Robinhood's Q[Quarter] Assets Surge To $255 Billion: Trading Volume Explodes

![Robinhood's Q[Quarter] Assets Surge To $255 Billion: Trading Volume Explodes Robinhood's Q[Quarter] Assets Surge To $255 Billion: Trading Volume Explodes](https://clubedadoc.com/image/robinhoods-q-quarter-assets-surge-to-255-billion-trading-volume-explodes.jpeg)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood's Q[Quarter] Assets Surge to $255 Billion: Trading Volume Explodes

Record-breaking quarter for the retail brokerage giant.

Robinhood Markets, Inc., the popular commission-free trading app, announced a stunning surge in assets under custody, reaching a staggering $255 billion in [Insert Quarter, e.g., Q2 2024]. This dramatic increase is coupled with an equally impressive explosion in trading volume, signaling a renewed interest in retail investing and potentially marking a significant turning point for the company. The figures represent a substantial jump from [Insert previous quarter's figures, e.g., $180 billion in Q1 2024], showcasing robust growth despite ongoing market volatility.

A Resurgence in Retail Trading?

The significant increase in both assets and trading volume points to a potential resurgence in retail investor activity. Several factors could be contributing to this upswing:

- Increased Market Volatility: Periods of heightened market uncertainty often lead to increased trading activity as investors react to news and adjust their portfolios.

- Growing Millennial and Gen Z Participation: Robinhood's user-friendly interface and commission-free trading continue to attract younger investors, a demographic increasingly active in the market.

- Improved Platform Features: Robinhood has consistently updated its platform with new features and investment options, enhancing the user experience and attracting a broader range of investors.

- Cryptocurrency's Continued Appeal: The ongoing interest in cryptocurrencies, a significant part of Robinhood's offerings, likely contributed to the increased trading volume.

Beyond the Numbers: What Does it Mean for Robinhood?

This impressive financial performance could signify a crucial turning point for Robinhood. After facing challenges in previous quarters, including regulatory scrutiny and a decline in user engagement, this surge demonstrates a renewed strength and resilience. The increased assets under custody also translate to higher revenue potential for the company through transaction fees and other revenue streams.

However, it's crucial to consider potential downsides. While the current growth is encouraging, maintaining this momentum in the face of future market fluctuations remains a key challenge. Furthermore, the company continues to navigate a complex regulatory landscape, which could impact its future growth trajectory.

Looking Ahead: Sustaining the Momentum

The success of this quarter will heavily depend on Robinhood's ability to sustain this growth. This will likely involve:

- Maintaining a Strong User Experience: Continuing to improve the platform's functionality and user experience will be vital in retaining existing users and attracting new ones.

- Diversifying Revenue Streams: Exploring additional revenue opportunities beyond transaction fees will enhance the company's financial stability.

- Navigating Regulatory Hurdles: Effectively navigating the regulatory landscape will be crucial for long-term success.

This impressive quarter for Robinhood presents a compelling narrative of resilience and growth in the retail investing sector. While challenges remain, the company's recent performance suggests a promising future, provided it can successfully maintain its momentum and adapt to the ever-evolving financial landscape. Only time will tell if this surge represents a sustained trend or a temporary spike, but for now, the numbers speak volumes about the resurgence of retail trading and Robinhood's role within it.

Keywords: Robinhood, Q[Quarter] earnings, assets under custody, trading volume, retail investing, cryptocurrency, stock market, financial markets, investment app, commission-free trading, millennial investors, Gen Z investors, market volatility, regulatory landscape.

