Robinhood Stock (HOOD): Wellington Management's Recent Purchase Of 15,775 Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Stock (HOOD) Soars: Wellington Management's Significant Investment Sparks Interest

Robinhood Markets, Inc. (NASDAQ: HOOD) saw a surge in investor interest following the revelation that Wellington Management, a prominent global investment firm, recently acquired a significant stake in the company. The purchase of 15,775 shares signals a vote of confidence in Robinhood's future prospects, potentially influencing other investors and impacting the stock's price. This strategic move by Wellington Management comes at a crucial time for Robinhood, as the company navigates a changing financial landscape and strives to regain investor trust.

Wellington Management's Strategic Play: A Bullish Signal for HOOD?

Wellington Management, known for its meticulous research and long-term investment strategies, doesn't make acquisitions lightly. Their purchase of 15,775 Robinhood shares suggests a positive outlook on the company's potential for growth and profitability. This investment could be interpreted as a validation of Robinhood's recent efforts to diversify its revenue streams and improve its financial performance. While the exact reasons behind Wellington Management's decision remain undisclosed, several factors could have contributed to their investment:

- Improved Financial Performance: Robinhood has shown signs of improvement in recent quarters, reporting better-than-expected earnings and increased user engagement. These positive trends might have convinced Wellington Management that the company is on a path to recovery.

- Expansion into New Markets: Robinhood's continued expansion into new financial products and services, such as crypto trading and wealth management, could be another attractive factor for Wellington Management. This diversification strategy reduces reliance on single revenue streams, making the company more resilient.

- Long-Term Growth Potential: The long-term growth potential of the retail brokerage industry remains significant, with an increasing number of young investors entering the market. Wellington Management may see Robinhood as well-positioned to capitalize on this growth.

Analyzing the Impact on HOOD Stock Price

The news of Wellington Management's investment has already generated considerable buzz around Robinhood stock. While it's impossible to predict the precise impact on the HOOD stock price, it's likely to have a positive influence in the short to medium term. The involvement of a reputable and influential firm like Wellington Management lends credibility and boosts investor confidence. However, it's crucial to remember that stock prices are influenced by numerous factors, and this investment doesn't guarantee future success.

What This Means for Investors

This development provides a compelling case study in how institutional investor activity can affect individual stock performance. For potential investors, this news warrants further due diligence into Robinhood's financial statements and future projections. Understanding the company's strategic direction and competitive landscape is vital before making any investment decisions. Remember to always conduct thorough research and consult with a financial advisor before investing in any stock.

Looking Ahead: Robinhood's Path to Recovery

While the purchase of 15,775 shares by Wellington Management is a significant positive development, Robinhood still faces challenges. The company needs to continue focusing on improving its operational efficiency, enhancing its customer experience, and navigating the evolving regulatory environment. Success will depend on its ability to execute its strategic plan and deliver consistent financial performance. The future of HOOD stock will largely depend on the company's ability to maintain this positive momentum.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Stock (HOOD): Wellington Management's Recent Purchase Of 15,775 Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps National Guard Deployment Deemed Illegal By Court Ruling

Jun 14, 2025

Trumps National Guard Deployment Deemed Illegal By Court Ruling

Jun 14, 2025 -

U S Open Round 2 Sam Burns Discusses His Low Score At Oakmont

Jun 14, 2025

U S Open Round 2 Sam Burns Discusses His Low Score At Oakmont

Jun 14, 2025 -

Tacoma Amber Alert Police Seek Publics Help Finding Missing Child

Jun 14, 2025

Tacoma Amber Alert Police Seek Publics Help Finding Missing Child

Jun 14, 2025 -

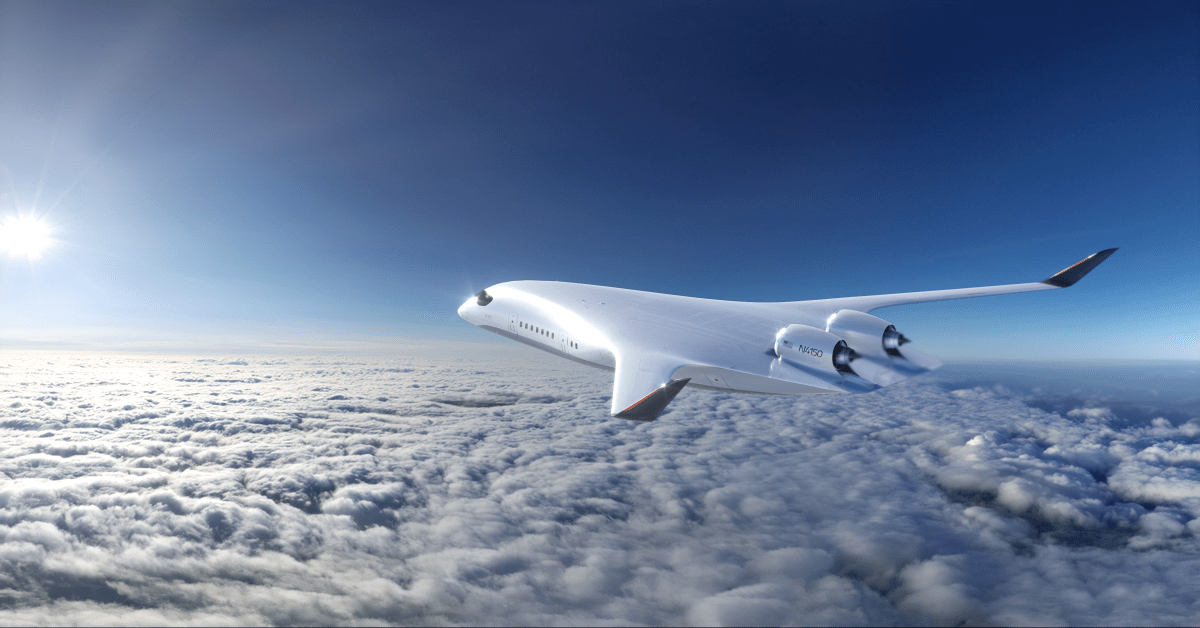

Low Carbon Air Travel Is This Company The Key To A Greener Future

Jun 14, 2025

Low Carbon Air Travel Is This Company The Key To A Greener Future

Jun 14, 2025 -

Autenticidade Eleitoral Em Angola O Papel Da Tecnologia Na Validacao Dos Resultados

Jun 14, 2025

Autenticidade Eleitoral Em Angola O Papel Da Tecnologia Na Validacao Dos Resultados

Jun 14, 2025