Robinhood (HOOD) Stock: Wellington Management's Recent Acquisition Of 15,775 Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood (HOOD) Stock: Wellington Management's Significant Investment Sparks Interest

Wellington Management, a prominent global investment firm, recently acquired 15,775 shares of Robinhood (HOOD) stock, igniting renewed interest in the controversial yet popular trading platform. This move comes amidst a period of fluctuating performance for HOOD, making the investment a noteworthy development for market analysts and individual investors alike. The acquisition suggests a potential vote of confidence in Robinhood's future prospects, prompting many to question the reasoning behind this strategic move and its implications for the stock's trajectory.

Deciphering Wellington Management's Investment in Robinhood

Wellington Management, known for its long-term investment strategy and significant holdings in diverse sectors, rarely makes headlines with individual stock purchases. Their acquisition of a relatively small (in the context of Wellington's overall portfolio) but noticeable number of Robinhood shares therefore warrants closer examination. Several factors could contribute to this decision:

-

Long-term growth potential: Despite recent market volatility, Robinhood continues to hold a substantial user base and a prominent position in the retail brokerage market. Wellington may be betting on the platform's long-term potential for growth and innovation. This aligns with their history of investing in companies with strong future prospects, even during periods of market uncertainty.

-

Strategic repositioning: Robinhood has been actively working to diversify its revenue streams beyond its core trading platform. The introduction of new features and services could be attracting the attention of long-term investors like Wellington, who see value beyond the company's current market capitalization. They may be anticipating future profitability gains from these initiatives.

-

Market undervaluation: Some analysts believe that Robinhood's current stock price may not fully reflect its intrinsic value. Wellington's investment could indicate a belief that the market is currently undervaluing the company's potential.

Robinhood's Recent Performance and Future Outlook

Robinhood has experienced a rollercoaster ride in recent years. After its highly anticipated IPO, the stock price experienced significant volatility, largely influenced by shifts in market sentiment and regulatory pressures. However, the company has shown resilience, continuously adapting to the ever-evolving landscape of the financial technology sector.

The introduction of new revenue streams, including subscription services and crypto trading, are vital to Robinhood's long-term sustainability. The success of these initiatives will be key to the company's future performance and will likely influence investor sentiment, including the continued interest of large institutional investors like Wellington Management.

The impact of this acquisition on HOOD's stock price remains to be seen. However, the involvement of a reputable firm like Wellington Management could serve as a catalyst for increased investor confidence and potentially contribute to a more positive market outlook for Robinhood.

What Does This Mean for Investors?

While Wellington Management's investment doesn't guarantee future success for Robinhood, it certainly offers food for thought for potential investors. It underscores the importance of conducting thorough due diligence before making any investment decisions. Analyzing Robinhood's financial statements, understanding its business model, and considering the broader market conditions are all crucial steps in forming an informed opinion. Remember to consult with a financial advisor before making any investment decisions.

Are you considering investing in Robinhood (HOOD) stock? Share your thoughts in the comments below. Learning from the choices of major investment firms can be a valuable tool in building your own investment strategy, but remember to always conduct your own thorough research.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood (HOOD) Stock: Wellington Management's Recent Acquisition Of 15,775 Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Delaney Rowes Statement Identifying The Implied Subject

Jun 14, 2025

Delaney Rowes Statement Identifying The Implied Subject

Jun 14, 2025 -

Continued Demonstrations L A Protests Ignore Extended Curfew

Jun 14, 2025

Continued Demonstrations L A Protests Ignore Extended Curfew

Jun 14, 2025 -

Los Angeles Law Enforcement Heightens Security Ahead Of Anticipated No Kings Day Protests

Jun 14, 2025

Los Angeles Law Enforcement Heightens Security Ahead Of Anticipated No Kings Day Protests

Jun 14, 2025 -

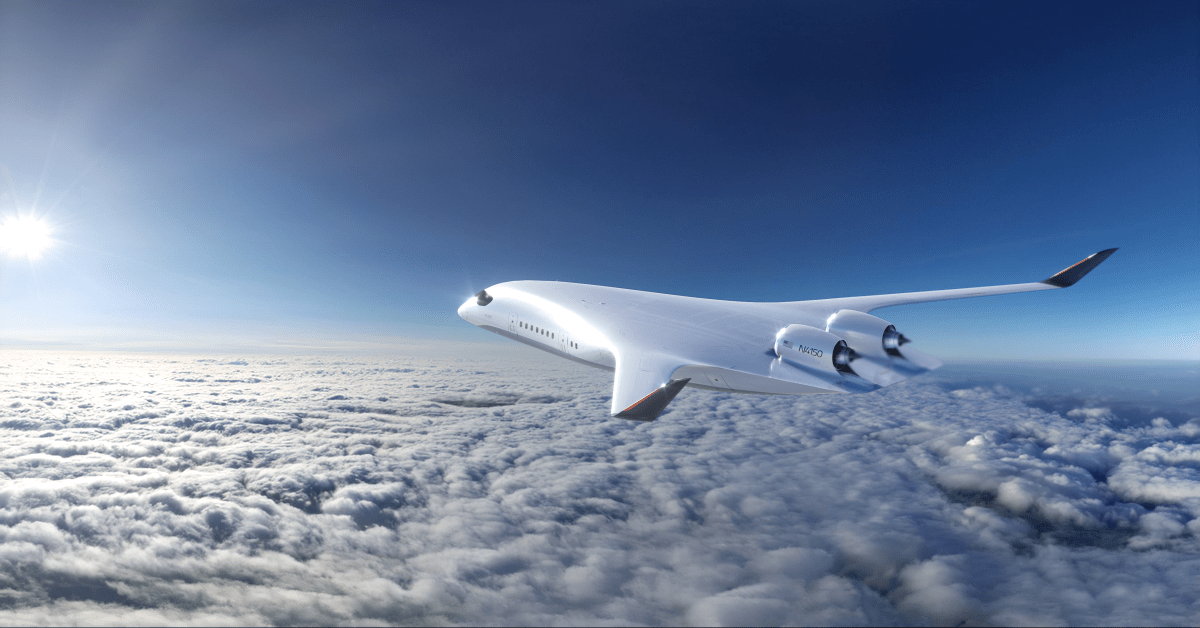

The Future Of Green Air Travel One Companys Pioneering Efforts

Jun 14, 2025

The Future Of Green Air Travel One Companys Pioneering Efforts

Jun 14, 2025 -

Nijjar And Pama Management Face Lawsuit For Alleged Tenant Exploitation In California

Jun 14, 2025

Nijjar And Pama Management Face Lawsuit For Alleged Tenant Exploitation In California

Jun 14, 2025