Robinhood's Assets Surge To Record $255 Billion: Trading Volume Explodes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood's Assets Surge to Record $255 Billion: Trading Volume Explodes

Record-breaking growth for the popular trading app signals a resurgence in retail investor activity.

Robinhood, the commission-free trading app that revolutionized retail investing, has announced a stunning surge in assets under custody, reaching a record-breaking $255 billion. This dramatic increase is accompanied by a significant explosion in trading volume, indicating a renewed enthusiasm among individual investors. The news comes as a significant boost to the company, following a period of market volatility and regulatory scrutiny.

This remarkable growth signifies several key trends in the current financial landscape. Firstly, it underscores the enduring popularity of commission-free trading platforms. Robinhood's user-friendly interface and accessibility have attracted millions, democratizing access to the stock market in a way previously unimaginable. Secondly, the increased trading volume points towards a resurgence in retail investor participation, potentially fueled by factors such as increased market volatility and the growing popularity of meme stocks. Finally, it suggests a growing confidence in the platform itself, overcoming previous concerns regarding outages and regulatory challenges.

What Fueled This Explosive Growth?

Several factors likely contributed to Robinhood's exceptional growth:

- Increased Market Volatility: Periods of market uncertainty often see a surge in trading activity as investors react to changing conditions. This increased volatility likely drove many users to utilize Robinhood's platform.

- Meme Stock Phenomenon: The continued impact of meme stocks, while controversial, has undoubtedly played a role in attracting new users and boosting trading volumes on platforms like Robinhood. The ease of participating in these trends through the app's user-friendly interface has likely been a major factor.

- Improved Platform Stability: Following previous technical issues and regulatory scrutiny, Robinhood has made significant strides in improving its platform stability and reliability, fostering greater user trust.

- Expansion of Offerings: Robinhood's expansion beyond simple stock trading, into areas such as options trading and cryptocurrency, has broadened its appeal and attracted a wider range of users.

Concerns Remain?

While the news is undoubtedly positive for Robinhood, some concerns remain. The company still faces ongoing regulatory challenges and needs to continue to demonstrate its commitment to protecting user funds and ensuring platform stability. The dependence on volatile trading activity for revenue growth also presents a potential risk.

The Future of Robinhood:

This record-breaking growth positions Robinhood strongly for future expansion and innovation. The company is well-placed to capitalize on the growing retail investment market, provided it continues to address regulatory concerns and maintain platform stability. The future success of Robinhood will likely depend on its ability to adapt to evolving market conditions and maintain its reputation for user-friendly accessibility.

Further Reading:

This impressive surge in assets under custody and trading volume represents a significant milestone for Robinhood and highlights the evolving landscape of retail investing. The company's ability to navigate future challenges and capitalize on this momentum will be key to its continued success.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood's Assets Surge To Record $255 Billion: Trading Volume Explodes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Speculation Mounts Unraveling Delaney Rowes Cryptic Remark

Jun 13, 2025

Speculation Mounts Unraveling Delaney Rowes Cryptic Remark

Jun 13, 2025 -

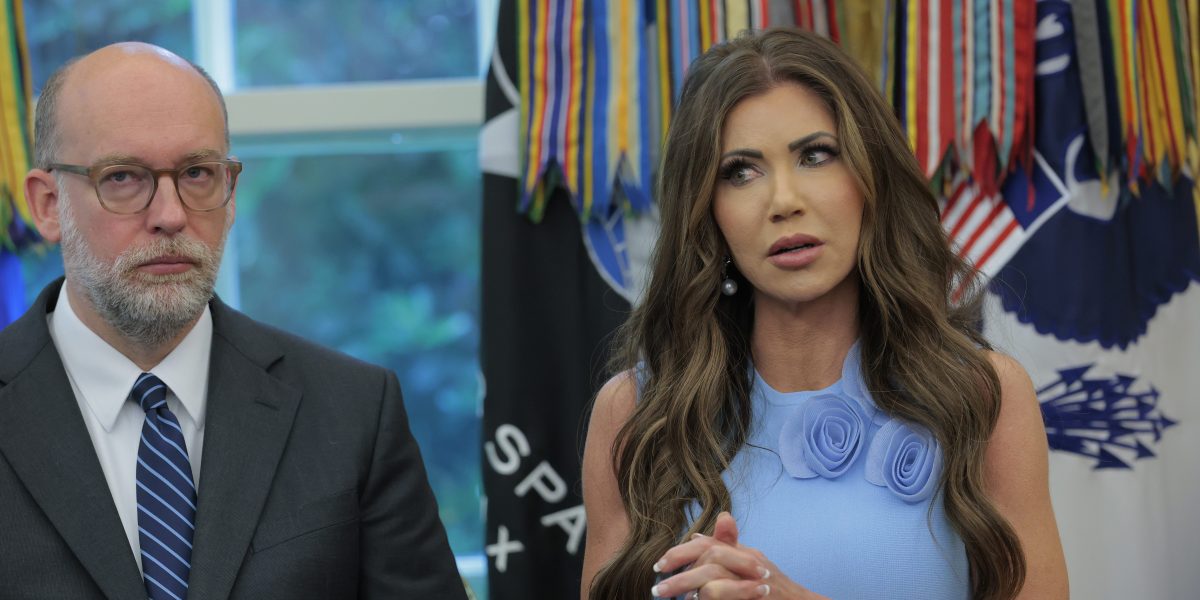

From Deployment Order To Denial Understanding Kristi Noems Changing Narrative On Protests

Jun 13, 2025

From Deployment Order To Denial Understanding Kristi Noems Changing Narrative On Protests

Jun 13, 2025 -

Nationals At Mets Wednesday June 11th Game Preview Betting Odds And Prop Bet Suggestions

Jun 13, 2025

Nationals At Mets Wednesday June 11th Game Preview Betting Odds And Prop Bet Suggestions

Jun 13, 2025 -

49ers Kittle Addresses Recent Criticism Of Deebo Samuel

Jun 13, 2025

49ers Kittle Addresses Recent Criticism Of Deebo Samuel

Jun 13, 2025 -

The Noem Hegseth Discussion A Closer Look At The Call For Military Intervention Against Civilians

Jun 13, 2025

The Noem Hegseth Discussion A Closer Look At The Call For Military Intervention Against Civilians

Jun 13, 2025