Robinhood Reports Record $255B In Assets, Driven By Crypto And Trading Volume Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Rides Crypto Wave: Record $255B in Assets Reported

Robinhood Markets, Inc. announced record-breaking assets under custody (AUC), totaling a staggering $255 billion as of June 30, 2024. This monumental surge is primarily attributed to the robust growth in cryptocurrency trading and overall trading volume, solidifying Robinhood's position as a major player in the fintech industry. The impressive figures represent a significant leap from previous quarters, signaling a positive trend for the company after facing challenges in recent years.

This unprecedented growth comes amidst a period of renewed interest in the cryptocurrency market and increased retail investor participation in trading. While regulatory uncertainty continues to loom large over the crypto landscape, Robinhood’s performance suggests a resilient demand for accessible investment platforms.

Crypto's Contribution to Robinhood's Success

The contribution of cryptocurrency trading to Robinhood's success cannot be overstated. The platform's user-friendly interface and relatively low fees have attracted a large number of crypto investors, contributing significantly to the overall increase in assets under custody. The recent rise in the price of Bitcoin and other major cryptocurrencies has further boosted trading activity and, consequently, Robinhood's AUC.

- Increased User Engagement: Robinhood's crypto offerings have fostered greater user engagement, leading to increased trading frequency and higher average revenue per user (ARPU).

- Diversification Strategy: The success underscores the importance of diversification within Robinhood's offerings. While stocks and options remain key components, crypto has become a significant driver of growth.

- Future Outlook: The continued growth in the crypto market suggests that Robinhood's investment in this sector will likely yield further positive results in the coming quarters.

Trading Volume Fuels Growth

Beyond cryptocurrency, Robinhood also witnessed a significant increase in overall trading volume across various asset classes. This surge in activity, fueled by both seasoned and new investors, significantly contributed to the impressive $255 billion figure.

- Retail Investor Participation: The rise in trading volume points to increased retail investor participation, suggesting a growing appetite for active trading strategies.

- Improved Platform Functionality: Ongoing improvements to Robinhood's platform, including enhanced user experience and trading tools, have likely contributed to the increased trading activity.

- Market Volatility: While market volatility can be a double-edged sword, it has also driven increased trading volume on the platform.

Challenges and Future Prospects

While the record AUC is undeniably positive news for Robinhood, the company still faces challenges. Regulatory scrutiny of the cryptocurrency market and the potential for future market downturns pose significant risks. However, Robinhood's adaptability and strategic focus on technology and user experience position it well to navigate these hurdles. Their commitment to innovation and expansion into new markets, coupled with their strong performance in the crypto space, paints a promising picture for the company's future.

Looking ahead, Robinhood's continued success will likely depend on its ability to maintain its user-friendly platform, navigate regulatory complexities, and continue to adapt to the ever-evolving landscape of the financial technology sector. The company will need to proactively address user concerns, enhance security measures, and expand its offerings to retain its competitive edge.

Call to action: Stay informed about the latest developments in the fintech and cryptocurrency markets by subscribing to our newsletter [link to newsletter signup]. You can also follow us on social media for real-time updates.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Reports Record $255B In Assets, Driven By Crypto And Trading Volume Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Delaney Rowe Speaks Out Relationship Status Update And B J Novak Rumors

Jun 14, 2025

Delaney Rowe Speaks Out Relationship Status Update And B J Novak Rumors

Jun 14, 2025 -

Pittsburgh Pirates Andrew Mc Cutchen Honors Joey Wentzs Performance And Hall Of Fame Discussion

Jun 14, 2025

Pittsburgh Pirates Andrew Mc Cutchen Honors Joey Wentzs Performance And Hall Of Fame Discussion

