Robinhood Asset Surge: $255 Billion And 108% Trading Volume Growth

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Asset Surge: $255 Billion and 108% Trading Volume Growth Signals Market Confidence

Robinhood, the popular commission-free trading app, has announced a significant surge in assets under custody, reaching a staggering $255 billion. This impressive figure, coupled with a 108% increase in trading volume, points towards a growing confidence in the platform and potentially, a broader shift in investor behavior. The news comes amidst a period of fluctuating market conditions, making the growth even more noteworthy.

This substantial increase in both assets and trading activity isn't just a flash in the pan; it represents a sustained trend reflecting a number of factors impacting the retail investment landscape.

Factors Contributing to Robinhood's Growth

Several key factors likely contributed to this impressive growth:

-

Increased Retail Investor Participation: The pandemic-era boom in retail investing continues to fuel platforms like Robinhood. More individuals are engaging with the markets, drawn by the accessibility and ease of use offered by commission-free trading apps. This trend is expected to continue, albeit at a potentially slower pace than during the initial surge.

-

Improved Platform Features and Functionality: Robinhood has consistently worked on enhancing its platform, adding new features and improving the overall user experience. The introduction of new investment options, improved educational resources, and a more streamlined interface are all contributing to increased user engagement and retention.

-

Cryptocurrency Market Influence: Robinhood's foray into the cryptocurrency market has undoubtedly played a significant role. The volatile yet captivating nature of cryptocurrencies continues to attract a large pool of investors, many of whom utilize platforms like Robinhood for trading. The recent price fluctuations in Bitcoin and other major cryptocurrencies have likely impacted trading volume significantly. .

-

Strategic Partnerships and Acquisitions: While not explicitly detailed in the recent announcement, Robinhood's strategic partnerships and potential acquisitions could contribute to attracting new users and expanding its asset base. This aspect warrants further investigation as Robinhood continues its expansion.

What This Means for the Future

The substantial growth experienced by Robinhood suggests a healthy appetite for retail investment and an increasing reliance on digital platforms for trading. This trend underscores the evolving financial landscape, with technology playing a pivotal role in empowering individual investors.

However, it’s crucial to acknowledge the inherent risks associated with investing, especially in volatile markets. While Robinhood offers a user-friendly platform, investors should always conduct thorough research and understand the potential downsides before making any investment decisions.

Looking ahead, several key questions remain:

- Can Robinhood maintain this impressive growth trajectory?

- How will increased regulatory scrutiny impact the platform's future?

- Will the current market volatility affect investor confidence and trading activity?

The answers to these questions will significantly shape Robinhood's future and the broader retail investment landscape. The company's continued success will depend on its ability to adapt to changing market conditions, enhance its platform, and maintain investor trust.

Call to action: Stay informed about market trends and investment strategies. Consider consulting with a financial advisor before making any investment decisions. .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Asset Surge: $255 Billion And 108% Trading Volume Growth. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Morgan Wallens I M The Problem Tour Setlist Houston Show Highlights

Jun 14, 2025

Morgan Wallens I M The Problem Tour Setlist Houston Show Highlights

Jun 14, 2025 -

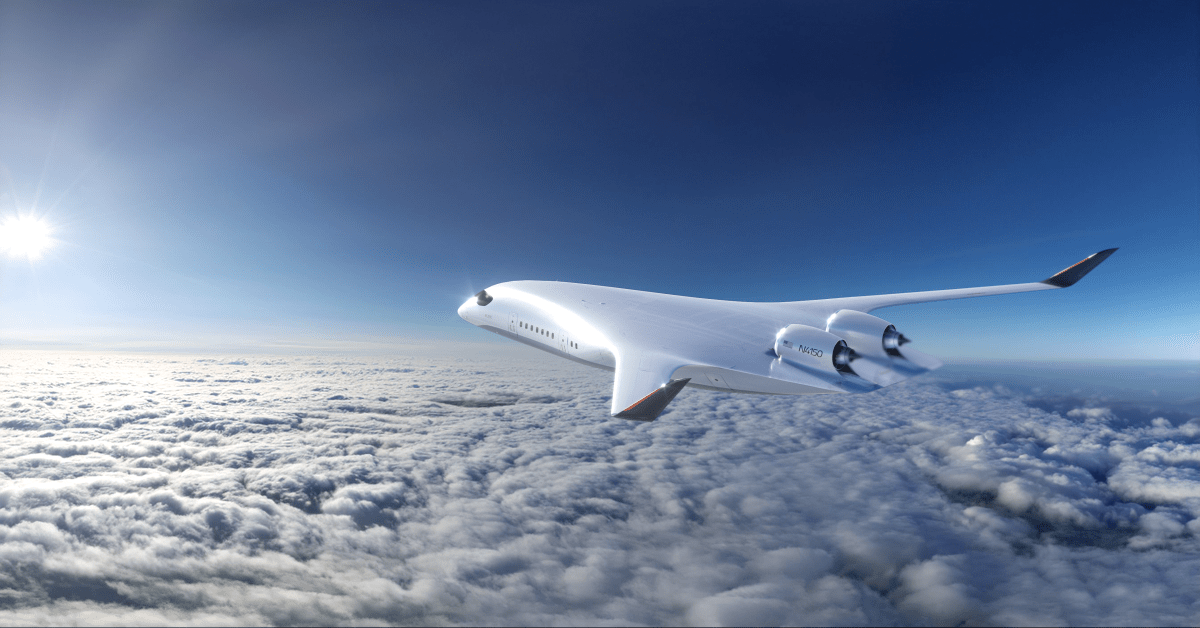

The Future Of Flight How This Company Is Leading Low Carbon Air Travel

Jun 14, 2025

The Future Of Flight How This Company Is Leading Low Carbon Air Travel

Jun 14, 2025 -

Air India Flight Crash Full Story And Casualty Details Emerging

Jun 14, 2025

Air India Flight Crash Full Story And Casualty Details Emerging

Jun 14, 2025 -

Houston Gets First Look Morgan Wallen Shares I M The Problem Tour Setlist

Jun 14, 2025

Houston Gets First Look Morgan Wallen Shares I M The Problem Tour Setlist

Jun 14, 2025 -

Lei Eleitoral Angolana Juiz Aposentado Apela Por Melhorias

Jun 14, 2025

Lei Eleitoral Angolana Juiz Aposentado Apela Por Melhorias

Jun 14, 2025