Robinhood (HOOD) Stock: Wellington Management Group LLP Increases Holdings By 15,775 Shares

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood (HOOD) Stock: Wellington Management Ups Stake, Signaling Potential Growth?

Wellington Management Group LLP, a prominent investment firm, recently increased its holdings in Robinhood Markets, Inc. (HOOD) by a significant 15,775 shares, sparking renewed interest in the volatile fintech stock. This move comes amidst a period of fluctuating performance for Robinhood, leaving investors wondering whether this is a bullish signal for the future.

The recent filing with the Securities and Exchange Commission (SEC) revealed that Wellington Management now owns 1,217,954 shares of HOOD, representing a substantial increase in their overall position. This strategic move by such a large and experienced investment firm is noteworthy and warrants closer examination. Could this be an indication that Wellington Management sees untapped potential in Robinhood's future?

What's Driving the Interest in Robinhood?

Several factors might be contributing to Wellington Management's increased investment in Robinhood. One key aspect is Robinhood's ongoing efforts to diversify its revenue streams beyond its initial commission-free trading model. The company has been aggressively expanding into new areas, including:

- Cryptocurrency trading: Although facing regulatory scrutiny, crypto trading remains a significant revenue generator for Robinhood.

- Subscription services: Robinhood's subscription tiers offer premium features, attracting a more engaged and potentially higher-value user base.

- Expansion of financial products: Robinhood is steadily adding new financial products, broadening its appeal to a wider range of customers.

However, it's crucial to acknowledge the challenges Robinhood continues to face. The company has been grappling with:

- Increased competition: The brokerage industry is fiercely competitive, with established players and new entrants vying for market share.

- Regulatory hurdles: The regulatory landscape for fintech companies is constantly evolving, presenting ongoing challenges and uncertainties.

- Market volatility: The broader macroeconomic climate and overall market volatility significantly impact Robinhood's performance.

Analyzing Wellington Management's Decision

Wellington Management's decision to increase its holdings in HOOD suggests a degree of confidence in the company's long-term prospects. While the short-term performance of Robinhood's stock can be unpredictable, this investment might indicate a belief in the company's ability to overcome current obstacles and capitalize on future opportunities. The firm's extensive research and due diligence likely played a significant role in this strategic move. It's important to note that this is just one data point, and investors should conduct their own thorough research before making any investment decisions.

What Does This Mean for Investors?

The impact of Wellington Management's investment on HOOD's stock price remains to be seen. While it's not a guarantee of future success, it does suggest that at least one major player in the investment world sees potential in Robinhood's trajectory. This news, coupled with the company's ongoing efforts to diversify its offerings, could contribute to increased investor confidence.

However, potential investors should always proceed with caution, considering the inherent risks associated with investing in the stock market, especially in volatile growth stocks like Robinhood. Consult with a financial advisor before making any investment decisions based on this or any other news.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood (HOOD) Stock: Wellington Management Group LLP Increases Holdings By 15,775 Shares. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

