Robinhood's Q[Quarter]-to-Date Report: $255 Billion In Assets, Trading Volume Surge

![Robinhood's Q[Quarter]-to-Date Report: $255 Billion In Assets, Trading Volume Surge Robinhood's Q[Quarter]-to-Date Report: $255 Billion In Assets, Trading Volume Surge](https://clubedadoc.com/image/robinhoods-q-quarter-to-date-report-255-billion-in-assets-trading-volume-surge.jpeg)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood's Q[Quarter]-to-Date Report: $255 Billion in Assets, Trading Volume Surge Signals Market Confidence

Robinhood, the popular commission-free trading app, has announced impressive quarter-to-date (QTD) figures, showcasing a significant surge in trading volume and a substantial increase in assets under custody. The report, released [Insert Date], reveals a total of $255 billion in assets, demonstrating a robust recovery and renewed confidence in the platform despite recent market volatility. This significant jump highlights a potential shift in investor behavior and the continued appeal of Robinhood's user-friendly interface and accessible trading options.

A Resurgence in Trading Activity:

The report not only boasts impressive asset figures but also underscores a notable upswing in trading volume. While specific numbers regarding the percentage increase haven't been publicly disclosed yet, analysts suggest a substantial rise compared to previous quarters. This surge in activity could be attributed to several factors, including:

- Increased Retail Investor Participation: The accessibility of Robinhood's platform continues to attract a large number of retail investors, contributing significantly to the heightened trading volume.

- Market Volatility and Opportunities: Periods of market fluctuation often lead to increased trading activity as investors seek to capitalize on opportunities or mitigate risks.

- Expansion of Offerings: Robinhood's continuous expansion of its product offerings, including crypto trading and other investment options, likely plays a role in attracting and retaining users.

$255 Billion in Assets: A Milestone for Robinhood:

The staggering figure of $255 billion in assets under custody represents a considerable milestone for Robinhood. This significant increase underlines the growing trust and confidence investors have in the platform. It also suggests a broader trend of retail investors embracing digital trading platforms for their investment needs. This signifies a potential shift away from traditional brokerage firms, further solidifying Robinhood's position in the competitive financial technology landscape.

Challenges and Future Outlook:

While the QTD report paints a positive picture, Robinhood still faces challenges. The company continues to navigate regulatory hurdles and competition from established players in the brokerage industry. Maintaining its user base and fostering trust amidst market fluctuations will remain crucial for its long-term success. Furthermore, continued innovation and expansion of its product offerings will be essential to sustain its growth trajectory.

What This Means for Investors:

The robust QTD report from Robinhood offers a positive signal for the broader market, suggesting a level of confidence among retail investors. However, it's crucial to remember that market conditions can change rapidly. Investors should always conduct thorough research and consider their risk tolerance before making any investment decisions.

Looking Ahead:

Robinhood's future performance will be closely watched by investors and industry analysts alike. The company's ability to adapt to changing market dynamics and maintain its innovative edge will be critical in determining its continued success. The upcoming full quarterly report will provide a more comprehensive view of its financial performance and strategic direction.

Keywords: Robinhood, QTD report, assets under custody, trading volume, retail investors, market volatility, financial technology, fintech, brokerage, investment, stock market, crypto trading, financial news

Related Articles: [Link to an article about recent market trends] [Link to an article about the regulatory landscape for fintech companies]

(Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.)

![Robinhood's Q[Quarter]-to-Date Report: $255 Billion In Assets, Trading Volume Surge Robinhood's Q[Quarter]-to-Date Report: $255 Billion In Assets, Trading Volume Surge](https://clubedadoc.com/image/robinhoods-q-quarter-to-date-report-255-billion-in-assets-trading-volume-surge.jpeg)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood's Q[Quarter]-to-Date Report: $255 Billion In Assets, Trading Volume Surge. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

