Robinhood Reports Record $255B In Assets, Driven By Soaring Crypto And Stock Trading

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Rides Crypto and Stock Surge to Record $255 Billion in Assets

Robinhood Markets, the popular commission-free trading app, announced a record-breaking $255 billion in assets under custody, a stunning figure driven by a surge in both cryptocurrency and traditional stock trading activity. This represents a significant milestone for the company, showcasing its continued growth and solidifying its position in the competitive fintech landscape. The impressive figures highlight the increasing appetite for retail investment, particularly in volatile but potentially lucrative markets.

Crypto's Explosive Contribution to Robinhood's Success

A key driver behind this record-breaking asset figure is the undeniable boom in cryptocurrency trading. The recent surge in Bitcoin and other altcoins has attracted a significant influx of new investors to platforms like Robinhood, boosting trading volume and consequently, assets under custody. Robinhood's user-friendly interface and commission-free model have proven particularly attractive to first-time crypto investors navigating the sometimes complex world of digital assets. This success underscores the growing mainstream adoption of cryptocurrencies and the crucial role that accessible platforms play in this evolution. Experts predict continued growth in this sector, suggesting Robinhood is well-positioned for future success.

Stock Market Activity Remains a Strong Force

While the crypto market undoubtedly contributed significantly, robust activity in traditional stock trading also fueled Robinhood's record-breaking asset numbers. The ongoing economic recovery, coupled with continued investor confidence, has resulted in increased trading volume across various sectors. Robinhood's appeal to younger, tech-savvy investors has proven to be a winning strategy, attracting a demographic increasingly active in the stock market. The platform's ease of use and educational resources are likely contributing factors to this success.

Challenges and Future Outlook for Robinhood

Despite this remarkable achievement, Robinhood isn't without its challenges. Increased regulatory scrutiny of the cryptocurrency market and the inherent volatility of digital assets present ongoing risks. Competition from established brokerages and emerging fintech companies also remains a significant factor. However, Robinhood’s commitment to innovation and expansion into new financial products positions them to navigate these hurdles effectively. The company continues to invest in improving its platform, enhancing security measures, and broadening its service offerings to maintain its competitive edge.

The Impact of Robinhood's Growth on the Broader Market

Robinhood's success is a reflection of broader trends in the investment world. The democratization of finance, driven by technology and commission-free trading, is lowering the barrier to entry for retail investors. This increased participation is influencing market dynamics and shaping the future of the financial industry. The company's continued growth has significant implications for competition, regulatory frameworks, and the overall evolution of investment platforms.

In Conclusion: Robinhood's record-breaking $255 billion in assets under custody is a testament to its success in attracting and retaining investors amidst a volatile but exciting market. The future remains bright, but navigating regulatory changes and fierce competition will be key to maintaining this momentum. The company's focus on innovation and user experience suggests they are well-prepared to meet these challenges head-on. Only time will tell how this success story unfolds, but for now, the numbers speak for themselves.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Reports Record $255B In Assets, Driven By Soaring Crypto And Stock Trading. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

