Robinhood's Record $255 Billion In Assets: Trading Volume Surge And Crypto Boom

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood's Record $255 Billion in Assets: A Trading Volume Surge and Crypto Boom Fuel Explosive Growth

Robinhood, the popular commission-free trading app, has announced a staggering $255 billion in assets under custody, marking a significant milestone in its relatively short history. This record-breaking figure reflects a dramatic surge in trading volume and a booming interest in cryptocurrency, solidifying Robinhood's position as a major player in the fintech landscape. But what factors contributed to this impressive growth, and what does it mean for the future of the company?

A Perfect Storm of Factors:

Several interconnected factors contributed to Robinhood's explosive growth and record-breaking asset numbers. The pandemic undoubtedly played a significant role, pushing millions of people towards online investing for the first time. Lockdowns and increased screen time created a fertile ground for the adoption of user-friendly platforms like Robinhood.

1. The Rise of Retail Investing: The democratization of investing, largely fueled by commission-free trading platforms, attracted a wave of new, often younger, investors. Robinhood's intuitive interface and gamified features made investing accessible to a broader audience than ever before. This influx of retail investors directly contributed to the increased trading volume.

2. The Cryptocurrency Craze: The continued rise of Bitcoin and other cryptocurrencies has been a major driver of Robinhood's success. The platform's easy-to-use crypto trading features attracted numerous users looking to participate in the volatile yet potentially lucrative cryptocurrency market. The significant price fluctuations in crypto assets have, in turn, generated substantial trading volume.

3. Improved Financial Performance: While Robinhood faced challenges and regulatory scrutiny in the past, the company has shown improved financial performance, boosting investor confidence and attracting further capital. This positive momentum further contributed to its growing asset base.

Challenges and Future Outlook:

Despite the impressive growth, Robinhood faces ongoing challenges. Increased regulatory scrutiny within the financial technology sector remains a concern. Competition from established players and emerging fintech startups continues to intensify. Maintaining user growth and engagement in a potentially cooling market will also be crucial.

What This Means for the Future:

Robinhood's $255 billion in assets under custody underscores the transformative impact of commission-free trading and the burgeoning interest in cryptocurrency. The company’s success highlights the increasing accessibility of financial markets and the potential for disruption in the traditional financial industry. However, the company must navigate regulatory hurdles and maintain its competitive edge to sustain its remarkable growth trajectory. The coming years will be pivotal in determining whether Robinhood can maintain its momentum and solidify its position as a leading force in the fintech revolution.

Keywords: Robinhood, assets under custody, trading volume, cryptocurrency, crypto boom, fintech, retail investing, commission-free trading, financial technology, investing app, Bitcoin, regulatory scrutiny, financial markets, stock market.

Call to Action (Subtle): Stay informed about the latest developments in the fintech industry by following reputable financial news sources. Understanding market trends is crucial for informed investing decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood's Record $255 Billion In Assets: Trading Volume Surge And Crypto Boom. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Third Night Of Riots In Northern Ireland Analyzing The Causes And Consequences

Jun 14, 2025

Third Night Of Riots In Northern Ireland Analyzing The Causes And Consequences

Jun 14, 2025 -

The Future Of Flight How One Company Is Transforming Low Carbon Air Travel

Jun 14, 2025

The Future Of Flight How One Company Is Transforming Low Carbon Air Travel

Jun 14, 2025 -

Tenant Exploitation Lawsuit Attorney General Bonta Targets Landlord Mike Nijjar And Pama Management

Jun 14, 2025

Tenant Exploitation Lawsuit Attorney General Bonta Targets Landlord Mike Nijjar And Pama Management

