Robinhood Asset Surge: $255B In Assets, 108% Trading Volume Increase, 65% Crypto Jump

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Robinhood Rides the Wave: Asset Surge Signals Renewed Market Confidence

Robinhood, the popular trading app, is experiencing a significant resurgence, boasting a remarkable increase in assets under custody and trading volume. The company reported a stunning $255 billion in assets, coupled with a 108% surge in trading volume and a jaw-dropping 65% jump in crypto trading. This dramatic upswing signals a renewed confidence in the market and potentially marks a turning point for the fintech giant.

This impressive growth comes after a period of turbulence for Robinhood, which included regulatory scrutiny and market volatility. The recent surge, however, points towards a significant shift in investor sentiment. But what are the factors driving this remarkable turnaround?

Unpacking the Numbers: A Deeper Dive into Robinhood's Growth

The sheer scale of Robinhood's growth is undeniable. Let's break down the key figures:

-

$255 Billion in Assets: This represents a substantial increase in assets under custody, indicating a significant influx of new users and increased trading activity by existing ones. This figure is a clear indicator of growing market trust in the platform.

-

108% Trading Volume Increase: This massive jump highlights a surge in overall trading activity. It suggests that investors are actively engaging with the market and utilizing Robinhood as their preferred platform. This could be attributed to several factors, including improved market conditions and Robinhood's ongoing efforts to enhance its platform and user experience.

-

65% Crypto Jump: The cryptocurrency market has seen its share of ups and downs. This significant jump in crypto trading on Robinhood underscores the continued interest in digital assets and suggests that investors are increasingly comfortable trading cryptocurrencies through regulated platforms. This growth aligns with the broader resurgence in the cryptocurrency market.

Factors Contributing to Robinhood's Resurgence

Several factors have likely contributed to Robinhood's recent success:

-

Improved Market Sentiment: The broader market recovery has undoubtedly played a significant role. Improved investor confidence has translated into increased trading activity across various asset classes.

-

Platform Enhancements: Robinhood has continually worked on improving its platform, adding new features and enhancing the overall user experience. This focus on user-friendliness and innovation has attracted new users and retained existing ones.

-

Regulatory Clarity (or lack thereof): While regulatory scrutiny remains a factor, a period of relative stability in the regulatory landscape may have contributed to increased investor confidence.

-

Growing Retail Investor Participation: The retail investor market continues to grow, and Robinhood remains a popular entry point for many new traders.

What This Means for the Future

Robinhood's remarkable resurgence highlights the dynamic nature of the financial technology sector and the ever-evolving preferences of retail investors. This growth suggests a potential shift in the market landscape, with a renewed focus on accessibility and user-friendly trading platforms. However, it's crucial to remember that market conditions can be volatile, and sustained growth will depend on a number of factors, including ongoing regulatory developments and the platform's ability to adapt to changing market trends.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Call to Action: Want to stay updated on the latest financial news? .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Robinhood Asset Surge: $255B In Assets, 108% Trading Volume Increase, 65% Crypto Jump. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Tenant Exploitation Lawsuit Targets Prominent Southern California Real Estate Developer

Jun 14, 2025

Tenant Exploitation Lawsuit Targets Prominent Southern California Real Estate Developer

Jun 14, 2025 -

Urgent Kidnapping Investigation Underway In Tacoma Washington

Jun 14, 2025

Urgent Kidnapping Investigation Underway In Tacoma Washington

Jun 14, 2025 -

Barry Sanders Health Scare Nfl Hall Of Famer Discusses Recent Heart Attack

Jun 14, 2025

Barry Sanders Health Scare Nfl Hall Of Famer Discusses Recent Heart Attack

Jun 14, 2025 -

Child Abduction In Tacoma Police Investigate Amber Alert Activated

Jun 14, 2025

Child Abduction In Tacoma Police Investigate Amber Alert Activated

Jun 14, 2025 -

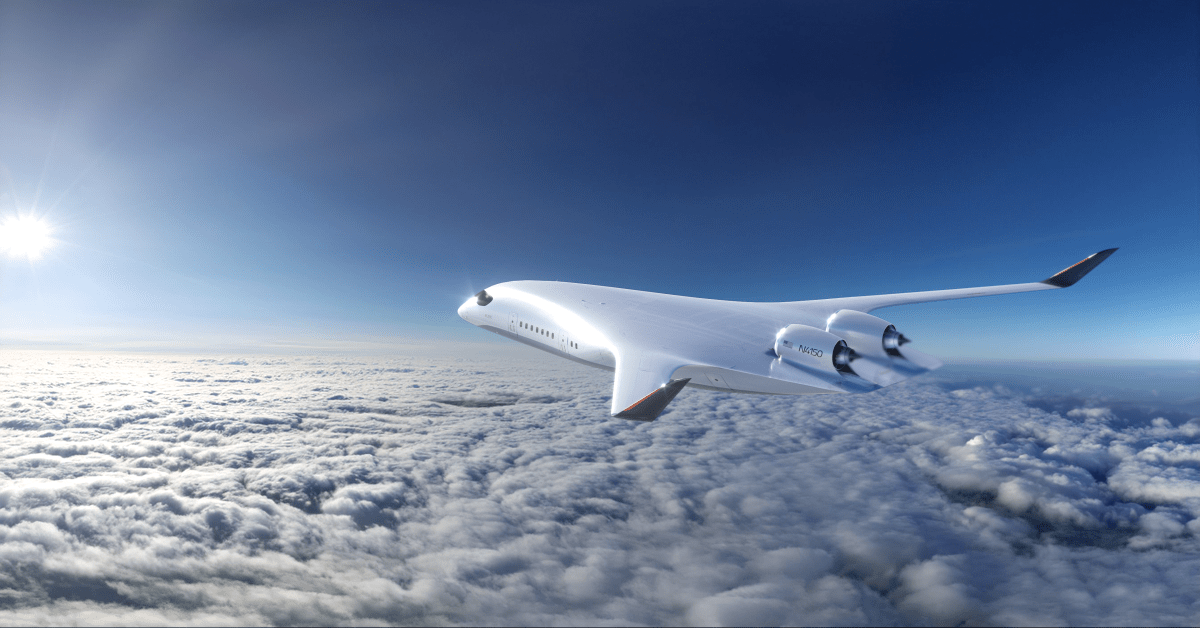

This Companys Innovation Could Change Low Carbon Air Travel Forever

Jun 14, 2025

This Companys Innovation Could Change Low Carbon Air Travel Forever

Jun 14, 2025