Jun 14, 2025 -

Barry Sanders Health Crisis Heart Attack And Recovery Journey

Jun 14, 2025

Barry Sanders Health Crisis Heart Attack And Recovery Journey

Jun 14, 2025 -

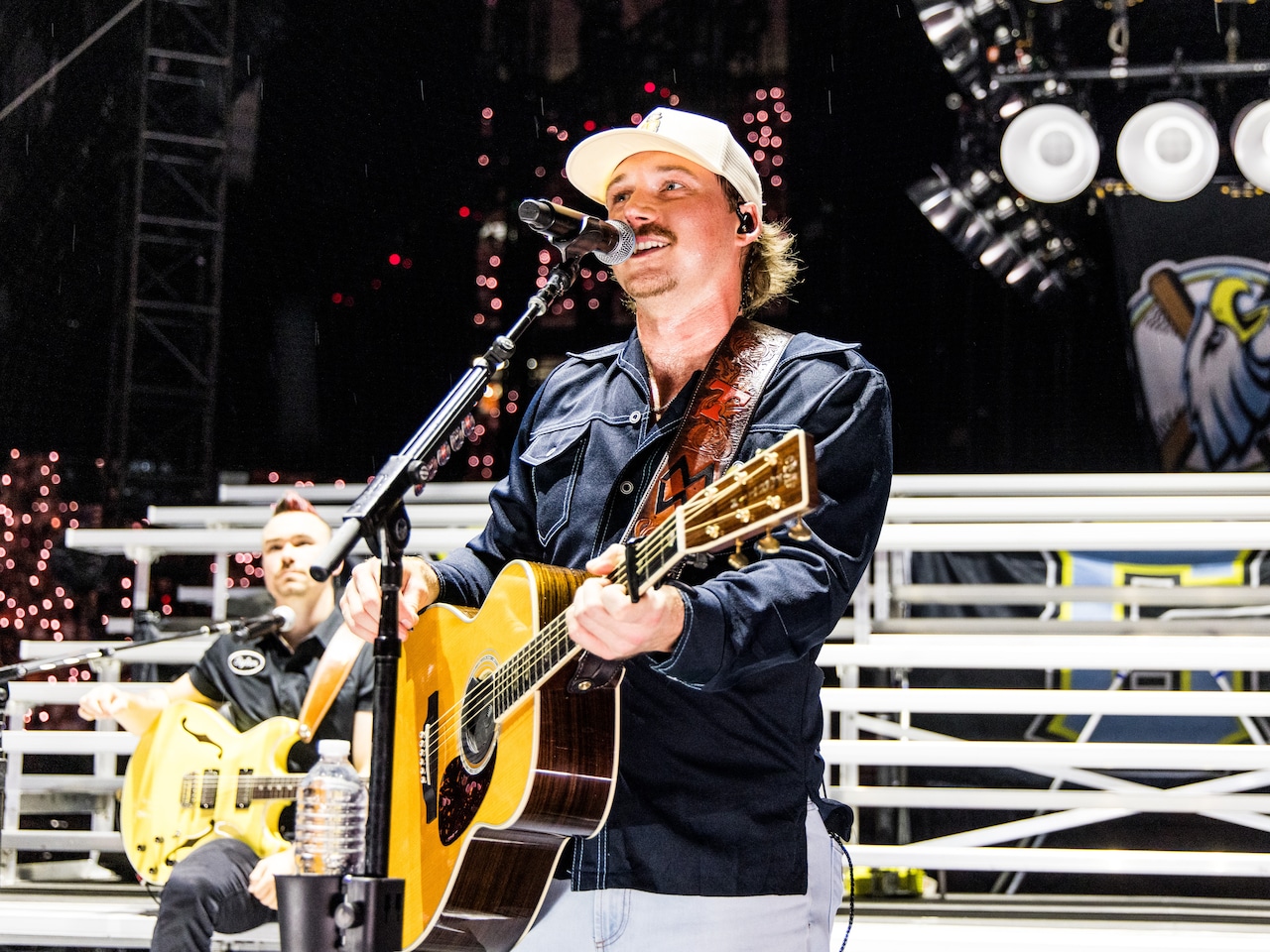

Houston Morgan Wallen Concert Cheap Tickets Available For June 20 And 21 Shows

Jun 14, 2025

Houston Morgan Wallen Concert Cheap Tickets Available For June 20 And 21 Shows

Jun 14, 2025 -

Burns Fires 65 At U S Open With Stunning Final Putt

Jun 14, 2025

Burns Fires 65 At U S Open With Stunning Final Putt

Jun 14, 2025