High Scores Predicted Analyzing The U S Open 2025 At Oakmont

Jun 14, 2025

High Scores Predicted Analyzing The U S Open 2025 At Oakmont

Jun 14, 2025 -

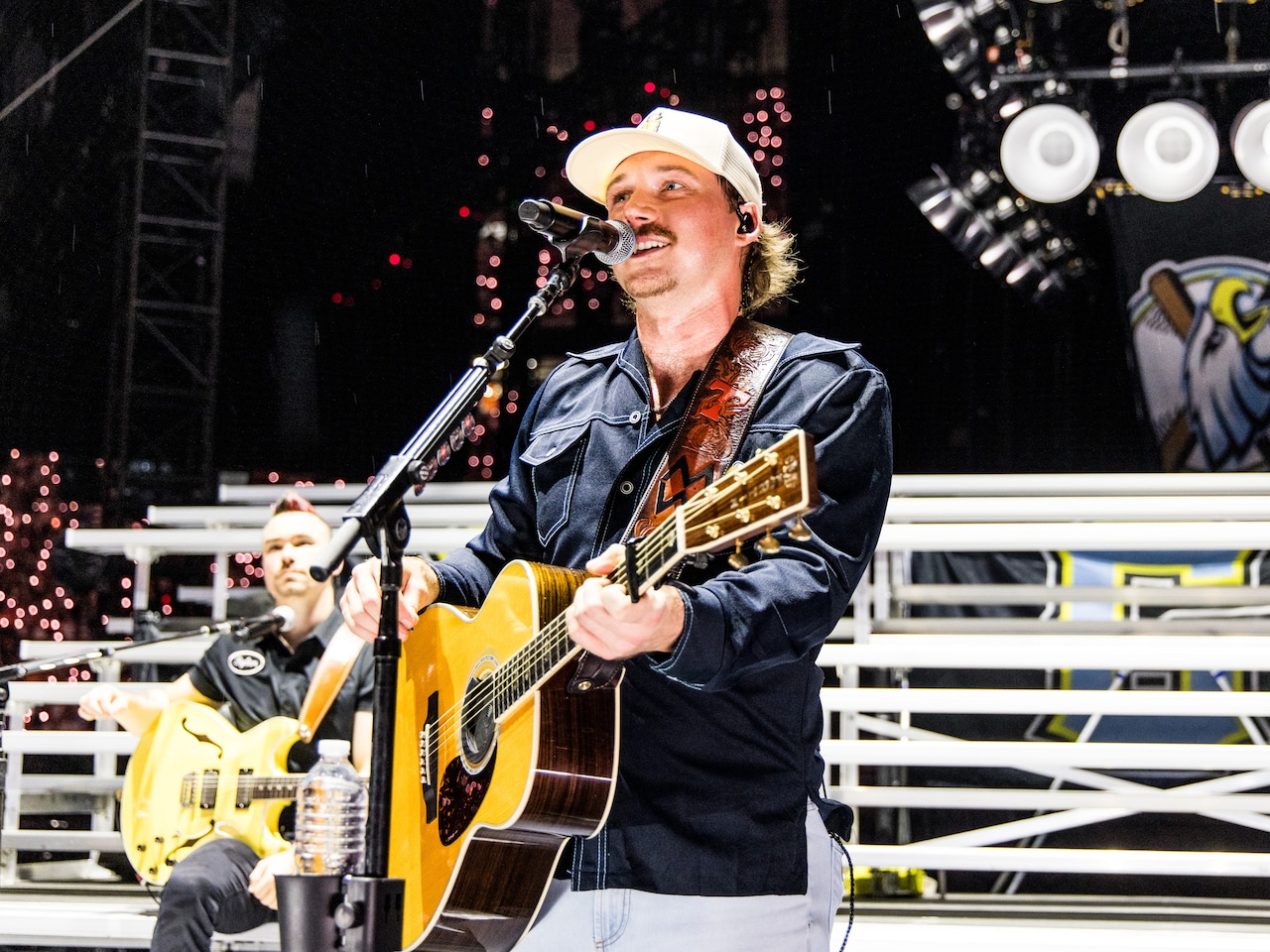

I M The Problem Merch Drop Morgan Wallens Tour Preparations

Jun 14, 2025

I M The Problem Merch Drop Morgan Wallens Tour Preparations

Jun 14, 2025 -

Institutional Investor Activity Wellington Managements Robinhood Hood Stake

Jun 14, 2025

Institutional Investor Activity Wellington Managements Robinhood Hood Stake

Jun 14, 2025 -

Get Your Morgan Wallen Tickets Now Cheap Seats For Houston June 20 21

Jun 14, 2025

Get Your Morgan Wallen Tickets Now Cheap Seats For Houston June 20 21

Jun 14, 2025 -

Morgan Wallen Tour Rehearsals Underway New Merch On The Way

Jun 14, 2025

Morgan Wallen Tour Rehearsals Underway New Merch On The Way

Jun 14, 2025