State Ag Files Suit Against Mike Nijjar Details Of The L Aist Investigation

Jun 14, 2025

State Ag Files Suit Against Mike Nijjar Details Of The L Aist Investigation

Jun 14, 2025 -

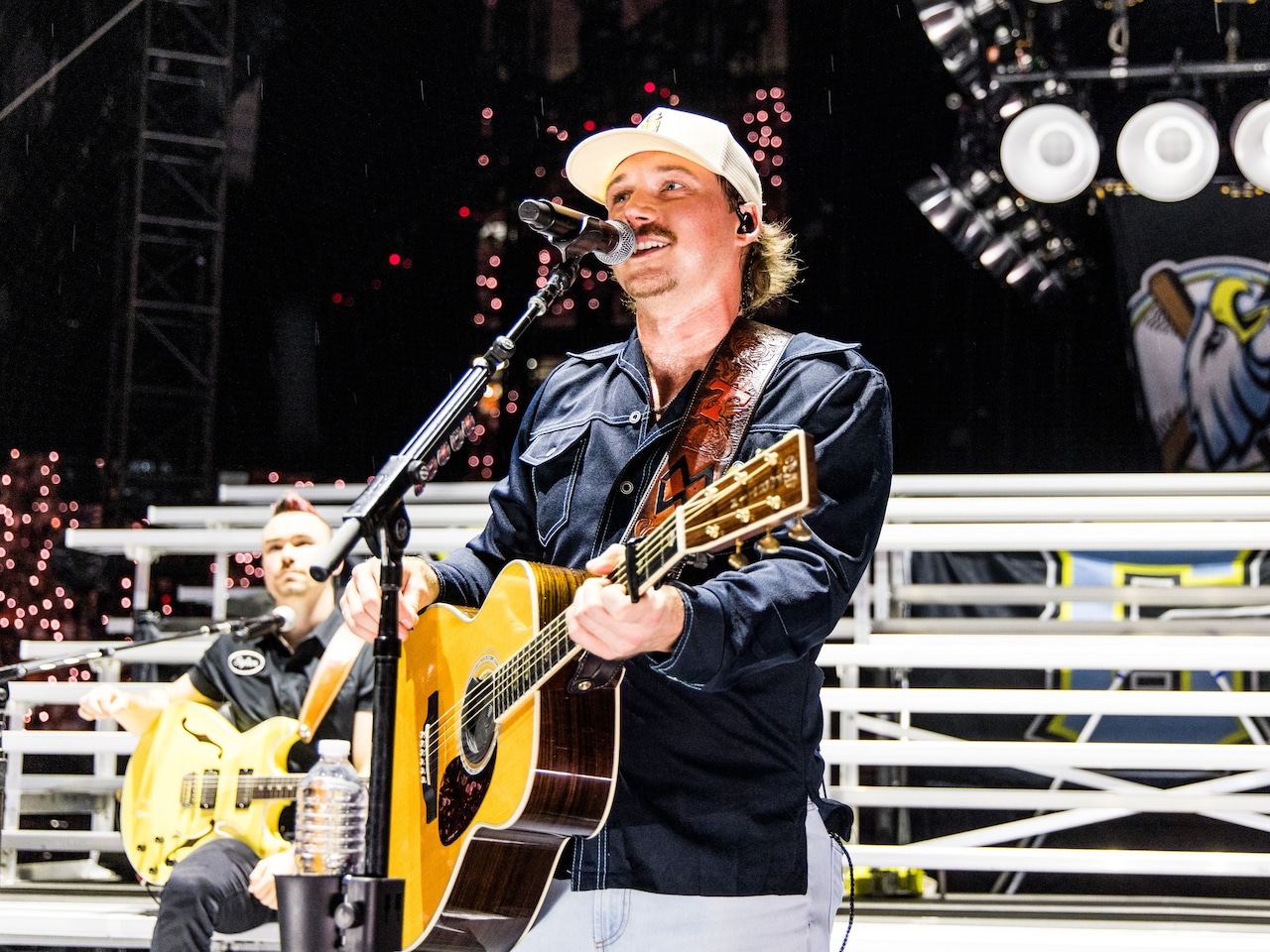

Grab Budget Friendly Morgan Wallen Tickets Houston I M The Problem Tour June 20 21

