Robinhood Asset Surge: $255B Record, 108% Trading Volume Increase, 65% Crypto Jump

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Asset Surge: Record $255B in Assets, Trading Volume Soars 108%

Robinhood, the popular commission-free trading platform, has announced a staggering surge in assets under custody, reaching a record-breaking $255 billion. This monumental increase is accompanied by a 108% jump in trading volume and a remarkable 65% rise in cryptocurrency trading activity, signaling a significant shift in investor behavior and market sentiment. The news sent ripples through the financial technology sector, prompting analysts to reassess the platform's position and future prospects.

This unprecedented growth reflects a confluence of factors, including increased retail investor participation, volatile market conditions, and the growing appeal of cryptocurrencies. Let's delve deeper into the key aspects of this remarkable surge.

Record-Breaking Assets Under Custody:

The $255 billion figure represents a substantial increase from previous quarters, highlighting the growing trust and adoption of Robinhood among both seasoned and novice investors. This influx of assets underscores the platform's success in attracting a broad range of users, from those trading individual stocks to those engaging in more complex investment strategies. This massive increase in assets under management (AUM) positions Robinhood firmly as a major player in the retail brokerage landscape.

Trading Volume Explodes:

The 108% increase in trading volume is equally impressive, demonstrating the heightened activity on the platform. This surge reflects the market's volatility and the increased engagement of retail investors responding to market fluctuations. Whether driven by short-term trading strategies or long-term investment goals, the sheer volume indicates a robust and active user base. This heightened activity could also be influenced by factors such as macroeconomic trends, geopolitical events, and evolving investor sentiment.

Cryptocurrency Trading Takes Off:

The 65% surge in cryptocurrency trading is particularly noteworthy, reflecting the enduring appeal of digital assets despite market corrections. This significant growth underlines Robinhood's strategic positioning within the burgeoning cryptocurrency market. The platform's user-friendly interface and relatively accessible entry point likely contributed to this substantial increase in crypto trading volume. This trend suggests a continued appetite for riskier, high-growth assets among retail investors.

What Does This Mean for the Future of Robinhood?

This dramatic surge in assets, trading volume, and cryptocurrency activity paints a positive picture for Robinhood's future. However, it's crucial to consider potential challenges. Increased regulatory scrutiny, competition from established players, and market volatility remain significant factors that could impact the company's trajectory.

Looking Ahead:

While the current figures are undeniably impressive, sustaining this level of growth will require strategic planning and adaptation. Robinhood's continued success will hinge on its ability to innovate, enhance its platform, and navigate the complexities of the ever-evolving financial landscape. The company will need to focus on attracting and retaining users, offering a diverse range of investment options, and providing robust customer support.

Keywords: Robinhood, asset surge, trading volume, cryptocurrency, record assets, financial technology, retail investors, market volatility, investment platform, AUM, crypto trading, stock market

Call to Action: Stay informed about the latest developments in the financial technology sector by following our blog for regular updates and insightful analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Asset Surge: $255B Record, 108% Trading Volume Increase, 65% Crypto Jump. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Air India Flight To London Crashes Casualties And Investigation

