Robinhood (HOOD) Stock: Wellington Management's Recent Purchase Analyzed

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood (HOOD) Stock: Wellington Management's Recent Purchase Analyzed

Robinhood Markets, Inc. (HOOD) has seen its stock price fluctuate wildly since its initial public offering (IPO). Recent investor activity, however, has piqued interest, particularly a significant purchase by the investment giant, Wellington Management. This article delves into the implications of Wellington Management's investment in HOOD stock and analyzes the potential future trajectory of the company.

Wellington Management's Strategic Move: A Vote of Confidence?

Wellington Management, a renowned asset management firm with trillions of dollars under management, recently increased its stake in Robinhood. This substantial purchase is being interpreted by many as a significant vote of confidence in the company's future prospects. While the exact reasons behind Wellington's investment remain undisclosed, several factors could be at play.

Possible Reasons for Wellington's Investment:

-

Long-Term Growth Potential: Wellington Management is known for its long-term investment strategy. They may see significant untapped potential in Robinhood's user base and its expansion into new financial services. The company's continued efforts to diversify its revenue streams beyond trading commissions could be a key attraction.

-

Undervalued Asset: Some analysts believe that HOOD stock is currently undervalued, presenting a compelling entry point for long-term investors. Wellington Management's purchase could reflect this assessment.

-

Market Share Growth: Despite facing stiff competition from established players, Robinhood continues to hold a significant market share, particularly among younger investors. Wellington may be betting on Robinhood's ability to maintain and expand this market share.

Robinhood's Recent Performance and Future Outlook

Robinhood has faced several challenges in recent years, including regulatory scrutiny and increased competition. However, the company has also demonstrated resilience, consistently innovating and expanding its product offerings. Recent improvements include:

-

Enhanced Security Measures: Robinhood has invested heavily in improving its security infrastructure and customer protection measures.

-

Expansion of Services: The company continues to expand its offerings beyond brokerage services, exploring areas like crypto trading and retirement accounts.

-

Improved Financials: While still unprofitable, Robinhood has shown progress in improving its financial performance, particularly in reducing operating expenses.

However, significant challenges remain, including:

-

Competition: The brokerage industry is highly competitive, with established players constantly vying for market share.

-

Regulatory Landscape: Navigating the evolving regulatory landscape remains a crucial challenge for Robinhood.

-

Maintaining User Growth: Attracting and retaining new users in a saturated market will be vital for Robinhood's continued success.

Conclusion: Weighing the Risks and Rewards of HOOD Stock

Wellington Management's investment in Robinhood represents a significant development, offering a degree of reassurance to investors. However, it's crucial to remember that investing in HOOD stock still carries inherent risks. The company's future performance will depend on its ability to overcome the challenges mentioned above and capitalize on its growth opportunities. Thorough due diligence is essential before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Further Reading:

Call to Action: Stay informed about market trends and company performance before making investment decisions. Consult with a qualified financial advisor for personalized advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood (HOOD) Stock: Wellington Management's Recent Purchase Analyzed. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Spieths Caddie Reveals 14 Years Of Loyalty A Golf World Shocker

Jun 13, 2025

Spieths Caddie Reveals 14 Years Of Loyalty A Golf World Shocker

Jun 13, 2025 -

Finding Faith World Premiere At Film Festival June 16 17

Jun 13, 2025

Finding Faith World Premiere At Film Festival June 16 17

Jun 13, 2025 -

Evolution A Wwe Stars Rivalry With Tiffany Stratton Heats Up

Jun 13, 2025

Evolution A Wwe Stars Rivalry With Tiffany Stratton Heats Up

Jun 13, 2025 -

Oakmonts Test Sam Burns Reflects On His 65 In U S Open Round 2

Jun 13, 2025

Oakmonts Test Sam Burns Reflects On His 65 In U S Open Round 2

Jun 13, 2025 -

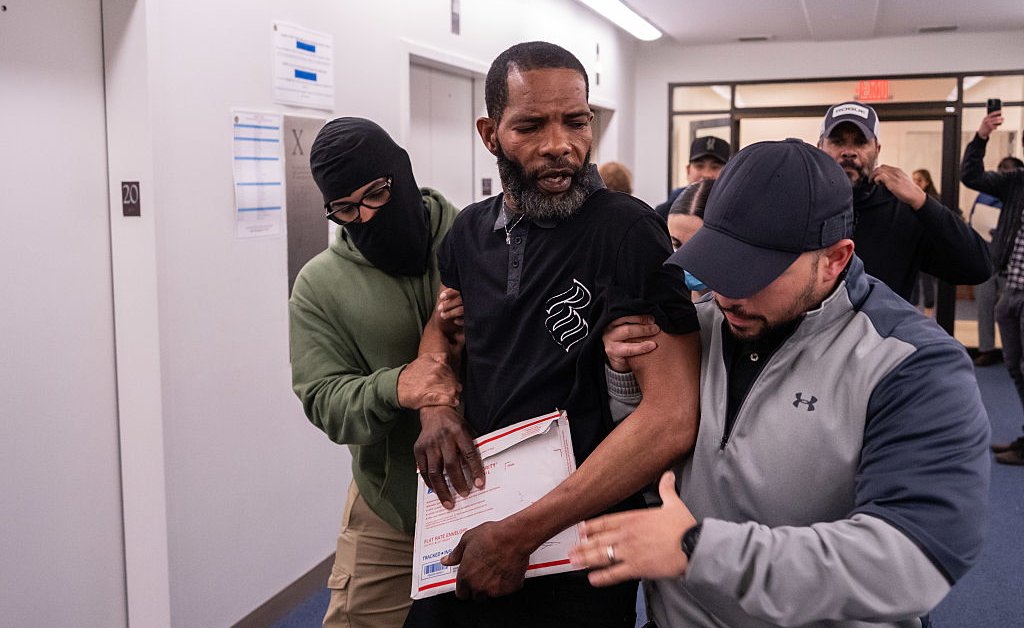

Trumps Immigration Enforcement What The Numbers Show On Arrests And Deportations

Jun 13, 2025

Trumps Immigration Enforcement What The Numbers Show On Arrests And Deportations

Jun 13, 2025