Jun 14, 2025

Grab Budget Friendly Morgan Wallen Tickets Houston I M The Problem Tour June 20 21

Jun 14, 2025 -

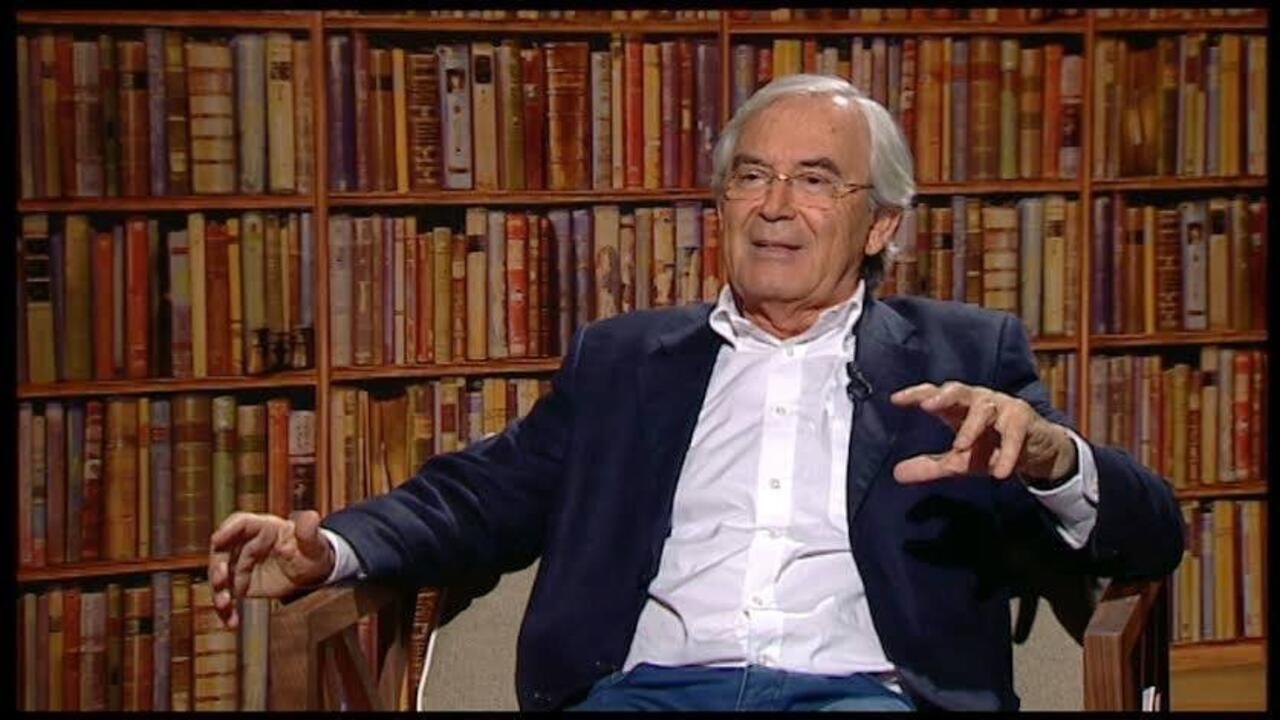

Reforma Da Lei Eleitoral Angolana Pedido De Juiz Jubilado Do Tribunal Constitucional

Jun 14, 2025

Reforma Da Lei Eleitoral Angolana Pedido De Juiz Jubilado Do Tribunal Constitucional

Jun 14, 2025 -

Crypto Trading Fuels Robinhoods Growth 255 Billion In Assets 65 Crypto Jump

Jun 14, 2025

Crypto Trading Fuels Robinhoods Growth 255 Billion In Assets 65 Crypto Jump

Jun 14, 2025 -

Korn Ferry Tour Press Conference Complete Transcript And Analysis

Jun 14, 2025

Korn Ferry Tour Press Conference Complete Transcript And Analysis

Jun 14, 2025