Robinhood's Q[Quarter] Earnings: Record $255 Billion In Assets, Trading Volume Surges

![Robinhood's Q[Quarter] Earnings: Record $255 Billion In Assets, Trading Volume Surges Robinhood's Q[Quarter] Earnings: Record $255 Billion In Assets, Trading Volume Surges](https://clubedadoc.com/image/robinhoods-q-quarter-earnings-record-255-billion-in-assets-trading-volume-surges.jpeg)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood's Q[Quarter] Earnings Soar: Record $255 Billion in Assets, Trading Volume Explodes

Headline: Robinhood's Q[Quarter] Earnings: Record $255 Billion in Assets, Trading Volume Surges

Robinhood, the popular commission-free trading app, announced its [Quarter, e.g., Q2 2024] earnings today, revealing a stunning performance fueled by a surge in trading activity and a record-breaking $255 billion in assets under custody. The results significantly exceeded analysts' expectations, sending shockwaves through the financial markets and solidifying Robinhood's position as a major player in the fintech industry.

This exceptional growth can be attributed to several key factors, highlighting the company's strategic initiatives and the broader trends shaping the investment landscape.

Record-Breaking Assets Under Custody

The most striking figure in Robinhood's [Quarter, e.g., Q2 2024] report is the unprecedented $255 billion in assets under custody. This represents a [Percentage]% increase compared to the same period last year and signifies a massive influx of new users and increased trading activity amongst existing customers. This substantial growth underscores Robinhood's continued appeal to both seasoned investors and newcomers navigating the increasingly accessible world of online trading.

Trading Volume Skyrockets

Complementing the impressive asset growth, Robinhood experienced a significant surge in trading volume during the [Quarter, e.g., Q2 2024]. The platform processed [Number] transactions, representing a [Percentage]% increase year-over-year. This robust trading activity directly translates to increased revenue for Robinhood, bolstering its financial performance and demonstrating the platform's enduring popularity. This increase can be partly attributed to [mention specific events or market trends that influenced trading volume, e.g., increased volatility in the crypto market, a specific stock surge].

Diversification Beyond Stock Trading

While stock trading remains a core component of Robinhood's business model, the company's strategic diversification into other financial products, such as cryptocurrencies and options trading, has also contributed to its overall success. The expansion into these areas has attracted a wider range of users and further enhanced the platform's appeal. The company’s ongoing efforts to improve its user experience and expand its product offerings are crucial to maintaining this momentum.

Challenges and Future Outlook

Despite the overwhelmingly positive Q[Quarter, e.g., Q2 2024] earnings, Robinhood still faces challenges. Increased regulatory scrutiny within the fintech sector and competition from established players remain significant hurdles. However, the company's strong performance and innovative approach suggest a positive outlook for the future.

Key takeaways from Robinhood's Q[Quarter, e.g., Q2 2024] earnings:

- Record-high assets under custody: $255 billion.

- Significant surge in trading volume: [Number] transactions, a [Percentage]% year-over-year increase.

- Continued growth fueled by diversification into crypto and options trading.

- Ongoing challenges related to regulation and competition.

Looking ahead, Robinhood will likely focus on:

- Further enhancing its platform's user experience.

- Expanding its product offerings to cater to a broader range of investors.

- Navigating the evolving regulatory landscape.

Robinhood's remarkable Q[Quarter, e.g., Q2 2024] performance underscores its ability to adapt to the dynamic financial landscape and capitalize on emerging trends. While challenges remain, the company's strong financial results and strategic initiatives suggest a promising future for this popular investment platform. Stay tuned for further updates as we continue to monitor Robinhood's progress. [Optional: Link to Robinhood's official investor relations page].

![Robinhood's Q[Quarter] Earnings: Record $255 Billion In Assets, Trading Volume Surges Robinhood's Q[Quarter] Earnings: Record $255 Billion In Assets, Trading Volume Surges](https://clubedadoc.com/image/robinhoods-q-quarter-earnings-record-255-billion-in-assets-trading-volume-surges.jpeg)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood's Q[Quarter] Earnings: Record $255 Billion In Assets, Trading Volume Surges. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Catch The Mets Vs Nationals Game Sny Coverage June 12 2025

Jun 13, 2025

Catch The Mets Vs Nationals Game Sny Coverage June 12 2025

Jun 13, 2025 -

Catch The Mets Nationals Game Sny Channel And Streaming Info June 12 2025

Jun 13, 2025

Catch The Mets Nationals Game Sny Channel And Streaming Info June 12 2025

Jun 13, 2025 -

Juan Soto Extends Hot Streak Punishes Mets With Another Blast

Jun 13, 2025

Juan Soto Extends Hot Streak Punishes Mets With Another Blast

Jun 13, 2025 -

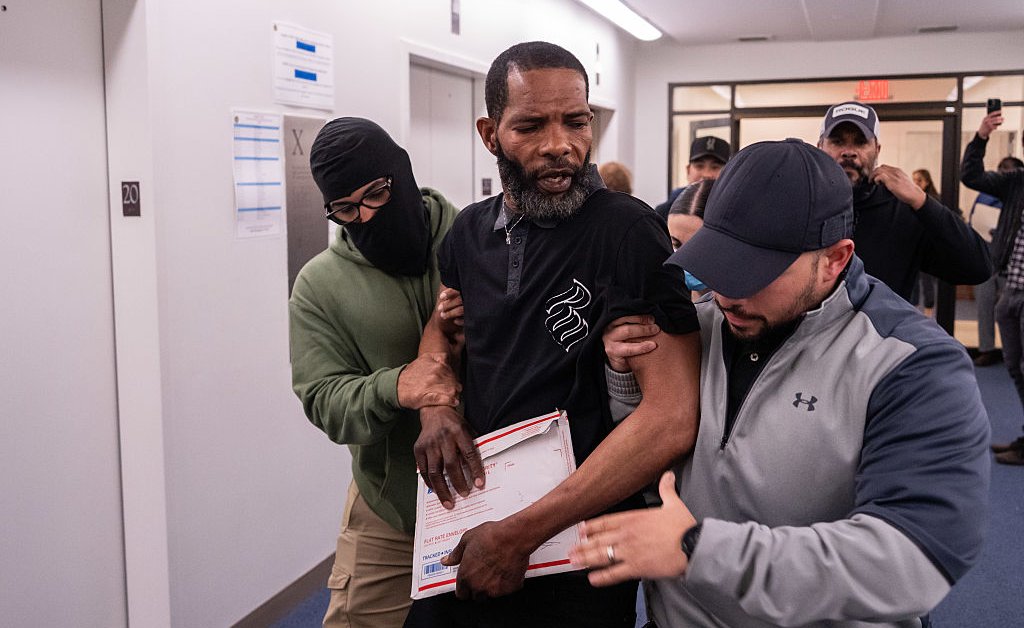

Data Unveils The Extent Of Trumps Migrant Arrest And Deportation Push

Jun 13, 2025

Data Unveils The Extent Of Trumps Migrant Arrest And Deportation Push

Jun 13, 2025 -

Chelsea Greens Gimmick Match Proposal To Wwe Veteran

Jun 13, 2025

Chelsea Greens Gimmick Match Proposal To Wwe Veteran

Jun 13, 2025