the stock market and the susceptibility of even seemingly stable companies to broader economic trends.

Analyzing the Long-Term Outlook for Roblox

Despite the recent setback, Roblox maintains several key strengths:

-

Massive User Base: The platform still commands a massive and engaged user base, providing a solid foundation for future growth. This large audience represents a considerable opportunity for monetization and expansion.

-

Strong Metaverse Position: Roblox is considered a key player in the burgeoning metaverse landscape, a sector with significant long-term potential. Continued investment in developing the platform's capabilities and features could solidify its position in this rapidly evolving market.

-

Monetization Strategies: Roblox's diverse monetization strategies, including in-app purchases and developer royalties, provide multiple avenues for revenue generation. The ability to adapt and refine these strategies will be crucial in navigating changing market conditions.

What Investors Should Do

The 4.4% drop presents a complex situation for investors. Those with a long-term outlook might view this as a buying opportunity, considering Roblox's potential within the metaverse and its strong user base. However, investors should carefully assess their risk tolerance and diversify their portfolio accordingly. Thorough research and understanding of the factors affecting Roblox's performance are essential before making any investment decisions. Consulting a financial advisor is always recommended for personalized guidance.

Stay Informed: Keep an eye on Roblox's upcoming financial reports and any announcements regarding new features or strategic partnerships. Staying updated on industry news and market trends will also help you make informed decisions.

Keywords: Roblox, RBLX, Roblox stock, stock market, stock drop, gaming, metaverse, online gaming, user growth, competition, economic impact, investment, investor, financial analysis, market analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Roblox Stock Drops: Analyzing The 4.4% Plunge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cillian Murphy Discusses Steve At Tiff Balancing Anxiety And Audience Engagement

Aug 15, 2025

Cillian Murphy Discusses Steve At Tiff Balancing Anxiety And Audience Engagement

Aug 15, 2025 -

What To Say And Definitely Not Say To Someone Experiencing Anxiety

Aug 15, 2025

What To Say And Definitely Not Say To Someone Experiencing Anxiety

Aug 15, 2025 -

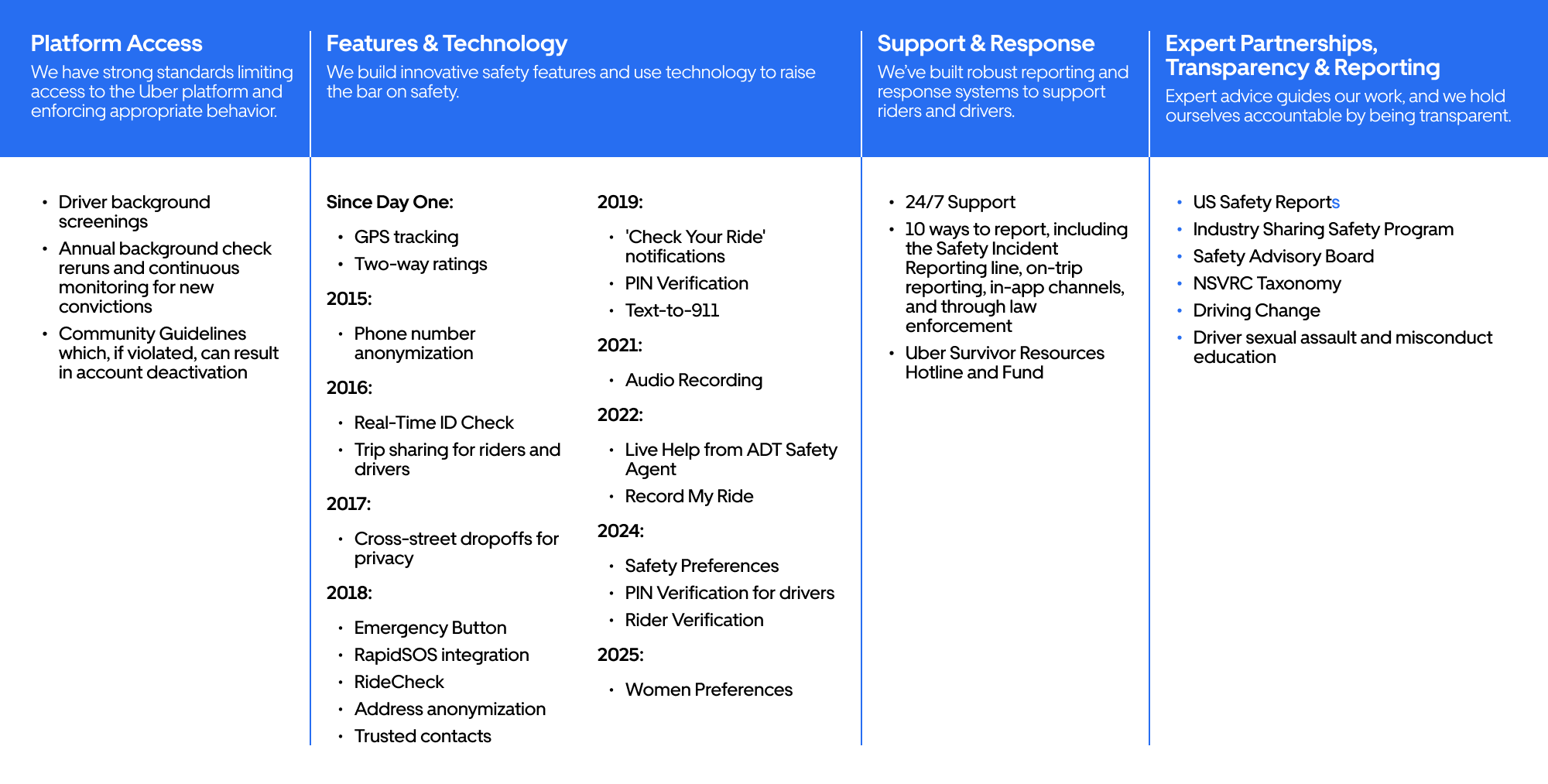

Uber Safety Record A Comprehensive Review

Aug 15, 2025

Uber Safety Record A Comprehensive Review

Aug 15, 2025 -

Trumps Redistricting Plan Faces Deadline Newsoms Standoff

Aug 15, 2025

Trumps Redistricting Plan Faces Deadline Newsoms Standoff

Aug 15, 2025 -

How Adhd Treatment Can Decrease The Likelihood Of Criminal Behavior Substance Abuse And Accidents

Aug 15, 2025

How Adhd Treatment Can Decrease The Likelihood Of Criminal Behavior Substance Abuse And Accidents

Aug 15, 2025

Latest Posts

-

Trump Administration Reviews Smithsonian Exhibitions For Policy Alignment

Aug 15, 2025

Trump Administration Reviews Smithsonian Exhibitions For Policy Alignment

Aug 15, 2025 -

Sisters Nader Enjoy A European Summer Family Vacation Photos

Aug 15, 2025

Sisters Nader Enjoy A European Summer Family Vacation Photos

Aug 15, 2025 -

The Impact Of X Ai On Memphis Local Concerns And Resistance

Aug 15, 2025

The Impact Of X Ai On Memphis Local Concerns And Resistance

Aug 15, 2025 -

Fortnite Outage Over Players Can Now Log In After Server Issues

Aug 15, 2025

Fortnite Outage Over Players Can Now Log In After Server Issues

Aug 15, 2025 -

The Social Security Act 90 Years Of Providing Security For Americans

Aug 15, 2025

The Social Security Act 90 Years Of Providing Security For Americans

Aug 15, 2025