Jun 14, 2025 -

Finding Faith Paula Patton Shares Her Personal Story Of Spiritual Growth

Jun 14, 2025

Finding Faith Paula Patton Shares Her Personal Story Of Spiritual Growth

Jun 14, 2025 -

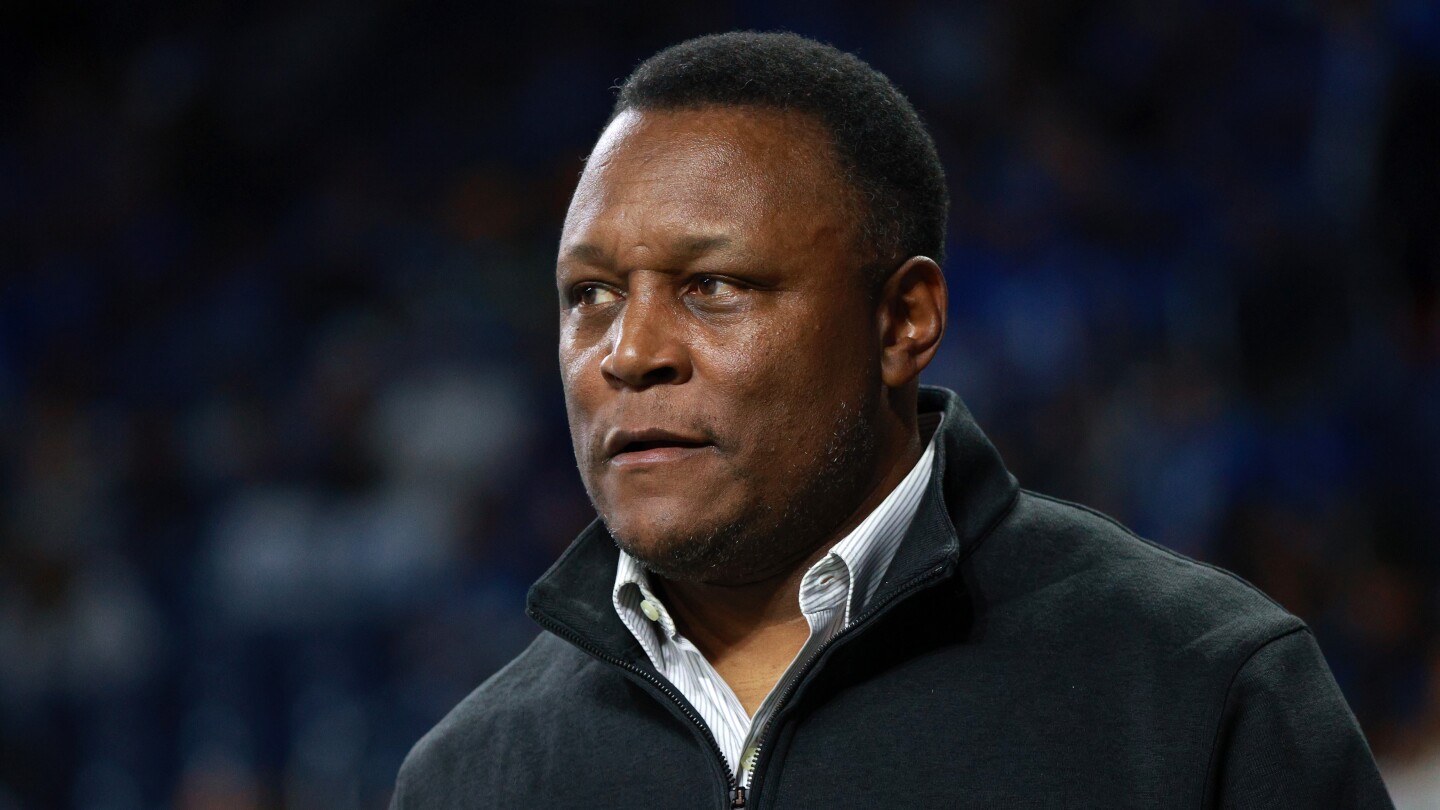

Barry Sanders Speaks Out His Journey After A Life Threatening Heart Attack

Jun 14, 2025

Barry Sanders Speaks Out His Journey After A Life Threatening Heart Attack

Jun 14, 2025