Jun 14, 2025

Air India Flight To London Crashes Casualties And Investigation

Jun 14, 2025 -

Delaney Rowe Clarifies Relationship Status Amidst Speculation

Jun 14, 2025

Delaney Rowe Clarifies Relationship Status Amidst Speculation

Jun 14, 2025 -

Oakmonts Challenge Conquered Sam Burns Stellar Play At The 2025 U S Open

Jun 14, 2025

Oakmonts Challenge Conquered Sam Burns Stellar Play At The 2025 U S Open

Jun 14, 2025 -

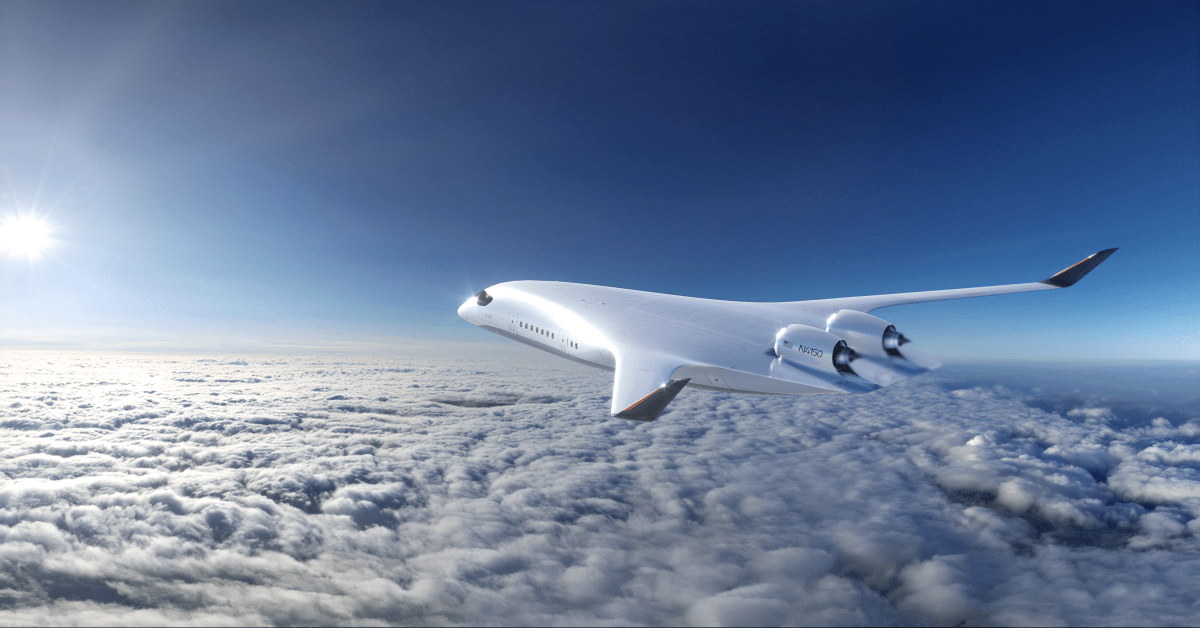

Low Carbon Air Travel Could This Company Be The Key

Jun 14, 2025

Low Carbon Air Travel Could This Company Be The Key

Jun 14, 2025 -

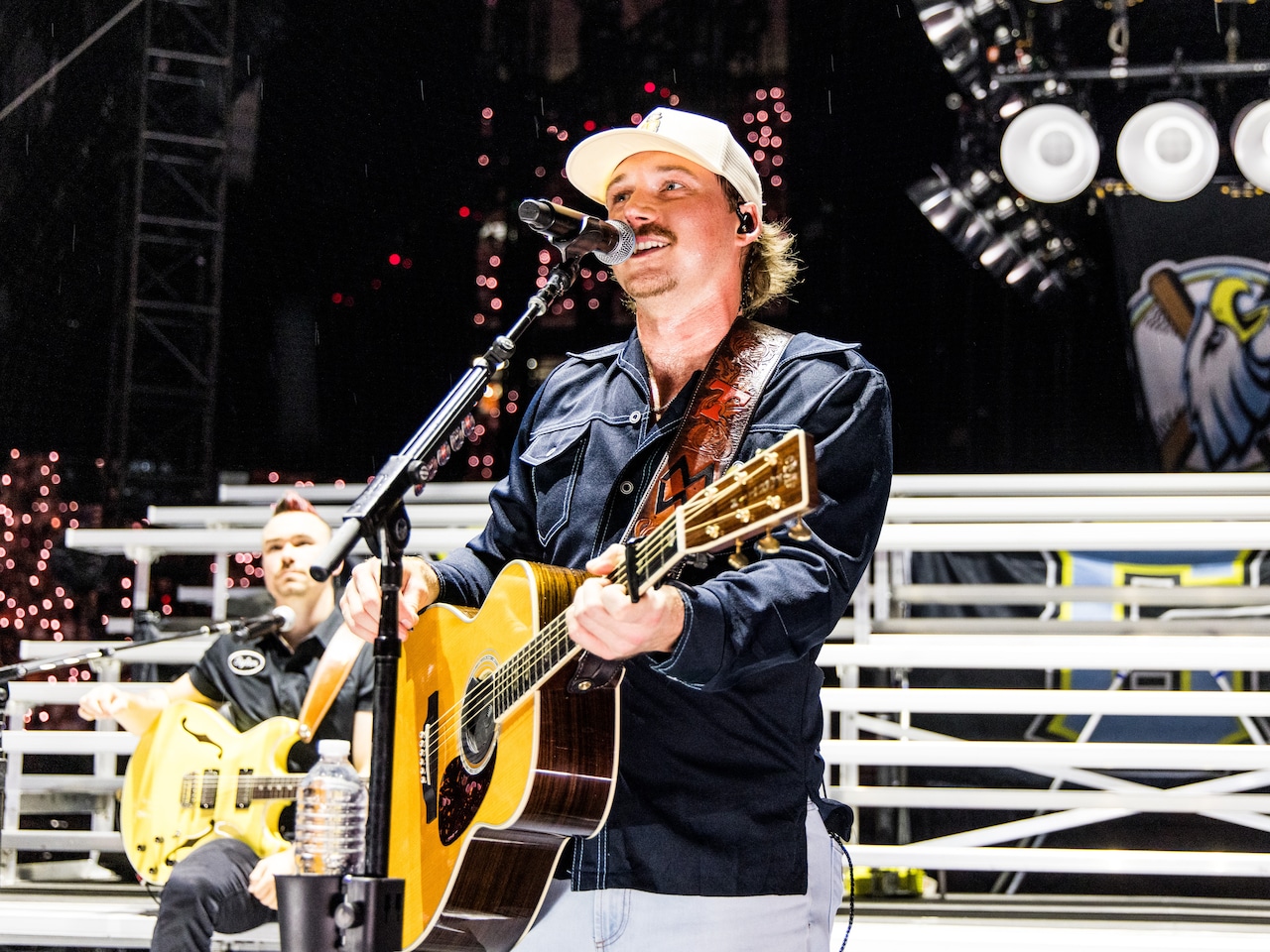

Houston Morgan Wallen Concert Discounted Tickets For June 20th And 21st

Jun 14, 2025

Houston Morgan Wallen Concert Discounted Tickets For June 20th And 21st

Jun 14, 2025