4 Year Old And Mother Safe Amber Alert Ends In Happy Reunion

Jun 14, 2025

4 Year Old And Mother Safe Amber Alert Ends In Happy Reunion

Jun 14, 2025 -

Kittle Steps Up Strong Defense Of Deebo Samuel After Fresh Attacks

Jun 14, 2025

Kittle Steps Up Strong Defense Of Deebo Samuel After Fresh Attacks

Jun 14, 2025 -

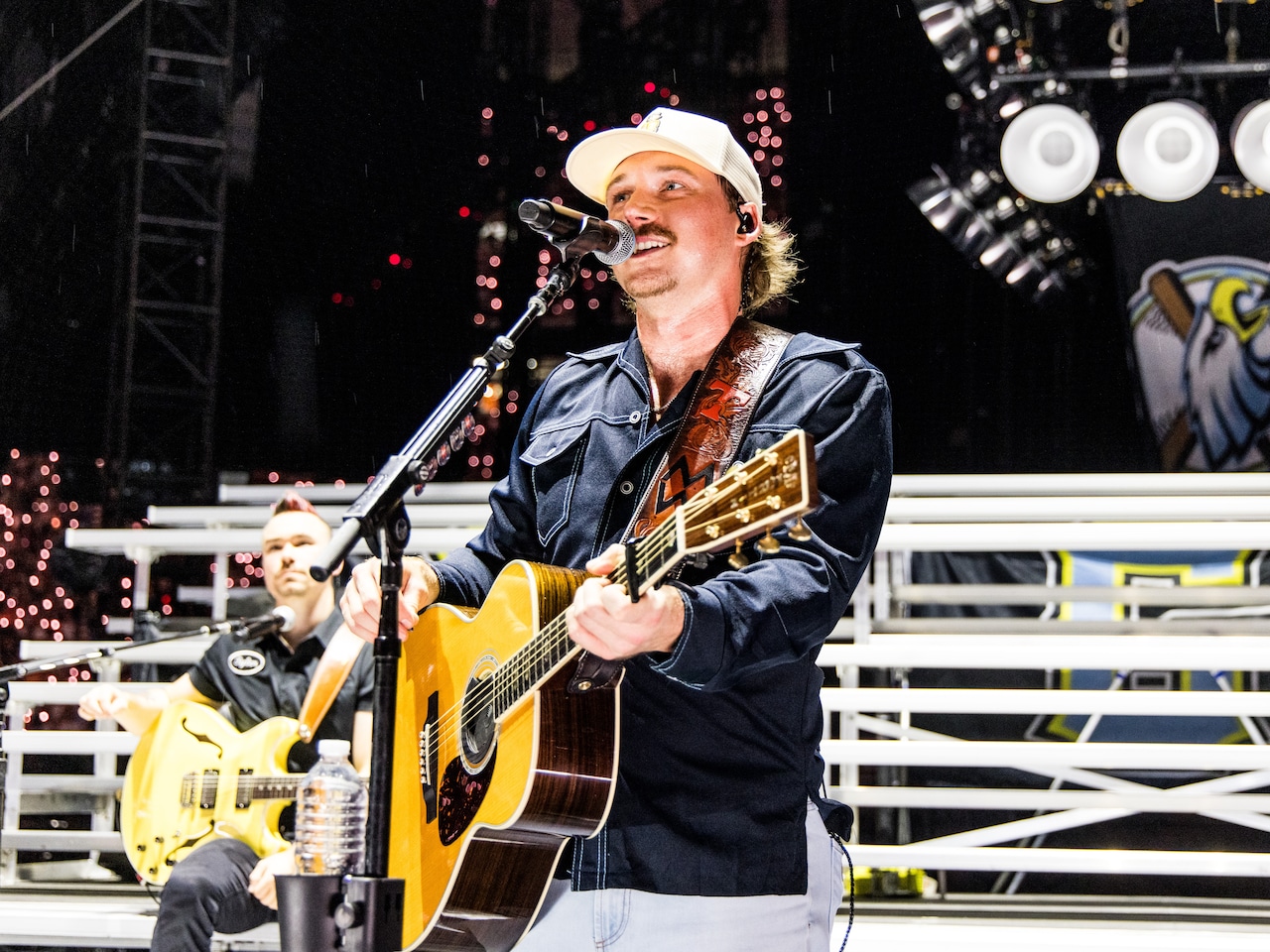

Find Cheap Tickets Morgan Wallens I M The Problem Tour In Houston June 20 21

Jun 14, 2025

Find Cheap Tickets Morgan Wallens I M The Problem Tour In Houston June 20 21

Jun 14, 2025 -

Korn Ferry Tour News Conference What You Need To Know

Jun 14, 2025

Korn Ferry Tour News Conference What You Need To Know

Jun 14, 2025 -

Nfl Great Barry Sanders Opens Up About Near Fatal Heart Attack

Jun 14, 2025

Nfl Great Barry Sanders Opens Up About Near Fatal Heart Attack

Jun 14, 2025