![Robinhood's Q[Quarter] Assets Surge To $255 Billion: Trading Volume Explodes Robinhood's Q[Quarter] Assets Surge To $255 Billion: Trading Volume Explodes](https://clubedadoc.com/image/robinhoods-q-quarter-assets-surge-to-255-billion-trading-volume-explodes.jpeg)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood's Q[Quarter] Assets Surge To $255 Billion: Trading Volume Explodes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Delaney Rowe Sets The Record Straight Her Relationship Status Explained

Jun 14, 2025

Delaney Rowe Sets The Record Straight Her Relationship Status Explained

Jun 14, 2025 -

Viral Video Fallout Kittle Speaks Out In Support Of Former Teammate Deebo Samuel

Jun 14, 2025

Viral Video Fallout Kittle Speaks Out In Support Of Former Teammate Deebo Samuel

Jun 14, 2025 -

Burns Blasts Into U S Open Contention With Record Breaking Oakmont Performance

Jun 14, 2025

Burns Blasts Into U S Open Contention With Record Breaking Oakmont Performance

Jun 14, 2025 -

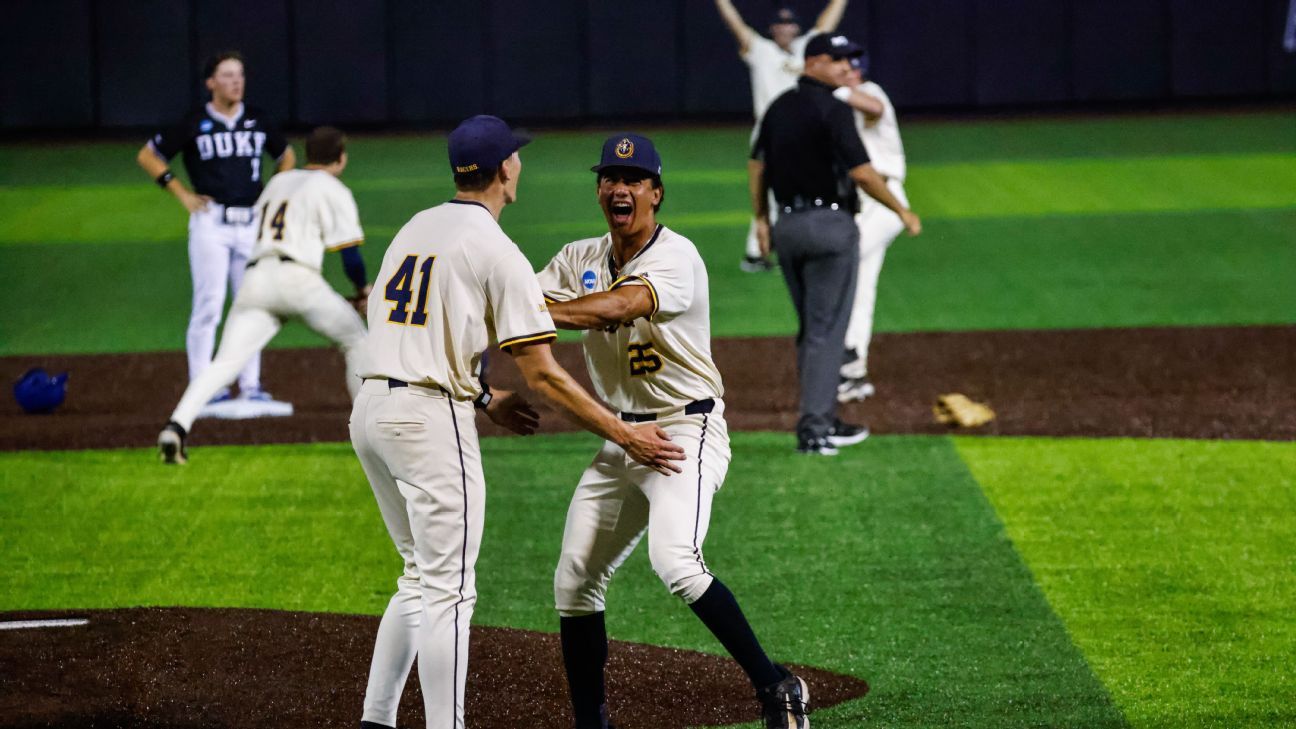

From Sparse Crowds To Packed Stands Murray States Rise To Omaha

Jun 14, 2025

From Sparse Crowds To Packed Stands Murray States Rise To Omaha

Jun 14, 2025 -

Will Sunnovas Bankruptcy Reshape The Solar Market Analysis And Outlook

Jun 14, 2025

Will Sunnovas Bankruptcy Reshape The Solar Market Analysis And Outlook

Jun 14, 2025