Robinhood (HOOD) Stock Purchase: Wellington Management's $1.5M+ Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood (HOOD) Stock Purchase: Wellington Management's $1.5M+ Investment Signals Renewed Confidence?

Wellington Management, a prominent Boston-based investment firm, has made headlines with its recent purchase of over $1.5 million worth of Robinhood (HOOD) stock. This significant investment comes amidst a period of fluctuating performance for the popular trading app, sparking renewed discussions about the future trajectory of HOOD stock. The move raises interesting questions about the market's perception of Robinhood and its potential for growth.

This investment represents a vote of confidence in Robinhood's long-term prospects, especially considering Wellington Management's reputation for rigorous due diligence and strategic long-term investments. The exact number of shares purchased hasn't been publicly disclosed, but the sheer monetary value indicates a substantial stake. This action follows a period of relative uncertainty for Robinhood, marked by challenges such as regulatory scrutiny and decreased trading volumes.

<h3>What does this mean for Robinhood investors?</h3>

While a single investment doesn't guarantee future success, Wellington Management's move could be interpreted as a positive sign. Large institutional investors like Wellington often conduct extensive research before making such significant purchases. Their decision suggests a belief that Robinhood's current valuation undervalues its potential. This could influence other investors to reconsider their positions, potentially driving up the stock price.

However, it's crucial to avoid reading too much into a single investment. The stock market remains volatile, and multiple factors beyond this investment will influence Robinhood's future performance. These factors include:

- Regulatory landscape: Ongoing regulatory changes in the financial sector continue to present both challenges and opportunities for Robinhood.

- Competition: The online brokerage industry is highly competitive, with established players and new entrants vying for market share.

- User growth and engagement: Robinhood's ability to attract and retain users will be crucial to its long-term success. Continued innovation in its product offerings will be vital in this aspect.

- Financial performance: Robinhood's financial results, including revenue and profitability, will remain a key indicator of its overall health and growth potential.

<h3>Analyzing Wellington Management's Investment Strategy</h3>

Wellington Management is known for its long-term, value-oriented investment strategy. Their investment in Robinhood suggests they see potential for significant long-term growth, possibly anticipating a turnaround or a sustained period of improved performance. This contrasts with short-term traders who might be more sensitive to immediate market fluctuations.

It’s worth noting that Wellington Management's portfolio is incredibly diverse, so this investment represents a small portion of their overall holdings. This should temper any overly optimistic interpretations.

<h3>The Future of HOOD Stock: What to Expect</h3>

The long-term outlook for HOOD stock remains uncertain. While Wellington Management's investment provides a degree of optimism, it's essential for investors to conduct their own thorough research before making any investment decisions. Considering the factors listed above, along with broader market conditions, will offer a more comprehensive perspective.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research and consult with a financial advisor before making any investment decisions.

This article uses relevant keywords like "Robinhood," "HOOD stock," "Wellington Management," "investment," "stock purchase," and related terms to improve its search engine optimization. Internal and external links (if applicable) could be added to further enhance SEO and provide readers with additional resources. The use of headings, bullet points, and bold text improves readability and user experience. Finally, the inclusion of a disclaimer protects against legal liability and demonstrates responsible journalism.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood (HOOD) Stock Purchase: Wellington Management's $1.5M+ Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

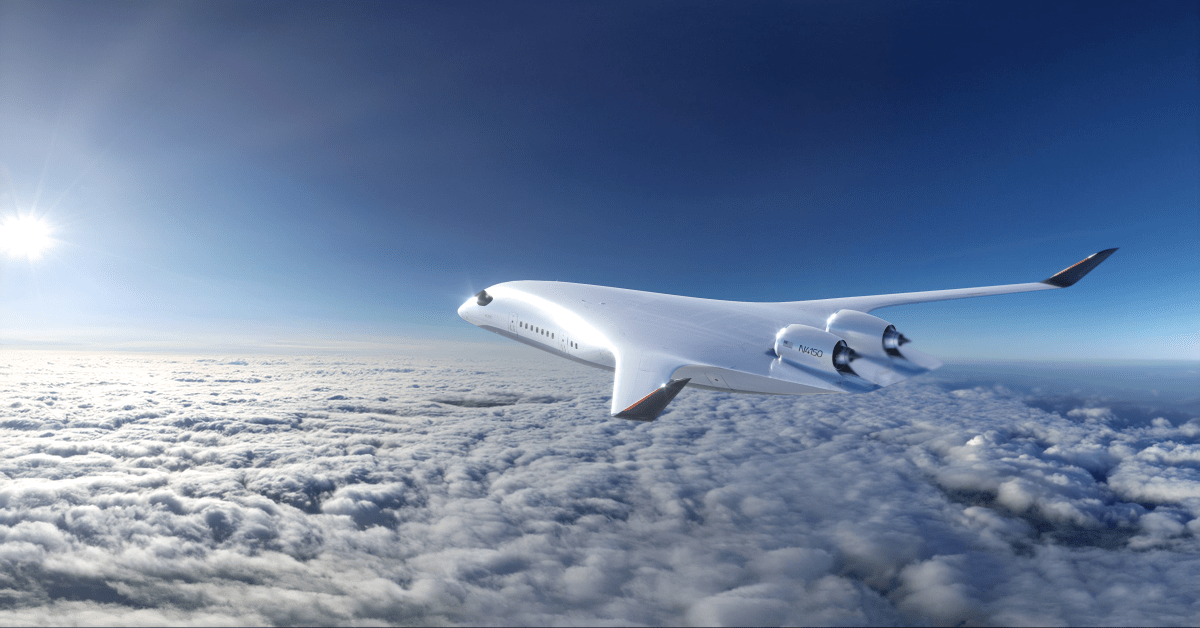

Green Aviation Takes Flight A Low Carbon Solution

Jun 14, 2025

Green Aviation Takes Flight A Low Carbon Solution

Jun 14, 2025 -

Kittles Supportive Response To Deebo Samuels Controversial Video

Jun 14, 2025

Kittles Supportive Response To Deebo Samuels Controversial Video

Jun 14, 2025 -

Attorney General Bonta Files Lawsuit Over Alleged Housing Code Violations By Nijjar And Pama

Jun 14, 2025

Attorney General Bonta Files Lawsuit Over Alleged Housing Code Violations By Nijjar And Pama

Jun 14, 2025 -

Robert Mac Intyres Impressive Iron Skills On Display At Difficult Scottish Links

Jun 14, 2025

Robert Mac Intyres Impressive Iron Skills On Display At Difficult Scottish Links

Jun 14, 2025 -

Houstons Morgan Wallen Concert Get Your Budget Friendly Tickets Now June 20 21

Jun 14, 2025

Houstons Morgan Wallen Concert Get Your Budget Friendly Tickets Now June 20 21

Jun 14, 2025